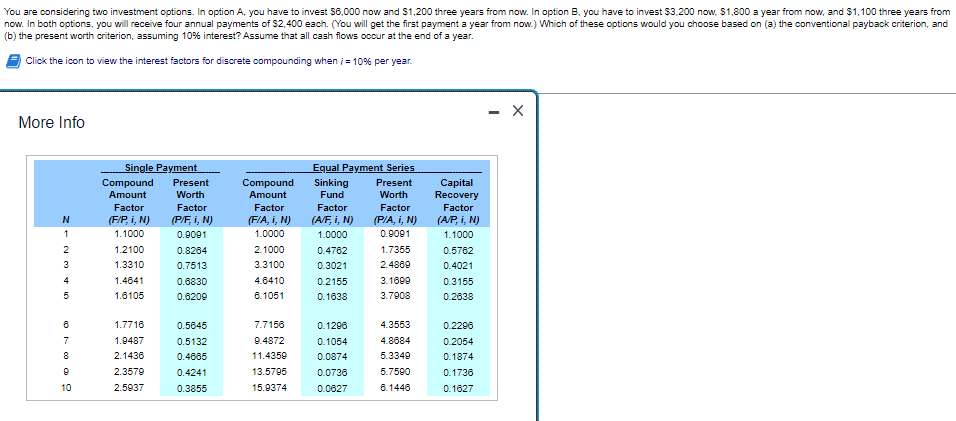

You are considering two investment options. In option A, you have to invest $6,000 now and $1,200 three years from now. In option B. you have to invest $3,200 now, $1,800 a year from now, and $1,100 three years from now. In both options, you will receive four annual payments of $2,400 each. (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion, assuming 10% interest? Assume that all cash flows occur at the end of a year. Click the icon to view the interest factors for discrete compounding when ; = 10% per year. - X More Info Equal Payment Series Single Payment Compound Amount Compound Amount Factor Sinking Fund Factor Present Worth Factor Factor (F/P, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) 1.1000 1.0000 1.0000 0.9091 1.2100 2.1000 0.4762 1.7355 1.3310 3.3100 0.3021 2.4889 1.4641 4.6410 0.2155 3.1699 1.6105 6.1051 0.1638 3.7908 1.7716 7.7156 0.1296 4.3553 1.9487 9.4872 0.1054 4.8684 2.1436 11.4359 0.0874 5.3349 2.3579 13.5795 0.0736 5.7590 2.5937 15.9374 0.0627 6.1446 N12345 6 7 8 9 10 Present Worth Factor (P/F, i, N) 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4685 0.4241 0.3855 Capital Recovery Factor (A/P, i, N) 1.1000 0.5782 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627

You are considering two investment options. In option A, you have to invest $6,000 now and $1,200 three years from now. In option B. you have to invest $3,200 now, $1,800 a year from now, and $1,100 three years from now. In both options, you will receive four annual payments of $2,400 each. (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion, assuming 10% interest? Assume that all cash flows occur at the end of a year. Click the icon to view the interest factors for discrete compounding when ; = 10% per year. - X More Info Equal Payment Series Single Payment Compound Amount Compound Amount Factor Sinking Fund Factor Present Worth Factor Factor (F/P, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) 1.1000 1.0000 1.0000 0.9091 1.2100 2.1000 0.4762 1.7355 1.3310 3.3100 0.3021 2.4889 1.4641 4.6410 0.2155 3.1699 1.6105 6.1051 0.1638 3.7908 1.7716 7.7156 0.1296 4.3553 1.9487 9.4872 0.1054 4.8684 2.1436 11.4359 0.0874 5.3349 2.3579 13.5795 0.0736 5.7590 2.5937 15.9374 0.0627 6.1446 N12345 6 7 8 9 10 Present Worth Factor (P/F, i, N) 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4685 0.4241 0.3855 Capital Recovery Factor (A/P, i, N) 1.1000 0.5782 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:You are considering two investment options. In option A, you have to invest $6,000 now and $1,200 three years from now. In option B. you have to invest $3,200 now, $1,800 a year from now, and $1,100 three years from

now. In both options, you will receive four annual payments of $2,400 each. (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and

(b) the present worth criterion, assuming 10% interest? Assume that all cash flows occur at the end of a year.

Click the icon to view the interest factors for discrete compounding when /= 10% per year.

- X

More Info

Single Payment

Equal Payment Series

Sinking Present

Fund

Worth

Compound

Amount

Factor

(F/A, i, N)

Factor

Factor

(A/F, i, N)

(P/A, i, N)

1.0000

1.0000

0.9091

2.1000

0.4762

1.7355

3.3100

0.3021

2.4869

4.6410

0.2155

3.1699

6.1051

0.1638

3.7908

7.7156

0.1296

4.3553

9.4872

0.1054

4.8684

11.4359

0.0874

5.3349

13.5795

0.0736

5.7590

15.9374

0.0627

6.1446

N

1

2

3

4

5

6

7

8

9

10

Compound

Amount

Factor

(F/P, i, N)

1.1000

1.2100

1.3310

1.4641

1.6105

1.7716

1.9487

2.1436

2.3579

2.5937

Present

Worth

Factor

(P/F, i, N)

0.9091

0.8264

0.7513

0.6830

0.6209

0.5645

0.5132

0.4685

0.4241

0.3855

Capital

Recovery

Factor

(A/P, i, N)

1.1000

0.5762

0.4021

0.3155

0.2638

0.2296

0.2054

0.1874

0.1736

0.1627

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman