19. Real national income means: (a) national income at current prices (b) national income at factor prices (c) national income at constant prices (d) national income at average prices of the past 10 year 20. GDP Deflator = Real income (a) Nominalincome Nominal income (b) x 100 x 100 Realincome Realincome (c) Population x 100 (d) None of these 21. Increase in price of commodities due to increase in taxes assumes relevance in the estimation of NNP MP because: (a) taxes are compulsory payments (b) taxes are transfer payments (c) taxes are paid out of income of the households teves cause a rise in market price of the commodities which otherwise would have been sold at a lower price

19. Real national income means: (a) national income at current prices (b) national income at factor prices (c) national income at constant prices (d) national income at average prices of the past 10 year 20. GDP Deflator = Real income (a) Nominalincome Nominal income (b) x 100 x 100 Realincome Realincome (c) Population x 100 (d) None of these 21. Increase in price of commodities due to increase in taxes assumes relevance in the estimation of NNP MP because: (a) taxes are compulsory payments (b) taxes are transfer payments (c) taxes are paid out of income of the households teves cause a rise in market price of the commodities which otherwise would have been sold at a lower price

Chapter6: Tracking The U.s. Economy

Section: Chapter Questions

Problem 1.1P

Related questions

Question

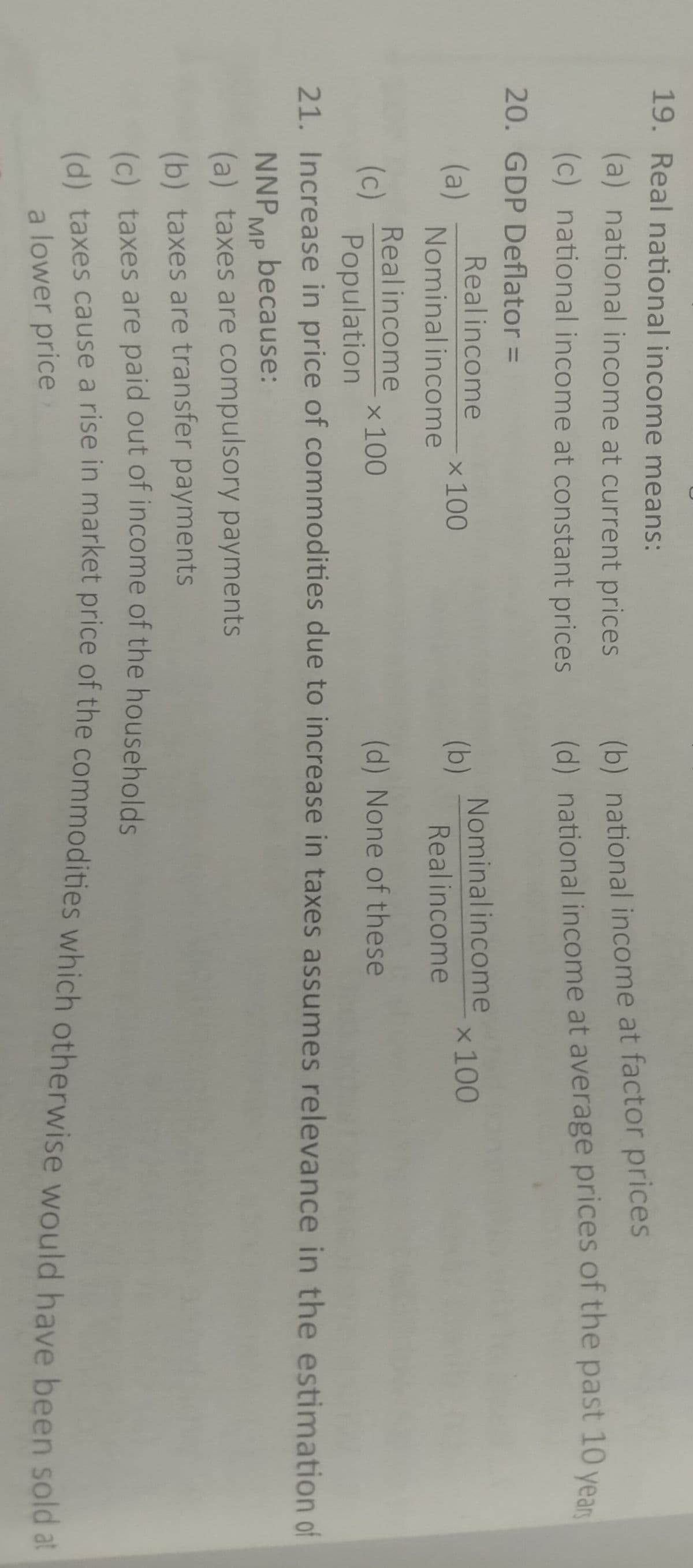

Transcribed Image Text:19. Real national income means:

(a) national income at current prices

(b) national income at factor prices

(c) national income at constant prices

(d) national income at average prices of the past 10 yean

20. GDP Deflator =

Realincome

(a)

Nominalincome

Nominalincome

(b)

x 100

x 100

Realincome

Realincome

(c)

Population

x 100

(d) None of these

21. Increase in price of commodities due to increase in taxes assumes relevance in the estimation of

NNP,

because:

MP

(a) taxes are compulsory payments

(b) taxes are transfer payments

(c) taxes are paid out of income of the households

a cause a rise in market price of the commodities which otherwise would have been sold at

a lower price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax