1a. 1b. 2. You are looking to buy a new car. The purchase price of the one you want is $15,000 and requires a $3,000 down payment. If the financing rate is 6.75% APR for four years, what will your monthly payments be? Suppose there is a special promotion that allows you to get $500 back (and still finance the rest at 6.75% APR) or get a 2.9% APR for four years. Which option will you choose? You can afford $1,000 a month for a house payment. You figure taxes and insurance will be about $250 a month. Assuming mortgage rates are 7% APR for a fixed rate loan, how much can you pay for a house assuming: a) a 20 year mortgage; b) a 25 year mortgage; c) a 30 year mortgage?

1a. 1b. 2. You are looking to buy a new car. The purchase price of the one you want is $15,000 and requires a $3,000 down payment. If the financing rate is 6.75% APR for four years, what will your monthly payments be? Suppose there is a special promotion that allows you to get $500 back (and still finance the rest at 6.75% APR) or get a 2.9% APR for four years. Which option will you choose? You can afford $1,000 a month for a house payment. You figure taxes and insurance will be about $250 a month. Assuming mortgage rates are 7% APR for a fixed rate loan, how much can you pay for a house assuming: a) a 20 year mortgage; b) a 25 year mortgage; c) a 30 year mortgage?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

I need help with this review problems

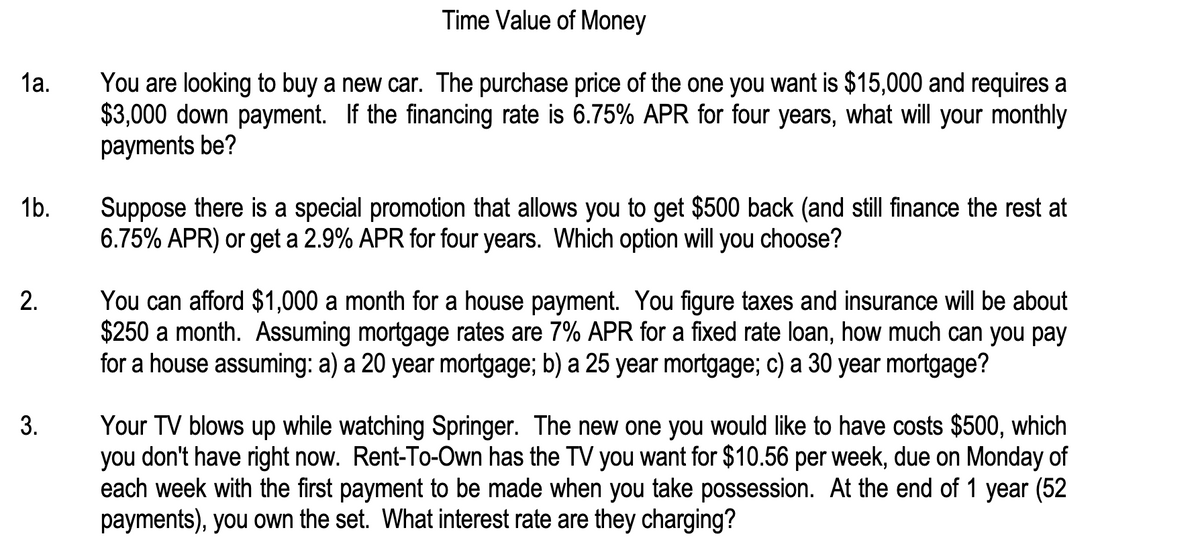

Transcribed Image Text:1a.

1b.

2.

3.

Time Value of Money

You are looking to buy a new car. The purchase price of the one you want is $15,000 and requires a

$3,000 down payment. If the financing rate is 6.75% APR for four years, what will your monthly

payments be?

Suppose there is a special promotion that allows you to get $500 back (and still finance the rest at

6.75% APR) or get a 2.9% APR for four years. Which option will you choose?

You can afford $1,000 a month for a house payment. You figure taxes and insurance will be about

$250 a month. Assuming mortgage rates are 7% APR for a fixed rate loan, how much can you pay

for a house assuming: a) a 20 year mortgage; b) a 25 year mortgage; c) a 30 year mortgage?

Your TV blows up while watching Springer. The new one you would like to have costs $500, which

you don't have right now. Rent-To-Own has the TV you want for $10.56 per week, due on Monday of

each week with the first payment to be made when you take possession. At the end of 1 year (52

payments), you own the set. What interest rate are they charging?

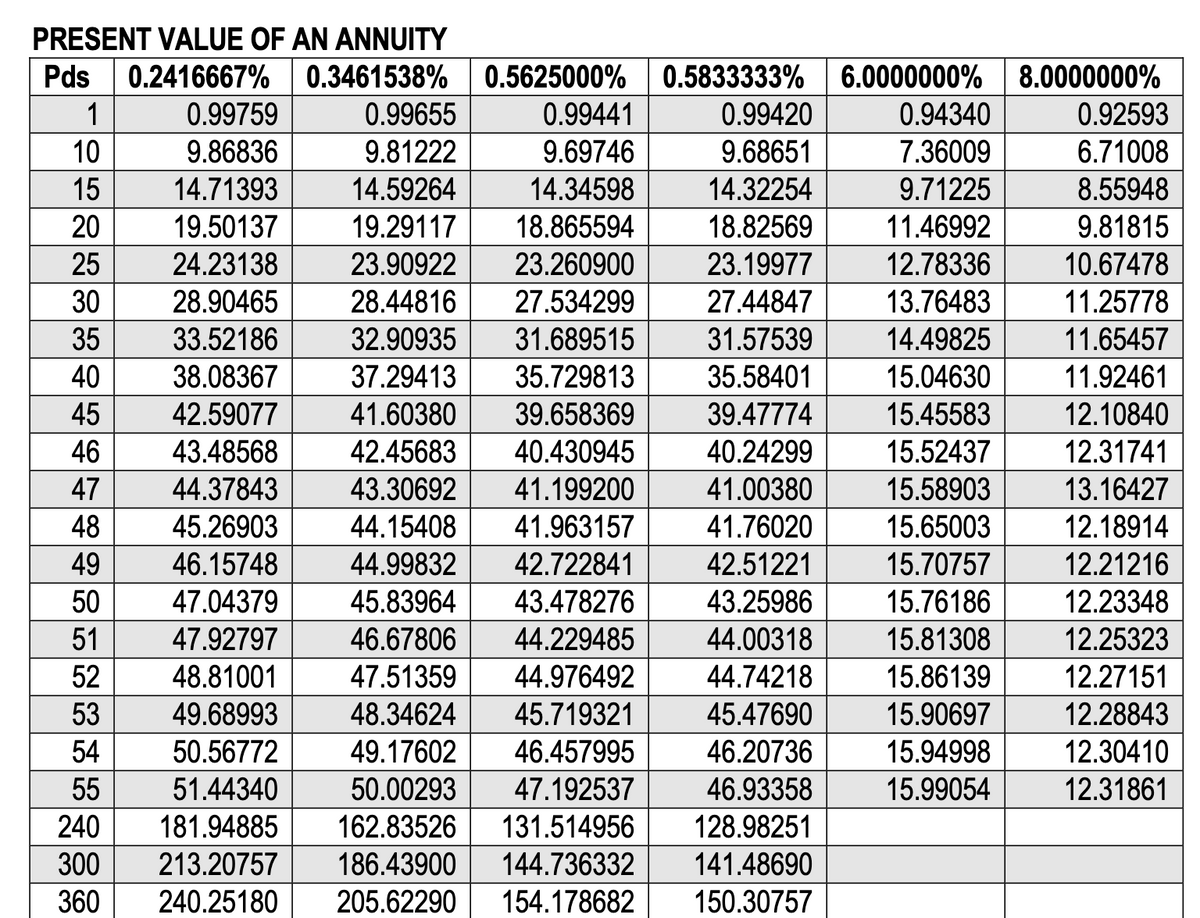

Transcribed Image Text:PRESENT VALUE OF AN ANNUITY

Pds 0.2416667% 0.3461538% 0.5625000% 0.5833333% 6.0000000% 8.0000000%

1

10

15

0.99655

0.99441

9.81222

9.69746

14.71393

14.59264

14.34598

19.50137

19.29117

18.865594

24.23138

23.90922

23.260900

28.90465

28.44816

27.534299

33.52186

32.90935 31.689515

38.08367

37.29413

35.729813

42.59077

41.60380 39.658369

43.48568

42.45683

40.430945

44.37843

43.30692

41.199200

45.26903

44.15408

41.963157

46.15748

44.99832 42.722841

47.04379

45.83964 43.478276

47.92797

46.67806

44.229485

48.81001

47.51359

44.976492

49.68993

48.34624

45.719321

50.56772

49.17602

46.457995

51.44340

50.00293 47.192537

240

181.94885 162.83526 131.514956

300 213.20757 186.43900 144.736332

360 240.25180

20

25

0.99759

9.86836

30

35

40

45

46

47

48

49

50

51

52

53

54

55

0.99420

9.68651

14.32254

18.82569

23.19977

27.44847

31.57539

35.58401

39.47774

40.24299

41.00380

41.76020

42.51221

43.25986

44.00318

44.74218

45.47690

46.20736

46.93358

128.98251

141.48690

205.62290 154.178682 150.30757

0.94340

7.36009

9.71225

11.46992

12.78336

13.76483

14.49825

15.04630

15.45583

15.52437

15.58903

15.65003

15.70757

15.76186

15.81308

15.86139

15.90697

15.94998

15.99054

0.92593

6.71008

8.55948

9.81815

10.67478

11.25778

11.65457

11.92461

12.10840

12.31741

13.16427

12.18914

12.21216

12.23348

12.25323

12.27151

12.28843

12.30410

12.31861

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education