2-3. Income statement. Morimatsu, Inc., produces a household appliance that sells for $90. The basic patent is held by the inventor, who is paid a royalty of $5 on each unit sold. The royalty is considered a marketing expense. The data taken from the books and other records of the company on December 31, 19--, are- shown below and on the following page: Inventories: JANUARY 1 DECEMBER 31 Finished goods. Work in process Materials. $4,584 8,159 3,420 $. 7,518 4,002 7,130 Sales.. $387,000 90,563 Materials purchased Freight in Direct labor. Indirect labor Depreciation -tactory equipment Miscellaneous factory overhead Rent .. Sales salaries.. Royalties paid Freight out Miscellaneous marketing expenses Ofice salaries 477 62,522 5,026 2,135 17,908 5,000 28,000 21,500 1,860 11,380 24,790

2-3. Income statement. Morimatsu, Inc., produces a household appliance that sells for $90. The basic patent is held by the inventor, who is paid a royalty of $5 on each unit sold. The royalty is considered a marketing expense. The data taken from the books and other records of the company on December 31, 19--, are- shown below and on the following page: Inventories: JANUARY 1 DECEMBER 31 Finished goods. Work in process Materials. $4,584 8,159 3,420 $. 7,518 4,002 7,130 Sales.. $387,000 90,563 Materials purchased Freight in Direct labor. Indirect labor Depreciation -tactory equipment Miscellaneous factory overhead Rent .. Sales salaries.. Royalties paid Freight out Miscellaneous marketing expenses Ofice salaries 477 62,522 5,026 2,135 17,908 5,000 28,000 21,500 1,860 11,380 24,790

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter27: Adjustments, Financial Statements, And Year-end Accounting For A Manufacturing

business

Section: Chapter Questions

Problem 1MP: Reese Manufacturing Company manufactures and sells a limited line of products made to customer...

Related questions

Question

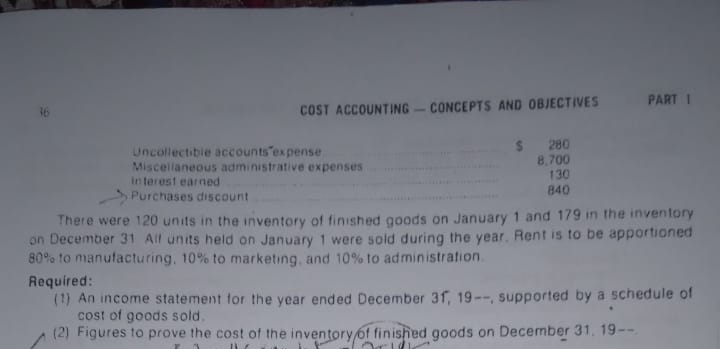

Transcribed Image Text:PART I

COST ACCOUNTING-CONCEPTS AND OBJECTIVES

Uncollectible accounts expense

Miscellaneous administrative expenses

in terest earned

Purchases discount

$ 280

8.700

130

840

There were 120 units in the inventory of finished goods on January 1 and 179 in the inventory

on December 31 All units held on January 1 were sold during the year. Rent is to be apportioned

80% to manufacturing, 10% to marketing, and 10% to administration.

Required:

(1) An income statement for the year ended December 31, 19--, supported by a schedule of

cost of goods sold.

(2) Figures to prove the cost of the inventory 6f finished goods on December 31. 19--

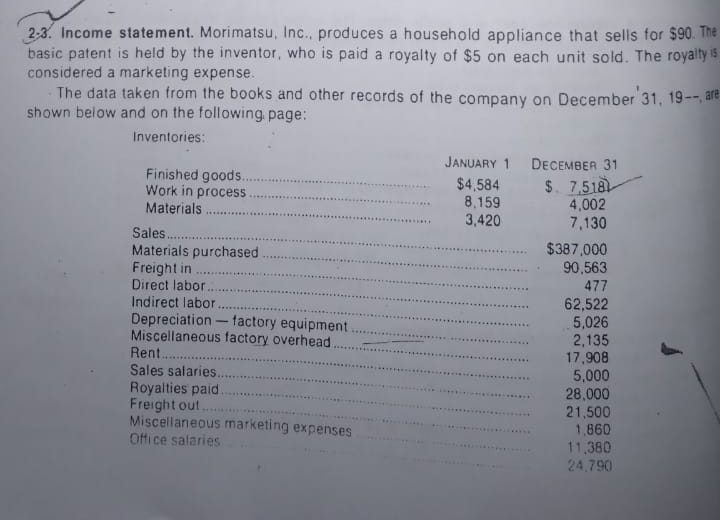

Transcribed Image Text:2-3. Income statement. Morimatsu, Inc., produces a household appliance that sells for $90. The

basic patent is held by the inventor, who is paid a royalty of $5 on each unit sold. The royalty is

considered a marketing expense.

The data taken from the books and other records of the company on December 31, 19-- are

shown below and on the following, page:

Inventories:

JANUARY 1 DECEMBER 31

Finished goods.

Work in process

Materials

$4,584

8,159

3,420

$. 7,518

4,002

7,130

Sales.

Materials purchased.

Freight in

Direct labor.

Indirect labor

$387,000

90,563

477

Depreciation-tactory equipment

Miscellaneous factory overhead

Rent..

Sales salaries..

Royalties paid.

Freight out.

Miscellaneous marketing expenses

62,522

5,026

2,135

17,908

5,000

28,000

21,500

1,860

11,380

24,790

.....

Office salaries

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning