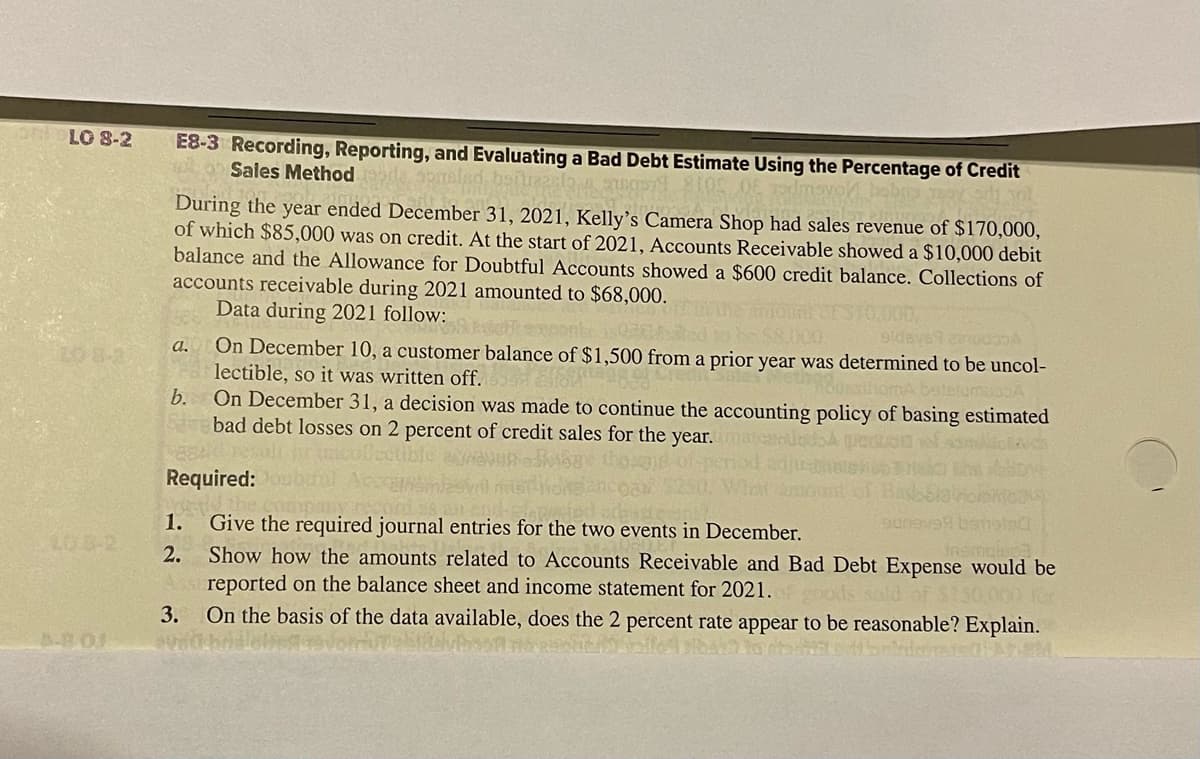

2 E8-3 Recording, Reporting, and Evaluating a Bad Debt Estimate Using the Percentage of Credit Sales Method aprelad 9 8100 During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2021, Accounts Receivable showed a $10,000 debit balance and the Allowance for Doubtful Accounts showed a $600 credit balance. Collections of accounts receivable during 2021 amounted to $68,000. a. b. 1. Data during 2021 follow: Pokemoont eldavs ainu5A On December 10, a customer balance of $1,500 from a prior year was determined to be uncol- lectible, so it was written off. PETER JssthomA betelumabbA Required: Give the required journal entries for the two events in December. Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the balance sheet and income statement for 2021. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Explain. 2. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year.

2 E8-3 Recording, Reporting, and Evaluating a Bad Debt Estimate Using the Percentage of Credit Sales Method aprelad 9 8100 During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2021, Accounts Receivable showed a $10,000 debit balance and the Allowance for Doubtful Accounts showed a $600 credit balance. Collections of accounts receivable during 2021 amounted to $68,000. a. b. 1. Data during 2021 follow: Pokemoont eldavs ainu5A On December 10, a customer balance of $1,500 from a prior year was determined to be uncol- lectible, so it was written off. PETER JssthomA betelumabbA Required: Give the required journal entries for the two events in December. Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the balance sheet and income statement for 2021. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Explain. 2. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 5EA: Millennium Associates records bad debt using the allowance, income statement method. They recorded...

Related questions

Question

100%

Transcribed Image Text:ObLO 8-2

10-8-2

A-BOL

E8-3 Recording, Reporting, and Evaluating a Bad Debt Estimate Using the Percentage of Credit

Sales Method

nga 105

During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $170,000,

of which $85,000 was on credit. At the start of 2021, Accounts Receivable showed a $10,000 debit

balance and the Allowance for Doubtful Accounts showed a $600 credit balance. Collections of

accounts receivable during 2021 amounted to $68,000.

Data during 2021 follow:

a.

b.

On December 10, a customer balance of $1,500 from a prior year was determined to be uncol-

lectible, so it was written off.

DesthomA betelumu.A

1.

2.

On December 31, a decision was made to continue the accounting policy of basing estimated

bad debt losses on 2 percent of credit sales for the year.

Required:

Give the required journal entries for the two events in December.

inomials

Show how the amounts related to Accounts Receivable and Bad Debt Expense would be

reported on the balance sheet and income statement for 2021.

sold of $150,000 for

3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Explain.

Expert Solution

Step 1

Journal Entry :- The act of logging any transaction, whether or not it is an economic one, is known as a journal entry. Transactions are recorded in an accounting journal that shows the debit and credit balances of a company. The journal entry contains multiple records, each of which is either a debit or a credit. The purpose of preparing the journal entry to segregate the transaction which are incurred to the debit and credit basis. Debit all expenses related transaction and credit all income related transaction.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning