Sheridan Ltd. purchased a delivery truck on July 1, 2024. The list price of the new truck was $93,000. Sheridan offered a used truck as a trade-in on the purchase. The used truck had been purchased for $39,000 and the accumulated depreciation to the date of the exchange was $36,300. Sheridan looked up the fair value of the used truck on a local web site and found that its used truck had resale value of $4,900. The dealer offered a $7,000 trade-in allowance on the purchase of the new truck. The deal was concluded and Sheridan paid $86,000 on the exchange. On November 1, 2024, a set of snow tires were purchased for $1,300. On December 31, 2024, the company's year-end, Sheridan recorded depreciation using the straight-line method, using an estimated useful life of 6 years and an estimated residual value of $6,300. On January 2, 2025, an inexperienced driver had an accident and totally destroyed the truck. The insurance company paid Sheridan $82,350 for the truck. a. b. C. d. Record the transaction on July 1, 2024. Record the transaction on November 1, 2024. Record the adjusting entry on December 31, 2024. Record the transaction on January 2, 2025.

Sheridan Ltd. purchased a delivery truck on July 1, 2024. The list price of the new truck was $93,000. Sheridan offered a used truck as a trade-in on the purchase. The used truck had been purchased for $39,000 and the accumulated depreciation to the date of the exchange was $36,300. Sheridan looked up the fair value of the used truck on a local web site and found that its used truck had resale value of $4,900. The dealer offered a $7,000 trade-in allowance on the purchase of the new truck. The deal was concluded and Sheridan paid $86,000 on the exchange. On November 1, 2024, a set of snow tires were purchased for $1,300. On December 31, 2024, the company's year-end, Sheridan recorded depreciation using the straight-line method, using an estimated useful life of 6 years and an estimated residual value of $6,300. On January 2, 2025, an inexperienced driver had an accident and totally destroyed the truck. The insurance company paid Sheridan $82,350 for the truck. a. b. C. d. Record the transaction on July 1, 2024. Record the transaction on November 1, 2024. Record the adjusting entry on December 31, 2024. Record the transaction on January 2, 2025.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8P: Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of...

Related questions

Question

Please help me with all answers thanku

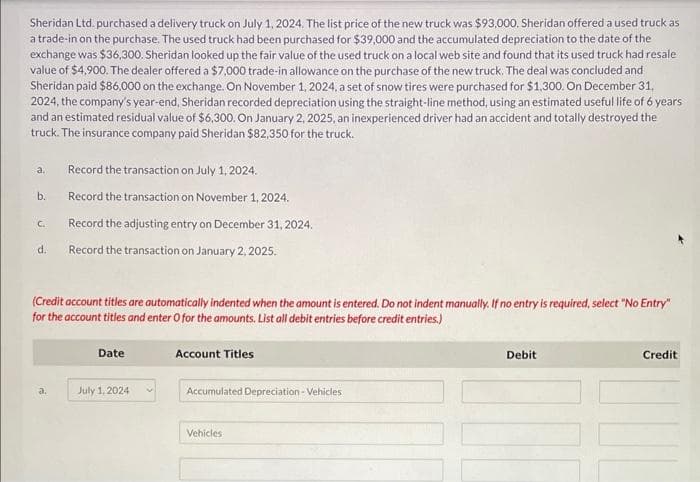

Transcribed Image Text:Sheridan Ltd. purchased a delivery truck on July 1, 2024. The list price of the new truck was $93,000. Sheridan offered a used truck as

a trade-in on the purchase. The used truck had been purchased for $39,000 and the accumulated depreciation to the date of the

exchange was $36,300. Sheridan looked up the fair value of the used truck on a local web site and found that its used truck had resale

value of $4,900. The dealer offered a $7,000 trade-in allowance on the purchase of the new truck. The deal was concluded and

Sheridan paid $86,000 on the exchange. On November 1, 2024, a set of snow tires were purchased for $1,300. On December 31,

2024, the company's year-end, Sheridan recorded depreciation using the straight-line method, using an estimated useful life of 6 years

and an estimated residual value of $6,300. On January 2, 2025, an inexperienced driver had an accident and totally destroyed the

truck. The insurance company paid Sheridan $82,350 for the truck.

a.

b.

C.

d.

Record the transaction on July 1, 2024.

Record the transaction on November 1, 2024.

Record the adjusting entry on December 31, 2024.

Record the transaction on January 2, 2025.

(Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"

for the account titles and enter O for the amounts. List all debit entries before credit entries.)

a.

Date

July 1, 2024

Account Titles

Accumulated Depreciation - Vehicles

Vehicles

Debit

Credit

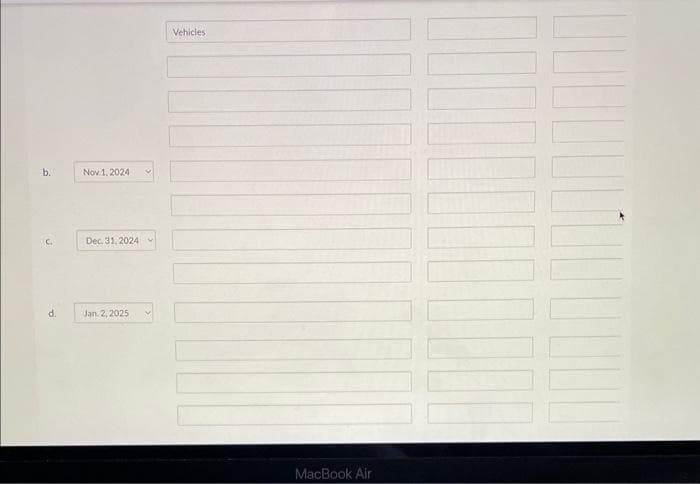

Transcribed Image Text:b.

C.

d.

Nov 1, 2024

Dec. 31, 2024

Jan 2, 2025

Vehicles

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College