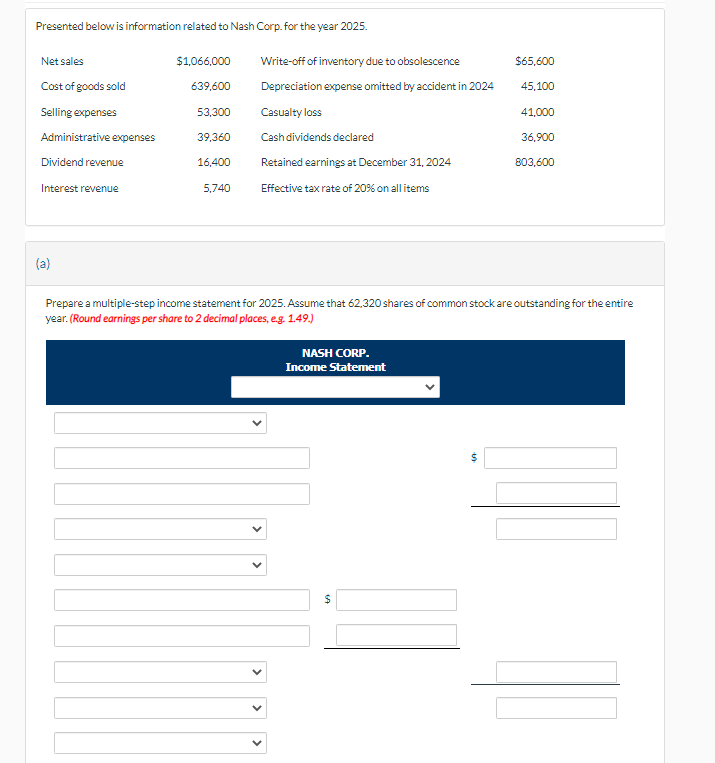

Presented below is information related to Nash Corp. for the year 2025. Net sales Cost of goods sold Selling expenses Administrative expenses Dividend revenue Interest revenue $1,066,000 639,600 53,300 39,360 16,400 5,740 Write-off of inventory due to obsolescence Depreciation expense omitted by accident in 2024 Casualty loss Cash dividends declared Retained earnings at December 31, 2024 Effective tax rate of 20% on all items $65,600 45,100 41,000 36,900 803,600

Presented below is information related to Nash Corp. for the year 2025. Net sales Cost of goods sold Selling expenses Administrative expenses Dividend revenue Interest revenue $1,066,000 639,600 53,300 39,360 16,400 5,740 Write-off of inventory due to obsolescence Depreciation expense omitted by accident in 2024 Casualty loss Cash dividends declared Retained earnings at December 31, 2024 Effective tax rate of 20% on all items $65,600 45,100 41,000 36,900 803,600

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 71APSA: Effects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in...

Related questions

Question

HELP ME

Transcribed Image Text:Presented below is information related to Nash Corp. for the year 2025.

Net sales

Cost of goods sold

Selling expenses

Administrative expenses

Dividend revenue

Interest revenue

(a)

$1,066,000

639,600

53,300

39,360

16,400

5,740

Write-off of inventory due to obsolescence

Depreciation expense omitted by accident in 2024

Casualty loss

Cash dividends declared

Retained earnings at December 31, 2024

Effective tax rate of 20% on all items

NASH CORP.

Income Statement

$

$65,600

$

45,100

Prepare a multiple-step income statement for 2025. Assume that 62,320 shares of common stock are outstanding for the entire

year. (Round earnings per share to 2 decimal places, e.g. 1.49.)

41,000

36,900

803,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning