2 Ifthe Brooklyn Club is currently collecting must the receivable balance be reduced to achieve an ACPof forty days! me poo Problem 5 The Robinson Hotel has the following ratios: Total asset turmover: Return on sales: Anba uo un 5 percent Juaad ot The total assets of the Robinson Hotel equal $5,000,000. Assume the balance sheet numbere at the beginning and end of the year are the same. painbay 1. Determine the firm's total annual sales. 2 Determine the firm's net income. 3. Determine the amount of the firm's total debt.

2 Ifthe Brooklyn Club is currently collecting must the receivable balance be reduced to achieve an ACPof forty days! me poo Problem 5 The Robinson Hotel has the following ratios: Total asset turmover: Return on sales: Anba uo un 5 percent Juaad ot The total assets of the Robinson Hotel equal $5,000,000. Assume the balance sheet numbere at the beginning and end of the year are the same. painbay 1. Determine the firm's total annual sales. 2 Determine the firm's net income. 3. Determine the amount of the firm's total debt.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 16P: Ratios Analyses: McCormick Refer to the information for McCormick above. Additional information for...

Related questions

Question

Transcribed Image Text:1. the the club can and still :

2. If the Brooklyn Club is currently in by how much

282 Chapter 5

Required:

good rating for credit and collections.

must the receivable balance be reduced to achieve an ACP of forty days?

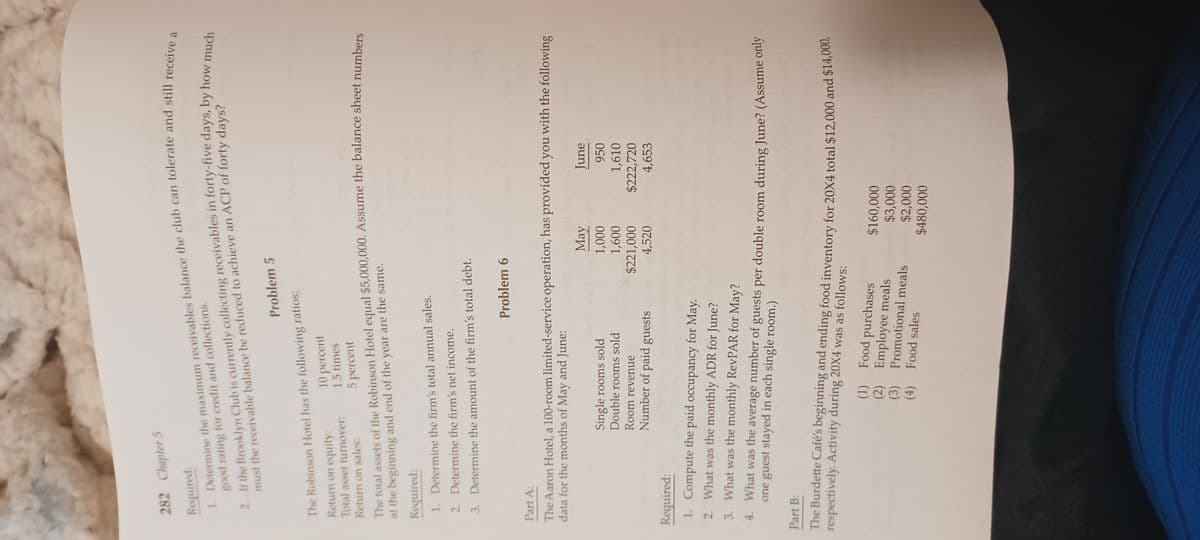

Problem 5

The Robinson Hotel has the following ratios:

Return on equity:

Total asset turnover:

Return on sales:

10 percent

1.5 times

5 percent

The total assets of the Robinson Hotel equal $5,000,000. Assume the balance sheet numbere

at the beginning and end of the year are the same.

Required:

1. Determine the firm's total annual sales.

2. Determine the firm's net income.

3. Determine the amount of the firm's total debt.

Problem 6

Part A:

The Aaron Hotel, a 100-room limited-service operation, has provided you with the following

data for the months of May and June:

May

June

Single rooms sold

Double rooms sold

000

009'

1,610

$222,720

4,653

Room revenue

$221,000

Number of paid guests

4,520

Required:

1. Compute the paid occupancy for May.

2. What was the monthly ADR for June?

3. What was the monthly RevPAR for May?

4. What was the average number of guests per double room during June? (Assume oluy

one guest stayed in each single room.)

Part B:

The Burdette Café's beginning and ending food inventory for 20X4 total $12,000 and $14,000,

respectively. Activity during 20X4 was as follows:

(1)

(2) Employee meals

Food purchases

$160,000

$3,000

$2,000

$480,000

(3)

Promotional meals

Food sales

()

Transcribed Image Text:Ratio Analysis 28

8. Equipment is purchased with

long-term notes.

9 Utility expenses are paid (they

10. A cash dividend is paid.

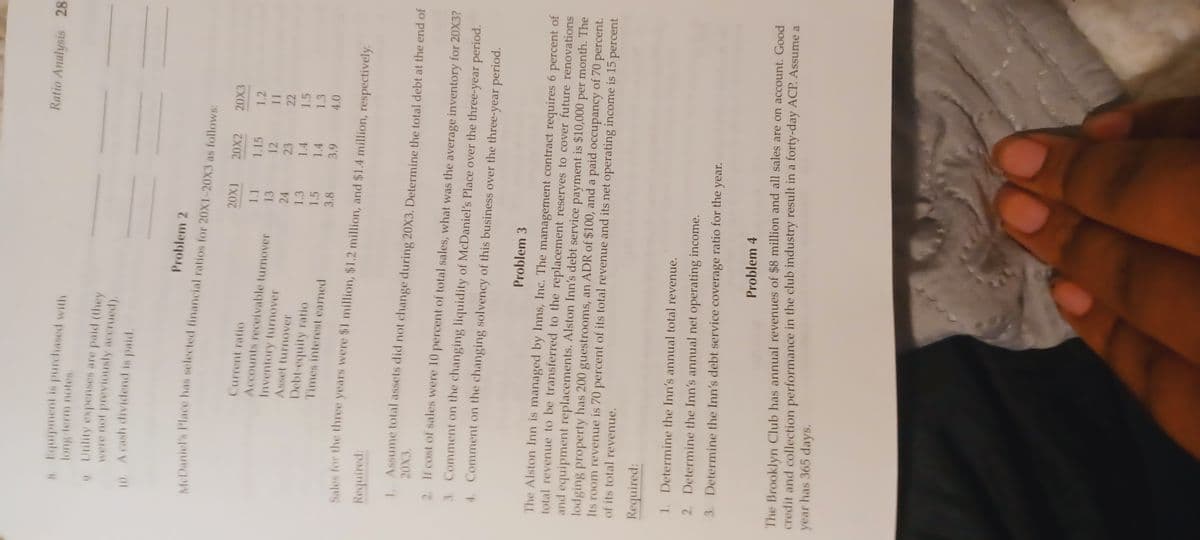

Problem 2

MeDaniel's Place has selected financial ratios for 20X1-20X3 as follows:

20X2

20X3

Current ratio

Accounts receivable turnover

1.15

1.2

Inventory turnover

13

12

23

22

Asset turnover

Debt-equity ratio

1.3

1.4

1.5

1.5

1.4

1.3

Times interest earned

3.8

3.9

Sales for the three years were $1 million, $1.2 million, and $1.4 million, respectively.

Required:

1. Assume total assets did not change during 20X3. Determine the total debt at the end of

20X3,

2. If cost of sales were 10 percent of total sales, what was the average inventory for 20X3?

3. Comment on the changing liquidity of McDaniel's Place over the three-year period.

4. Comment on the changing solvency of this business over the three-year period.

Problem 3

The Alston Inn is managed by Inns, Inc. The management contract requires 6 percent of

total revenue to be transferred to the replacement reserves to cover future renovations

and equipment replacements. Alston Inn's debt service payment is $10,000 per month. The

lodging property has 200 guestrooms, an ADR of $100, and a paid occupancy of 70 percent.

Its room revenue is 70 percent of its total revenue and its net operating income is 15 percent

of its total revenue.

Required:

1. Determine the Inn's annual total revenue.

2. Determine the Inn's annual net operating income.

3. Determine the Inn's debt service coverage ratio for the year.

Problem 4

The Brooklyn Club has annual revenues of $8 million and all sales are on account. Good

credit and collection performance in the club industry result in a forty-day ACP. Assume a

year has 365 days.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning