2 June 10 Land Common Stock Paid-in Capital in Excess of Par-Common Stock 268500 200000 68500

Q: Shade Company adopted a standard cost system several years ago. The standard costs for direct labor…

A: Direct material costs are the costs of raw materials or parts that go directly into producing…

Q: First Quarter $ 18,000 $ 21,600 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases $…

A: The Income Statement is an essential economic statement which shows a company's profit and loss over…

Q: Find the capital beginning when, Additional Income = 150,000.00 Net Income = 120,000.00

A: Formula used: Ending capital = Beginning capital + Additional capital + Net profit - withdrawals

Q: uppose it costs $10,000 to purchase a new car. The annual perating cost and resale value of a used…

A: Explanation of Concept Annual Worth Concept of retention and replacement analysis, replacement…

Q: The following account balances were listed on the trial balance of Edgar Company at the end of the…

A: Correct cash balance = Accounts payable + Common stock + Notes payable - Equipment - Land

Q: Shoemaker Perkins Company uses a standard cost system and had 500 pounds of raw material X15 on hand…

A: Formula: Material purchase price variance = (Actual price per pound - Standard price per…

Q: Tom gave his daughter, Nicole, permission to access his business account online but not his…

A: Answer:- Online banking meaning:- Online banking, often known as internet banking, refers to online…

Q: Prepare Machinery Account for 2015.

A: Given in the question: Company changes depreciation method from written down to straight line method…

Q: Refer to the following data of SG Company: Assets to be realized 1,375,000 Liabilities liquidated…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: products that it sells to the same market. Excerpted below are its budgeted and actual operating…

A: The weighted-average budgeted contribution margin per unit is: Total budgeted contribution/ budgeted…

Q: The following are the assets and liabilities of Tee, Pak, and Long artnership on April 30, 200B…

A: Under piecemeal distribution, payments are made to creditors and partners as and when assets are…

Q: Nana Adom Company Limited is a wholesale company that deals in general goods. The following…

A: Cash Budget- A cash budget is a plan for identifying an organization's cash inflows and outflows. It…

Q: Accounts receivable Inventory Net sales (all credit) Cost of goods sold Total assets Total…

A: Formula: Receivables turnover ratio = ( Net credit sales / Average Accounts receivables )

Q: June 1, 2022, when the prevailing market rate on similar instruments was at 14%, ABC Company…

A: An interest of 12% is paid every on every May 31. Date of purchase of bond = June 1 ,2022 Purchase…

Q: Find the rate of interest and final amount resulting from an investment of P800 at 12% simple…

A: Simple interest: It is the return an individual gets on the amount invested by him at the end of…

Q: The Chart of Accounts for 5C's Computer Center appears below: 5C's Computer Center Chart of Accounts…

A: Journal Entry The basic process of accounting work is first to make the required journal entry for…

Q: The income statement of Mus Plaga Services for the year ending 31 May 2021 showed service revenue of…

A: Cash received from customers will be beginning balance of accounts receivable plus total revenue…

Q: Sheridan Hardware payroll for November 2020 is summarized below. Payroll Wages Due FICA State…

A:

Q: The following balance sheet accounts were taken from the partnership of J&J Co. on March 31, 2020…

A: Liquidation means where the business of firm is closed down , assets are sold out and liabilities…

Q: Evoc Company Statements of Financial Position December 31 Intangibles and other assets. Property,…

A: Introduction: Working capital : Deduction of Current liabilities from Current Assets derives the…

Q: fter the realization of non-cash assets, the following account balances appeared in the genera…

A: Realization Account: When the firm dissolved then a new account is opened that is known as…

Q: Show in tabular form (depreciation schedule) the computation for the depreciation expenses,…

A: Business organizations are required to charge the depreciation expense so as to show the fair value…

Q: For taxable year 2018, the company's sixth year of operations, the records of Mega S Gross sales…

A: Gross income is income available after deductions from the sales all expenses including cost of…

Q: A 10-year convertible bond with a coupon rate 6% can be converted into 20 shares of common stock.…

A: Given Information Convertible Bond = 10 Year Coupon Rate = 6% Converted = 20 Shares Common stock…

Q: You can earn .47 percent per month at your bank. If you deposit $3,000, how long must you wait until…

A: Computation of No. of months taken for deposit of $3,000 grown into $6,000 on an interest of 0.47%…

Q: Escuchar Products, a producer of DVD players, has established a labor standard for its…

A: Labor rate variance = Actual hours ×[standard rate - Actual rate] = (Actual hours×Standard rate) -…

Q: From the following information, furnished by Ms. Anucampa pertaining to the financial year ended as…

A: In the context of the given question, we are required to compute the total income of Ms. Anucampa…

Q: A Moving to another question will save this response. Question 9 Moon Co. decides to establish a…

A: Cash short and over account is expenses account. If ending balance of petty cash book is different…

Q: A service provider has a 12-month agreement to provide a customer with services for which the custom…

A: Ex post facto: It is a legal term that means that something is being made binding retroactively in a…

Q: How much is the value of the note that Mi will get from the partnership?

A: Capital balances on December 31, 2008- P200,000 Add:Revaluation Profit on Furniture Fixtures-…

Q: Ruggles, Stanton and Tracy are partners, having capitals of P321,742, P419,078, and P276,350,…

A: Partnership is a contract between two or persons who agreed to do business by mutual consent. The…

Q: Omar is the Head of IT Systems and Applications at AAA corporation. His job has been redesigned to…

A: The answer has been mentioned below.

Q: and Y are partners who share profits and losses in the ratio of 31, respectively On August 1, 2023,…

A: Partnership profit or losses are Apportioned according profit sharing ratio as mentioned in the…

Q: Moving estion 12 On March 1, a customer's account balance of $32,300 was deemed to be uncollectible.…

A: Introduction: Journals: Recording of a business transactions in a chronological order. Each and…

Q: A company performs $3,000 of services during the month and bills customers. The customers are…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: Q3 Hollaway Corporation has the following data for the current fiscal year: Actual Budget…

A: Sales mix variance reflects the difference between the planned and actual amounts. To calculate…

Q: прапу amount of (500) million Iraqi dinars for the purpose of purchasing equipment, and the period…

A: There are various methods by which depreciation can be calculated. The constant rate method means…

Q: Calculate the annual, semiannual, quarterly, and monthly premium for the following fe insurance…

A: The insurance premium are given in the table of insurance policy table given by the insurance board…

Q: I) II) III) The principal value of the bond. Trade discount and trade present value. Correct…

A: The principal value of the bond T = 6 months = 0.50 years R = 10% annually Difference between trade…

Q: Blossom Co. is owned by Irina Temelkova. The following information is an alphabetical listing of…

A: One of a company's core financial statements, the Net Income, depicts the company's income and…

Q: The balance sh the Delphine, Xavier, and Olivier partnership follows: Cash Noncash assets $ 69,360…

A: Assets: Cash = $ 69,360 Non-Cash Assets = $126,000 Liabilities: Outside Liabilities = $ 46,500…

Q: Question 1 The following internal control procedures are followed in Trisha’s Office Supplies: (a)…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: Cap Incorporated manufactures ball point pens that sell at wholesale for $0.80 per unit. Budgeted…

A: Full Costing also known as Absorption costing is a costing technique of including all fixed and…

Q: You are an audit manager of Cranberry & Co and you are currently responsible for the audit of…

A: Auditing- Auditing is the independent examination of financial information of any entity, regardless…

Q: A diesel-powered tractor with a cost of $249,520 and an estimated residual value of $7,600 is…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Franchise. Seattle Corporation pays a franchise fee of $20 million to enable it to sell Good's…

A: a . Annual Amortization = Franchise cost / useful life…

Q: How much is the goodwill on the consolidated balance sheet on December 31, 2021?

A: The requirement is to compute goodwill on the consolidated balance sheet on December 31, 2021. The…

Q: Blake Department Store sells television sets with one-year warranties that cover repair and…

A: Formula: Total sales revenue = Sales units x sales price per unit

Q: Use the information for the next two (2) questions. Bold Company estimated annual warranty expense…

A: Introduction: Warranty: Its a kind of Promise to the customers of the business for the units sold or…

Q: What is the shutdown point (in units) for one month? P 1,500 P 2,000 P 2,500 P 3,000

A:

Step by step

Solved in 2 steps

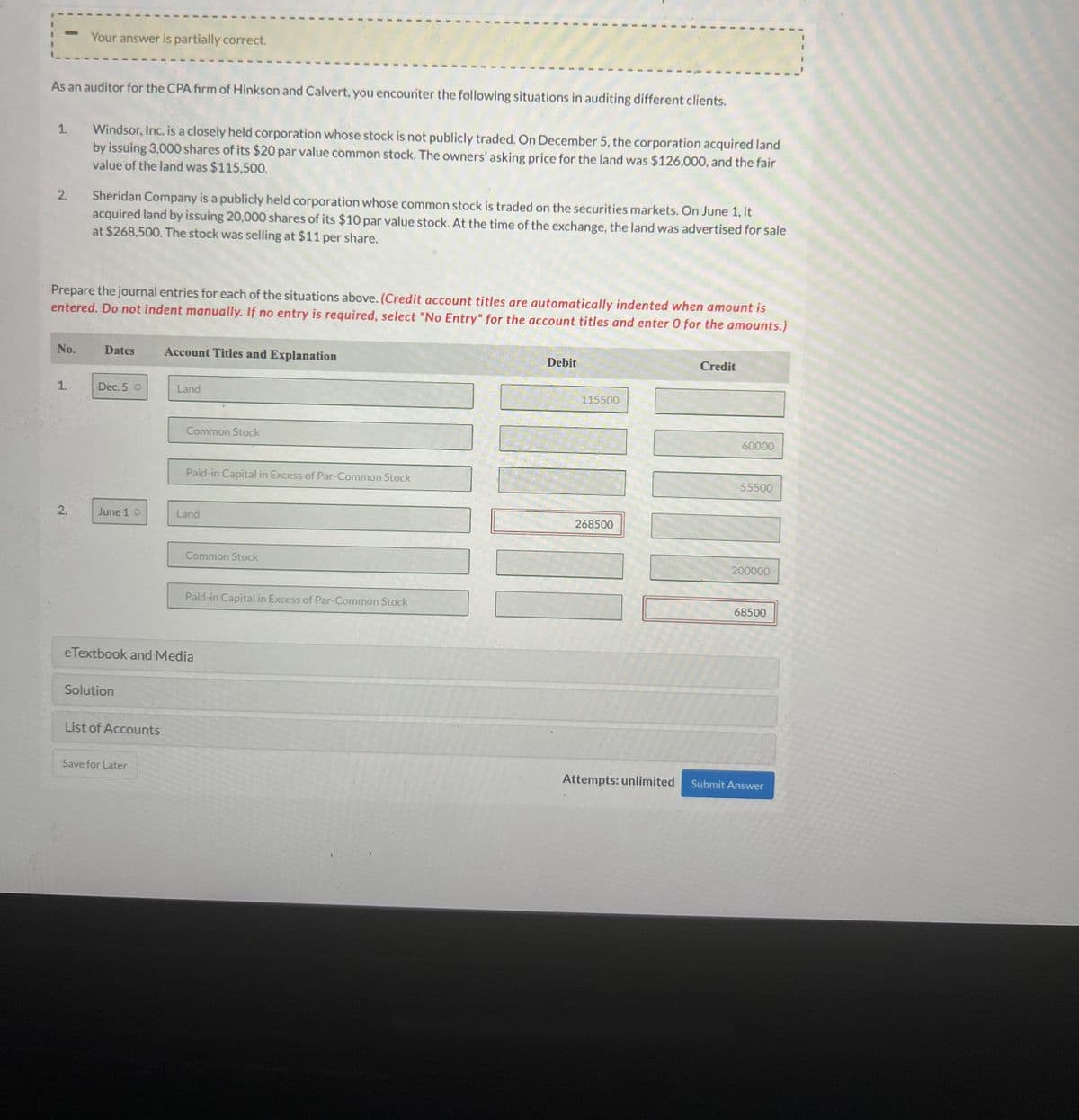

- As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients. 1. Monty Corp. is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 4,000 shares of its $20 par value common stock. The owners’ asking price for the land was $125,000, and the fair value of the land was $118,000. 2. Wildhorse Co. is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 19,000 shares of its $8 par value stock. At the time of the exchange, the land was advertised for sale at $269,000. The stock was selling at $9 per share. Prepare the journal entries for each of the situations above.As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients. 1. Bramble Corp. is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of its $19 par value common stock. The owners’ asking price for the land was $123,500, and the fair value of the land was $117,000. 2. Crane Company is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 21,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $275,000. The stock was selling at $11 per share. Prepare the journal entries for each of the situations above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the…As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients. 1. LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of its $20 par value common stock. The owners’ asking price for the land was $120,000, and the fair value of the land was $110,000. 2. Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $250,000. The stock was selling at $11 per share. Prepare the journal entries for each of the situations above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

- As an auditor for the CPA firm of Bunge and Dodd, you encounter the following situations in auditing different clients. Desi Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of its $20 par value common stock. The owners’ asking price for the land was $120,000, and the fair market value of the land was $115,000. Lucille Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $250,000.The stock was selling at $12 per share. Instructions: Prepare the journal entries for each of the situations above.As an auditer for cpa firm of Hickson and Calvert you encounter the following situations in auditing different clients 1. Skysong,inc is closely held corporation whos stock is not publicly traded on december 5, the corporation acquired land by issuing $3000 share of its $20 per a value common stock .the owner asking price for land was $121500 and the fair value of the land was $116500 2.oriole company is a publicly held corporation whose common stock is traded on the securities markets. On june 1, its acquired land by issuing 19000 shares of its $10 per a valua stock .at the time of the exchange the land was advertised for sale at $260000. The stock was selling at $11 per a share. Prepare the journal entries for each of the situations aboveIngram is a Certified Public Accountant (CPA) employed by Jordan, Keller and Lane, CPAs, to audit Martin Enterprises, Inc., a fast-growing service firm that went public two years ago. The financial statements Ingram audited were included in a proxy statement proposing a merger with several other firms. The proxy statement was filed with the Securities and Exchange Commission and included several inaccuracies. First, approximately $1 million, or more than 20 percent, of the previous year’s “net sales originally reported” had proven nonexistent by the time the proxy statement was filed and had been written off on Martin’s own books. This was not disclosed in the proxy statement, in violation of Accounting Board Opinion Number 9. Second, Martin’s net sales for the current year were stated as $11.3 million when in fact they were less than $10.5 million. Third, Martin’s net profits for the current year were reported as $700,000, when the firm actually had no earnings at all. a. What civil…

- In order to expand its operations, Barton Corp. raised $5million in a public offering of common stock, and also negotiated a $2 million loanfrom First National Bank. In connection with this financing, Barton engaged Hanover &Co., CPAs, to audit Barton’s financial statements. Hanover knew that the sole purpose ofthe audit was so that Barton would have audited financial statements to provide to FirstNational Bank and the purchasers of the common stock. Although Hanover conductedthe audit in conformity with its audit program, Hanover failed to detect material actsof embezzlement committed by Barton Corp.’s president. Hanover did not detect theembezzlement because of its inadvertent failure to exercise due care in designing theaudit program for this engagement.After completing the engagement, Hanover issued an unqualified opinion on Barton’sfinancial statements. The financial statements were relied upon by the purchasers ofthe common stock in deciding to purchase the shares. In…Mark Williams, CPA, was engaged by Jackson Financial Development Company to audit the financial statements of Apex Construction Company, a small closely held corporation. Williams was told when he was engaged that Jackson Financial needed reliable financial statements that would be used to determine whether to purchase a substantial amount of Apex Construction’s convertible debentures at the price asked by the estate of one of Apex’s former directors. Williams performed his audit in a negligent manner. As a result of his negligence, he failed to discover substantial defalcations by Carl Brown, the Apex controller. Jackson Financial purchased the debentures, but it would not have done so if the defalcations had been discovered. After discovery of the fraud, Jackson Financial promptly sold them for the highest price offered in the market at a $70,000 loss. If Apex Construction also sues Williams for negligence, what are the probable legal defenses Williams’s attorney would raise?…Mark Williams, CPA, was engaged by Jackson Financial Development Company to audit the financial statements of Apex Construction Company, a small closely held corporation. Williams was told when he was engaged that Jackson Financial needed reliable financial statements that would be used to determine whether to purchase a substantial amount of Apex Construction’s convertible debentures at the price asked by the estate of one of Apex’s former directors. Williams performed his audit in a negligent manner. As a result of his negligence, he failed to discover substantial defalcations by Carl Brown, the Apex controller. Jackson Financial purchased the debentures, but it would not have done so if the defalcations had been discovered. After discovery of the fraud, Jackson Financial promptly sold them for the highest price offered in the market at a $70,000 loss. What liability does Williams have to Jackson Financial? Explain

- Mark Williams, CPA, was engaged by Jackson Financial Development Company to audit the financial statements of Apex Construction Company, a small closely held corporation. Williams was told when he was engaged that Jackson Financial needed reliable financial statements that would be used to determine whether to purchase a substantial amount of Apex Construction’s convertible debentures at the price asked by the estate of one of Apex’s former directors. Williams performed his audit in a negligent manner. As a result of his negligence, he failed to discover substantial defalcations by Carl Brown, the Apex controller. Jackson Financial purchased the debentures, but it would not have done so if the defalcations had been discovered. After discovery of the fraud, Jackson Financial promptly sold them for the highest price offered in the market at a $70,000 loss. Will the negligence of Mark Williams, CPA, prevent him from recovering on a liability insurance policy covering the practice of…J, B & J, Certified Public Accountants, has audited the Highcredit Corporation for the past five years. Recently, the Securities and Exchange Commission (SEC) has commenced an investigation of Highcredit for possible violations of Federal securities law. The SEC has subpoenaed all of J, B & J’s working papers pertinent to the audit of Highcredit. Highcredit insists that J, B & J not turn over the documents to the SEC. What action should J, B & J take? Why?Major, Major & Sharpe, CPAs, are the auditors of MacLain Technologies. In connectionwith the public offering of $10 million of MacLain securities, Major expressed anunqualified opinion as to the financial statements. Subsequent to the offering, certainmisstatements were revealed. Major has been sued by the purchasers of the stockoffered pursuant to the registration statement that included the financial statementsaudited by Major. In the ensuing lawsuit by the MacLain investors, Major will be ableto avoid liability if(1) the misstatements were caused primarily by MacLain.(2) it can be shown that at least some of the investors did not actually read theaudited financial statements.(3) it can prove due diligence in the audit of the financial statements of MacLain.(4) MacLain had expressly assumed any liability in connection with the public offering.