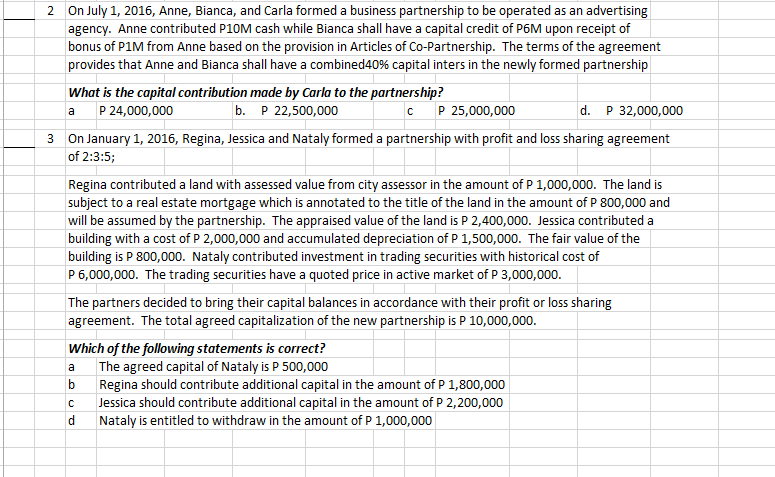

2 On July 1, 2016, Anne, Bianca, and Carla formed a business partnership to be operated as an advertising agency. Anne contributed P10M cash while Bianca shall have a capital credit of P6M upon receipt of bonus of P1M from Anne based on the provision in Articles of Co-Partnership. The terms of the agreement provides that Anne and Bianca shall have a combined40% capital inters in the newly formed partnership |What is the capital contribution made by Carla to the partnership? P 24,000,000 b. P 22,500,000 c P 25,000,000 d. P 32,000,000 a

2 On July 1, 2016, Anne, Bianca, and Carla formed a business partnership to be operated as an advertising agency. Anne contributed P10M cash while Bianca shall have a capital credit of P6M upon receipt of bonus of P1M from Anne based on the provision in Articles of Co-Partnership. The terms of the agreement provides that Anne and Bianca shall have a combined40% capital inters in the newly formed partnership |What is the capital contribution made by Carla to the partnership? P 24,000,000 b. P 22,500,000 c P 25,000,000 d. P 32,000,000 a

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 55P

Related questions

Question

Kindly answer 2 and 3 thank you

Transcribed Image Text:2 On July 1, 2016, Anne, Bianca, and Carla formed a business partnership to be operated as an advertising

agency. Anne contributed P10M cash while Bianca shall have a capital credit of P6M upon receipt of

bonus of P1M from Anne based on the provision in Articles of Co-Partnership. The terms of the agreement

provides that Anne and Bianca shall have a combined40% capital inters in the newly formed partnership

What is the capital contribution made by Carla to the partnership?

P 24,000,000

b. P 22,500,000

C P 25,000,000

a

d. P 32,000,000

3 On January 1, 2016, Regina, Jessica and Nataly formed a partnership with profit and loss sharing agreement

of 2:3:5;

Regina contributed a land with assessed value from city assessor in the amount of P 1,000,000. The land is

subject to a real estate mortgage which is annotated to the title of the land in the amount of P 800,000 and

will be assumed by the partnership. The appraised value of the land is P 2,400,000. Jessica contributed a

building with a cost of P 2,000,000 and accumulated depreciation of P 1,500,000. The fair value of the

|building is P 800,000. Nataly contributed investment in trading securities with historical cost of

P 6,000,000. The trading securities have a quoted price in active market of P 3,000,000.

|The partners decided to bring their capital balances in accordance with their profit or loss sharing

agreement. The total agreed capitalization of the new partnership is P 10,000,000.

Which of the following statements is correct?

|The agreed capital of Nataly is P 500,000

b Regina should contribute additional capital in the amount of P 1,800,000

Jessica should contribute additional capital in the amount of P 2,200,000

Nataly is entitled to withdraw in the amount of P 1,000,000

a

d

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning