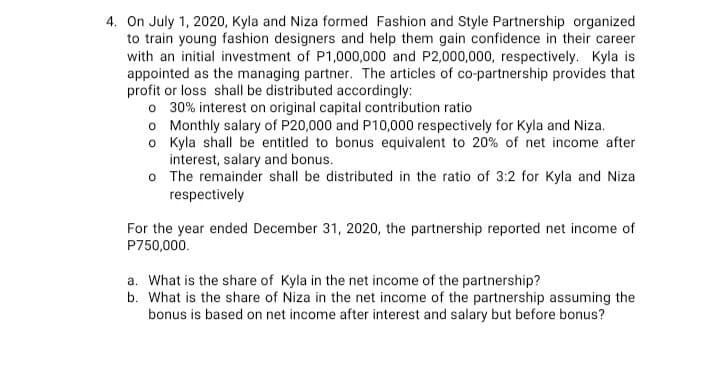

4. On July 1, 2020, Kyla and Niza formed Fashion and Style Partnership organized to train young fashion designers and help them gain confidence in their career with an initial investment of P1,000,000 and P2,000,000, respectively. Kyla is appointed as the managing partner. The articles of co-partnership provides that profit or loss shall be distributed accordingly: o 30% interest on original capital contribution ratio o Monthly salary of P20,000 and P10,000 respectively for Kyla and Niza. o Kyla shall be entitled to bonus equivalent to 20% of net income after interest, salary and bonus. o The remainder shall be distributed in the ratio of 3:2 for Kyla and Niza respectively For the year ended December 31, 2020, the partnership reported net income of P750,000. a. What is the share of Kyla in the net income of the partnership? b. What is the share of Niza in the net income of the partnership assuming the bonus is based on net income after interest and salary but before bonus?

4. On July 1, 2020, Kyla and Niza formed Fashion and Style Partnership organized to train young fashion designers and help them gain confidence in their career with an initial investment of P1,000,000 and P2,000,000, respectively. Kyla is appointed as the managing partner. The articles of co-partnership provides that profit or loss shall be distributed accordingly: o 30% interest on original capital contribution ratio o Monthly salary of P20,000 and P10,000 respectively for Kyla and Niza. o Kyla shall be entitled to bonus equivalent to 20% of net income after interest, salary and bonus. o The remainder shall be distributed in the ratio of 3:2 for Kyla and Niza respectively For the year ended December 31, 2020, the partnership reported net income of P750,000. a. What is the share of Kyla in the net income of the partnership? b. What is the share of Niza in the net income of the partnership assuming the bonus is based on net income after interest and salary but before bonus?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:4. On July 1, 2020, Kyla and Niza formed Fashion and Style Partnership organized

to train young fashion designers and help them gain confidence in their career

with an initial investment of P1,000,000 and P2,000,000, respectively. Kyla is

appointed as the managing partner. The articles of co-partnership provides that

profit or loss shall be distributed accordingly:

o 30% interest on original capital contribution ratio

o Monthly salary of P20,000 and P10,000 respectively for Kyla and Niza.

o Kyla shall be entitled to bonus equivalent to 20% of net income after

interest, salary and bonus.

o The remainder shall be distributed in the ratio of 3:2 for Kyla and Niza

respectively

For the year ended December 31, 2020, the partnership reported net income of

P750,000.

a. What is the share of Kyla in the net income of the partnership?

b. What is the share of Niza in the net income of the partnership assuming the

bonus is based on net income after interest and salary but before bonus?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you