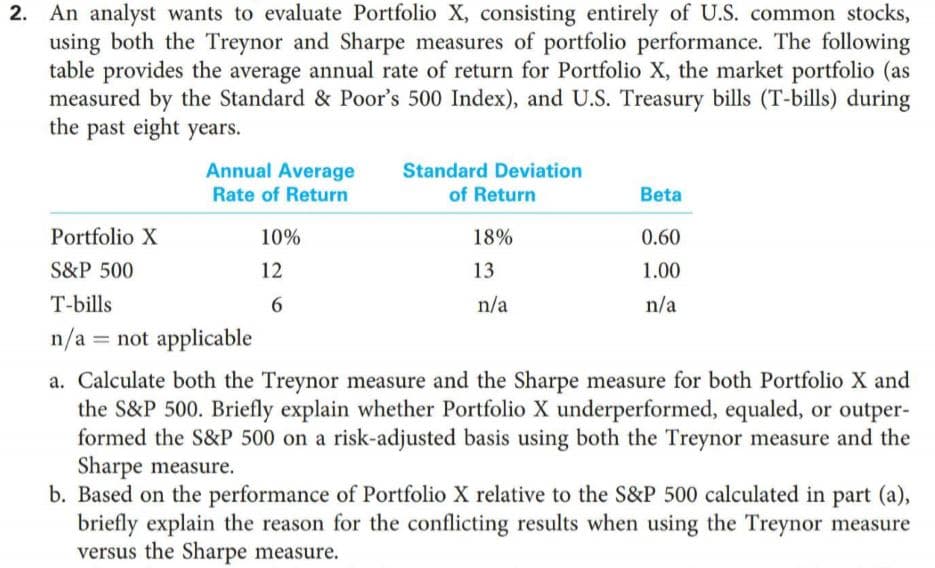

2. An analyst wants to evaluate Portfolio X, consisting entirely of U.S. common stocks, using both the Treynor and Sharpe measures of portfolio performance. The following table provides the average annual rate of return for Portfolio X, the market portfolio (as measured by the Standard & Poor's 500 Index), and U.S. Treasury bills (T-bills) during the past eight years. Annual Average Standard Deviation Rate of Return of Return Beta Portfolio X 10% 18% 0.60 S&P 500 13 1.00 12 n/a T-bills n/a n/a = not applicable a. Calculate both the Treynor measure and the Sharpe measure for both Portfolio X and the S&P 500. Briefly explain whether Portfolio X underperformed, equaled, or outper- formed the S&P 500 on a risk-adjusted basis using both the Treynor measure and the Sharpe measure. b. Based on the performance of Portfolio X relative to the S&P 500 calculated in part (a), briefly explain the reason for the conflicting results when using the Treynor measure versus the Sharpe measure.

2. An analyst wants to evaluate Portfolio X, consisting entirely of U.S. common stocks, using both the Treynor and Sharpe measures of portfolio performance. The following table provides the average annual rate of return for Portfolio X, the market portfolio (as measured by the Standard & Poor's 500 Index), and U.S. Treasury bills (T-bills) during the past eight years. Annual Average Standard Deviation Rate of Return of Return Beta Portfolio X 10% 18% 0.60 S&P 500 13 1.00 12 n/a T-bills n/a n/a = not applicable a. Calculate both the Treynor measure and the Sharpe measure for both Portfolio X and the S&P 500. Briefly explain whether Portfolio X underperformed, equaled, or outper- formed the S&P 500 on a risk-adjusted basis using both the Treynor measure and the Sharpe measure. b. Based on the performance of Portfolio X relative to the S&P 500 calculated in part (a), briefly explain the reason for the conflicting results when using the Treynor measure versus the Sharpe measure.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter2: Risk And Return: Part I

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:2. An analyst wants to evaluate Portfolio X, consisting entirely of U.S. common stocks,

using both the Treynor and Sharpe measures of portfolio performance. The following

table provides the average annual rate of return for Portfolio X, the market portfolio (as

measured by the Standard & Poor's 500 Index), and U.S. Treasury bills (T-bills) during

the past eight years.

Annual Average

Standard Deviation

Rate of Return

of Return

Beta

Portfolio X

10%

18%

0.60

S&P 500

13

1.00

12

n/a

T-bills

n/a

n/a = not applicable

a. Calculate both the Treynor measure and the Sharpe measure for both Portfolio X and

the S&P 500. Briefly explain whether Portfolio X underperformed, equaled, or outper-

formed the S&P 500 on a risk-adjusted basis using both the Treynor measure and the

Sharpe measure.

b. Based on the performance of Portfolio X relative to the S&P 500 calculated in part (a),

briefly explain the reason for the conflicting results when using the Treynor measure

versus the Sharpe measure.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning