2. Assume that individuals have the utility function over consumption (c) and labor (1) given by U (c,1) = 2c+0 log (20 – 1), where 0 is a constant parameter reflecting disutility from work. Suppose the only income that individ- uals have is from labor income. (a) Suppose labor income is taxed at rate T. Solve for utility-maximizing labor supply as a function of w, T, and 0.

2. Assume that individuals have the utility function over consumption (c) and labor (1) given by U (c,1) = 2c+0 log (20 – 1), where 0 is a constant parameter reflecting disutility from work. Suppose the only income that individ- uals have is from labor income. (a) Suppose labor income is taxed at rate T. Solve for utility-maximizing labor supply as a function of w, T, and 0.

Chapter10: Cost Functions

Section: Chapter Questions

Problem 10.10P

Related questions

Question

A3

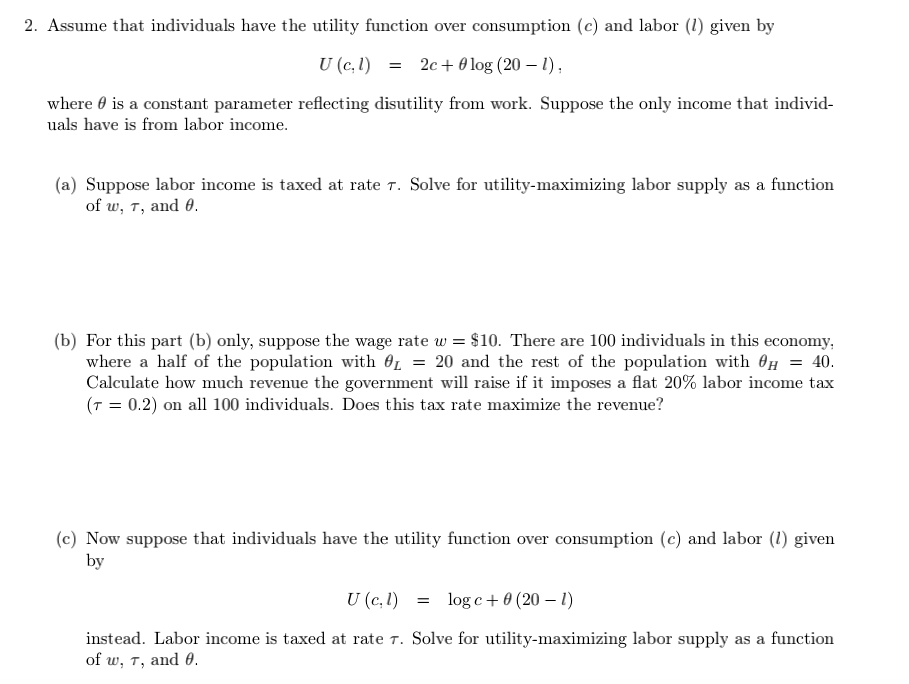

Transcribed Image Text:2. Assume that individuals have the utility function over consumption (c) and labor (1) given by

U (c,1) = 2c+0 log (20 – 1),

where 0 is a constant parameter reflecting disutility from work. Suppose the only income that individ-

uals have is from labor income.

(a) Suppose labor income is taxed at rate T. Solve for utility-maximizing labor supply as a function

of w, T, and 0.

(b) For this part (b) only, suppose the wage rate w = $10. There are 100 individuals in this economy,

where a half of the population with OL = 20 and the rest of the population with On = 40.

Calculate how much revenue the government will raise if it imposes a flat 20% labor income tax

(T = 0.2) on all 100 individuals. Does this tax rate maximize the revenue?

(c) Now suppose that individuals have the utility function over consumption (c) and labor (1) given

by

U (c, 1)

= log c+ 0 (20 – 1)

instead. Labor income is taxed at rate T. Solve for utility-maximizing labor supply as a function

of w, T, and 0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you