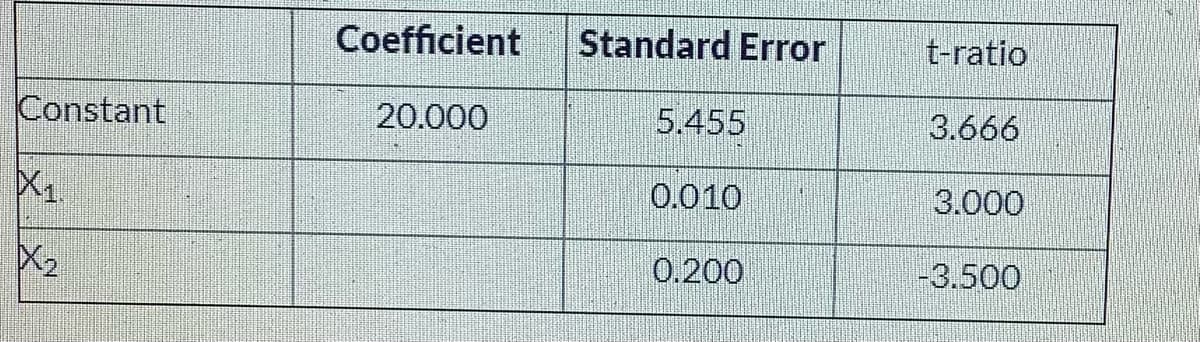

2. Below you are given a partial computer output based on a sample of 25 days of the price of a company's stock (Y in OMR), the Dow Jones industrial average (X 1 ) , and the stock price of the company's major competitor (X 2 in OMR). The 95% confidence interval for beta 2 is A. (- 1.0920, - 0.3080) B. (0.0095, 0.0505) C. (0.0104 , 0.0496 ) D. (- 1.1148, - 0.2852) E.None

2. Below you are given a partial computer output based on a sample of 25 days of the price of a company's stock (Y in OMR), the Dow Jones industrial average (X 1 ) , and the stock price of the company's major competitor (X 2 in OMR). The 95% confidence interval for beta 2 is A. (- 1.0920, - 0.3080) B. (0.0095, 0.0505) C. (0.0104 , 0.0496 ) D. (- 1.1148, - 0.2852) E.None

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section11.5: Interpreting Data

Problem 1E

Related questions

Question

2. Below you are given a partial computer output based on a sample of 25 days of the price of a company's stock (Y in OMR), the Dow Jones industrial average (X 1 ) , and the stock price of the company's major competitor (X 2 in OMR).

The 95% confidence interval for beta 2 is

A. (- 1.0920, - 0.3080)

B. (0.0095, 0.0505)

C. (0.0104 , 0.0496 )

D. (- 1.1148, - 0.2852)

E.None

Transcribed Image Text:Coefficient

Standard Error

t-ratio

Constant

20.000

5.455

3.666

0.010

3.000

X2

0.200

-3.500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL