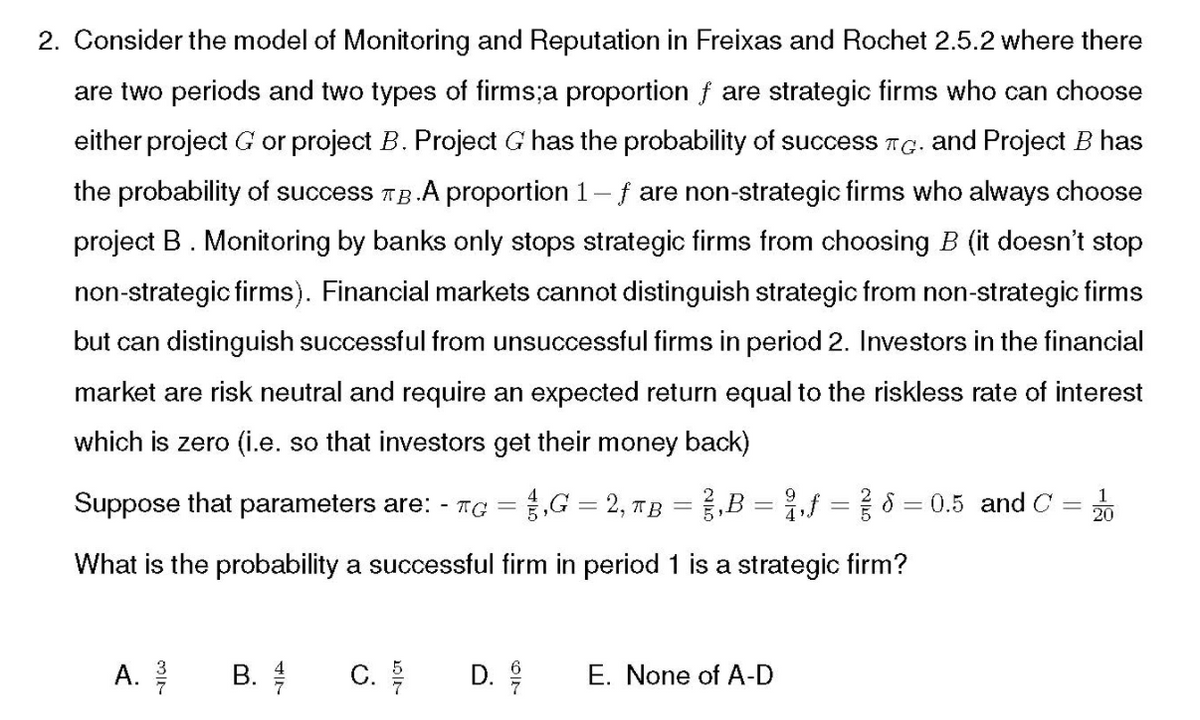

2. Consider the model of Monitoring and Reputation in Freixas and Rochet 2.5.2 where there are two periods and two types of firms;a proportion f are strategic firms who can choose either project G or project B. Project G has the probability of success TG. and Project B has the probability of success TB.A proportion 1- f are non-strategic firms who always choose project B. Monitoring by banks only stops strategic firms from choosing B (it doesn't stop non-strategic firms). Financial markets cannot distinguish strategic from non-strategic firms but can distinguish successful from unsuccessful firms in period 2. Investors in the financial market are risk neutral and require an expected return equal to the riskless rate of interest which is zero (i.e. so that investors get their money back) Suppose that parameters are: - TG = G = 2, TB =,B = ,f = 8 = 0.5 and C = What is the probability a successful firm in period 1 is a strategic firm? A. B. C. E. None of A-D

2. Consider the model of Monitoring and Reputation in Freixas and Rochet 2.5.2 where there are two periods and two types of firms;a proportion f are strategic firms who can choose either project G or project B. Project G has the probability of success TG. and Project B has the probability of success TB.A proportion 1- f are non-strategic firms who always choose project B. Monitoring by banks only stops strategic firms from choosing B (it doesn't stop non-strategic firms). Financial markets cannot distinguish strategic from non-strategic firms but can distinguish successful from unsuccessful firms in period 2. Investors in the financial market are risk neutral and require an expected return equal to the riskless rate of interest which is zero (i.e. so that investors get their money back) Suppose that parameters are: - TG = G = 2, TB =,B = ,f = 8 = 0.5 and C = What is the probability a successful firm in period 1 is a strategic firm? A. B. C. E. None of A-D

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 27PPS

Related questions

Question

Hand written plz...i'll give you multiple upvote..

Transcribed Image Text:2. Consider the model of Monitoring and Reputation in Freixas and Rochet 2.5.2 where there

are two periods and two types of firms;a proportion f are strategic firms who can choose

either project G or project B. Project G has the probability of success TG. and Project B has

the probability of success Tg.A proportion 1- f are non-strategic firms who always choose

project B. Monitoring by banks only stops strategic firms from choosing B (it doesn't stop

non-strategic firms). Financial markets cannot distinguish strategic from non-strategic firms

but can distinguish successful from unsuccessful firms in period 2. Investors in the financial

market are risk neutral and require an expected return equal to the riskless rate of interest

which is zero (i.e. so that investors get their money back)

Suppose that parameters are: - TC =1,G = 2, TB = },B = },f = { 8 = 0.5 and C

1

20

What is the probability a successful firm in period 1 is a strategic firm?

A. 을

C.

E. None of A-D

B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill