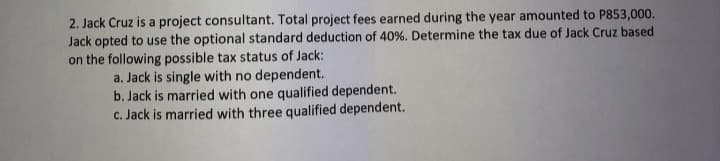

2. Jack Cruz is a project consultant. Total project fees earned during the year amounted to P853,000. Jack opted to use the optional standard deduction of 40%. Determine the tax due of Jack Cruz based on the following possible tax status of Jack: a. Jack is single with no dependent. b. Jack is married with one qualified dependent. c. Jack is married with three qualified dependent.

2. Jack Cruz is a project consultant. Total project fees earned during the year amounted to P853,000. Jack opted to use the optional standard deduction of 40%. Determine the tax due of Jack Cruz based on the following possible tax status of Jack: a. Jack is single with no dependent. b. Jack is married with one qualified dependent. c. Jack is married with three qualified dependent.

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 70IIP: In each of the following problems, identify the tax issue(s) posed by the facts presented. Determine...

Related questions

Question

Provide solutions

Transcribed Image Text:2. Jack Cruz is a project consultant. Total project fees earned during the year amounted to P853,000.

Jack opted to use the optional standard deduction of 40%. Determine the tax due of Jack Cruz based

on the following possible tax status of Jack:

a. Jack is single with no dependent.

b. Jack is married with one qualified dependent.

c. Jack is married with three qualified dependent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT