2. Prepare the consolidation worksheet entries for Dean Ltd's group at 1 July 2022, assuming that Lewis Ltd has not revalued the equipment in its own accounts.

2. Prepare the consolidation worksheet entries for Dean Ltd's group at 1 July 2022, assuming that Lewis Ltd has not revalued the equipment in its own accounts.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

27.4 question 2 what does it mean by "not revalued the equipment in its own accounts"

why the asset revaluation surplus=35000

Transcribed Image Text:12:53 am Mon 11 Oct

8% (

88

Edit PDF

Fill & Sign

+

Q M AA

Annotate

Favorites

•..

(+) Add Tool

International%20FinancialManagem...dition%20Jeff%20Madura%281%29 x

Financial Reporting, 3rd Edition by Janice Loftus

5. DIS CUSS TI UW ulC als WOIS TUI

1 and z AUUVC woUld ChUIngt II tuIC NICUI Liu paIU UNIY qYZUU 0

cash for the shares in Kidman Ltd.

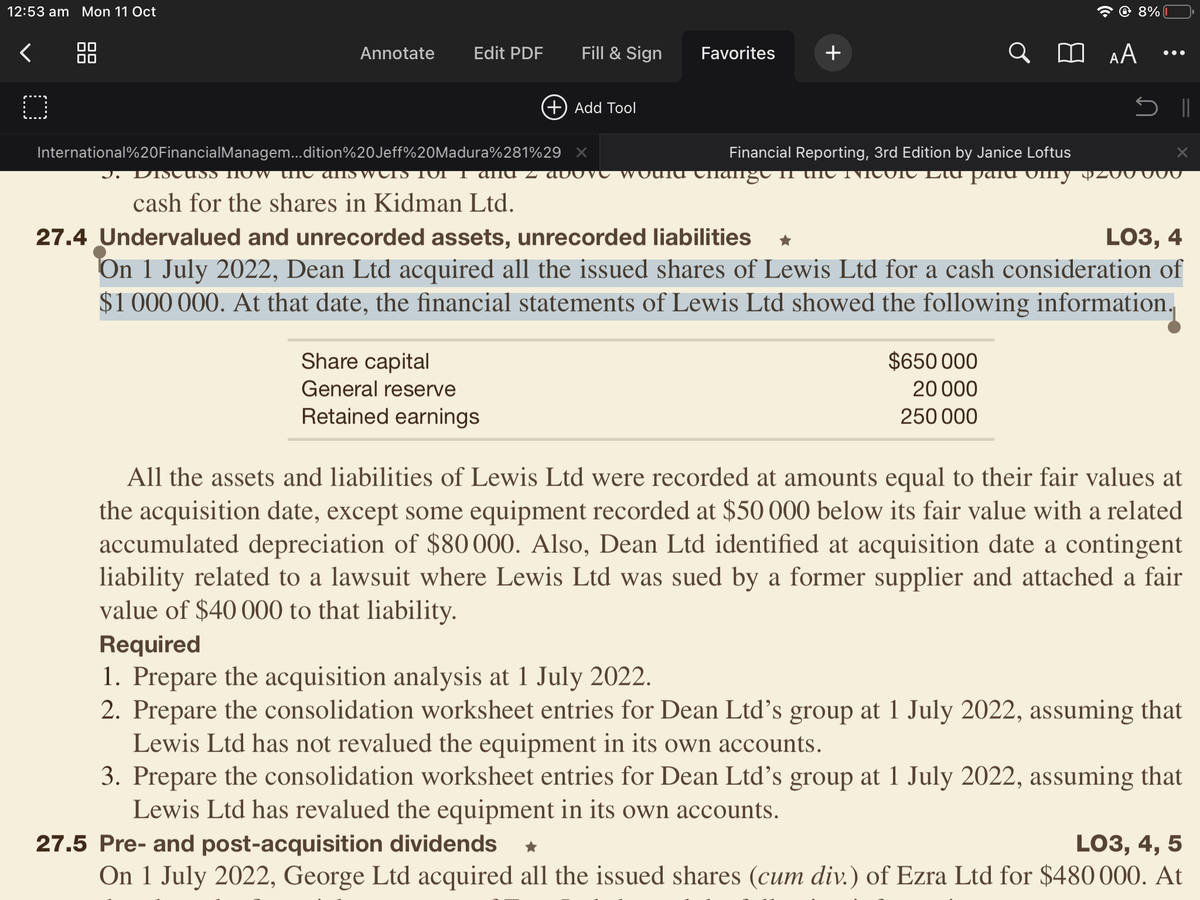

27.4 Undervalued and unrecorded assets, unrecorded liabilities

On 1 July 2022, Dean Ltd acquired all the issued shares of Lewis Ltd for a cash consideration of

$1 000 000. At that date, the financial statements of Lewis Ltd showed the following information.

LO3, 4

Share capital

$650 000

General reserve

20 000

Retained earnings

250 000

All the assets and liabilities of Lewis Ltd were recorded at amounts equal to their fair values at

the acquisition date, except some equipment recorded at $50 000 below its fair value with a related

accumulated depreciation of $80 000. Also, Dean Ltd identified at acquisition date a contingent

liability related to a lawsuit where Lewis Ltd was sued by a former supplier and attached a fair

value of $40 000 to that liability.

Required

1. Prepare the acquisition analysis at 1 July 2022.

2. Prepare the consolidation worksheet entries for Dean Ltd's group at 1 July 2022, assuming that

Lewis Ltd has not revalued the equipment in its own accounts.

3. Prepare the consolidation worksheet entries for Dean Ltd's group at 1 July 2022, assuming that

Lewis Ltd has revalued the equipment in its own accounts.

27.5 Pre- and post-acquisition dividends

LO3, 4, 5

On 1 July 2022, George Ltd acquired all the issued shares (cum div.) of Ezra Ltd for $480 000. At

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education