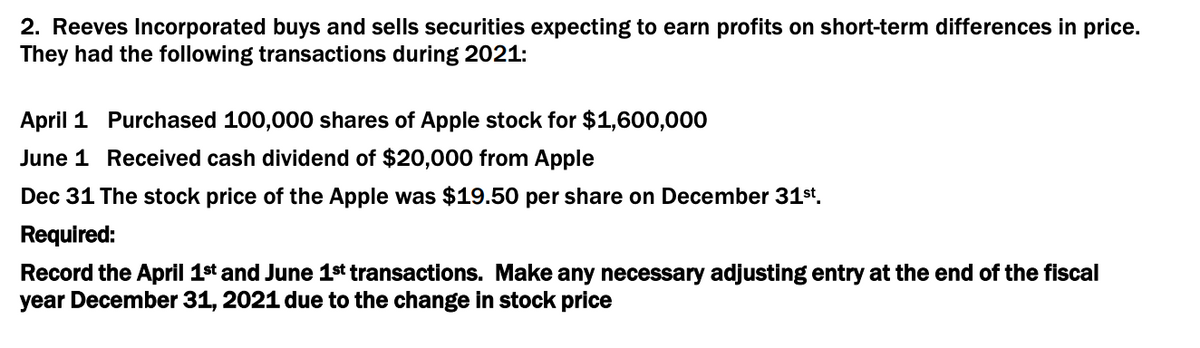

2. Reeves Incorporated buys and sells securities expecting to earn profits on short-term differences in price. They had the following transactions during 2021: April 1 Purchased 100,000 shares of Apple stock for $1,600,000 June 1 Received cash dividend of $20,000 from Apple Dec 31 The stock price of the Apple was $19.50 per share on December 31st. Required: Record the April 1st and June 1st transactions. Make any necessary adjusting entry at the end of the fiscal year December 31, 2021 due to the change in stock price

2. Reeves Incorporated buys and sells securities expecting to earn profits on short-term differences in price. They had the following transactions during 2021: April 1 Purchased 100,000 shares of Apple stock for $1,600,000 June 1 Received cash dividend of $20,000 from Apple Dec 31 The stock price of the Apple was $19.50 per share on December 31st. Required: Record the April 1st and June 1st transactions. Make any necessary adjusting entry at the end of the fiscal year December 31, 2021 due to the change in stock price

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

Transcribed Image Text:2. Reeves Incorporated buys and sells securities expecting to earn profits on short-term differences in price.

They had the following transactions during 2021:

April 1 Purchased 100,000 shares of Apple stock for $1,600,000

June 1 Received cash dividend of $20,000 from Apple

Dec 31 The stock price of the Apple was $19.50 per share on December 31st.

Required:

Record the April 1st and June 1st transactions. Make any necessary adjusting entry at the end of the fiscal

year December 31, 2021 due to the change in stock price

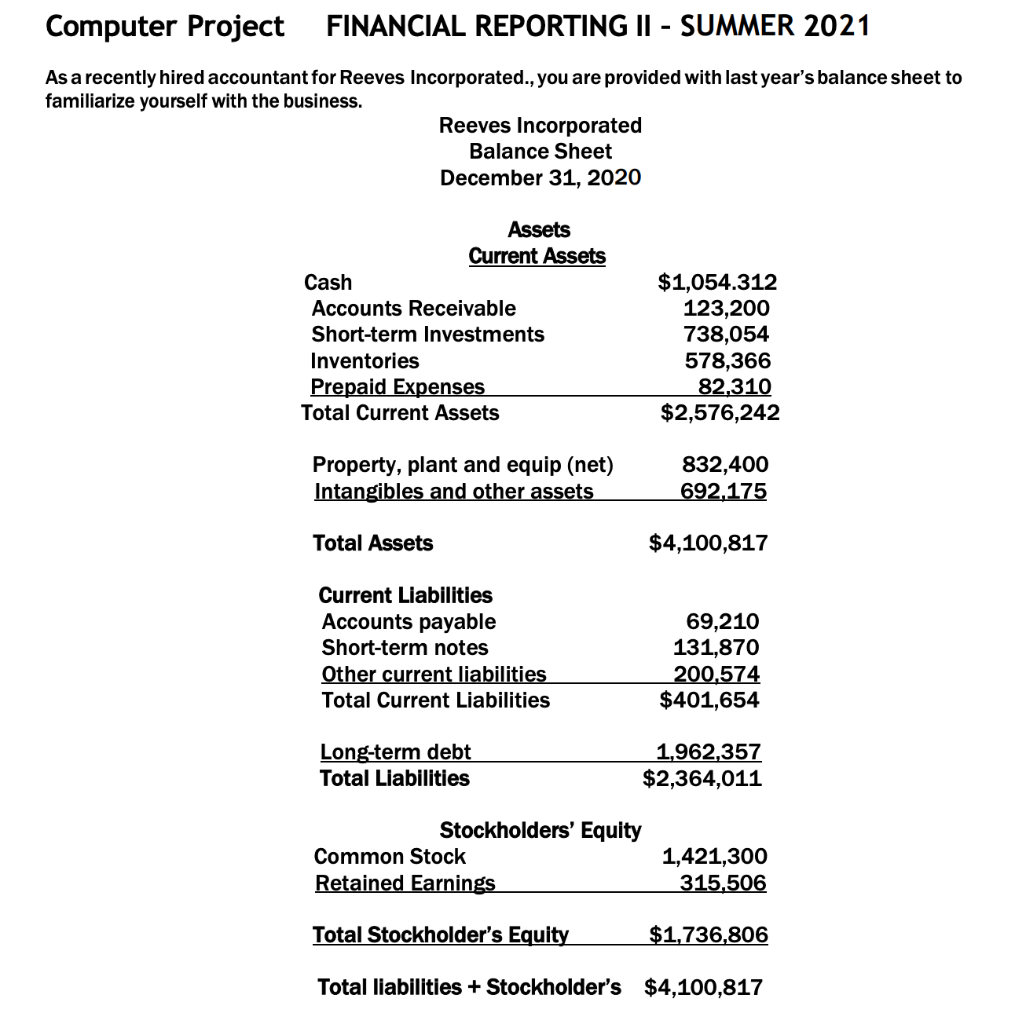

Transcribed Image Text:Computer Project

FINANCIAL REPORTING II - SUMMER 2021

As a recently hired accountant for Reeves Incorporated., you are provided with last year's balance sheet to

familiarize yourself with the business.

Reeves Incorporated

Balance Sheet

December 31, 2020

Assets

Current Assets

$1,054.312

123,200

738,054

578,366

82,310

$2,576,242

Cash

Accounts Receivable

Short-term Investments

Inventories

Prepaid Expenses

Total Current Assets

Property, plant and equip (net)

Intangibles and other assets

832,400

692,175

Total Assets

$4,100,817

Current Liabilities

Accounts payable

69,210

131,870

200,574

$401,654

Short-term notes

Other current liabilities

Total Current Liabilities

Long-term debt

1,962,357

$2,364,011

Total Liabilities

Stockholders' Equity

Common Stock

1,421,300

315,506

Retained Earnings

Total Stockholder's Equity

$1,736,806

Total liabilities + Stockholder's $4,100,817

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT