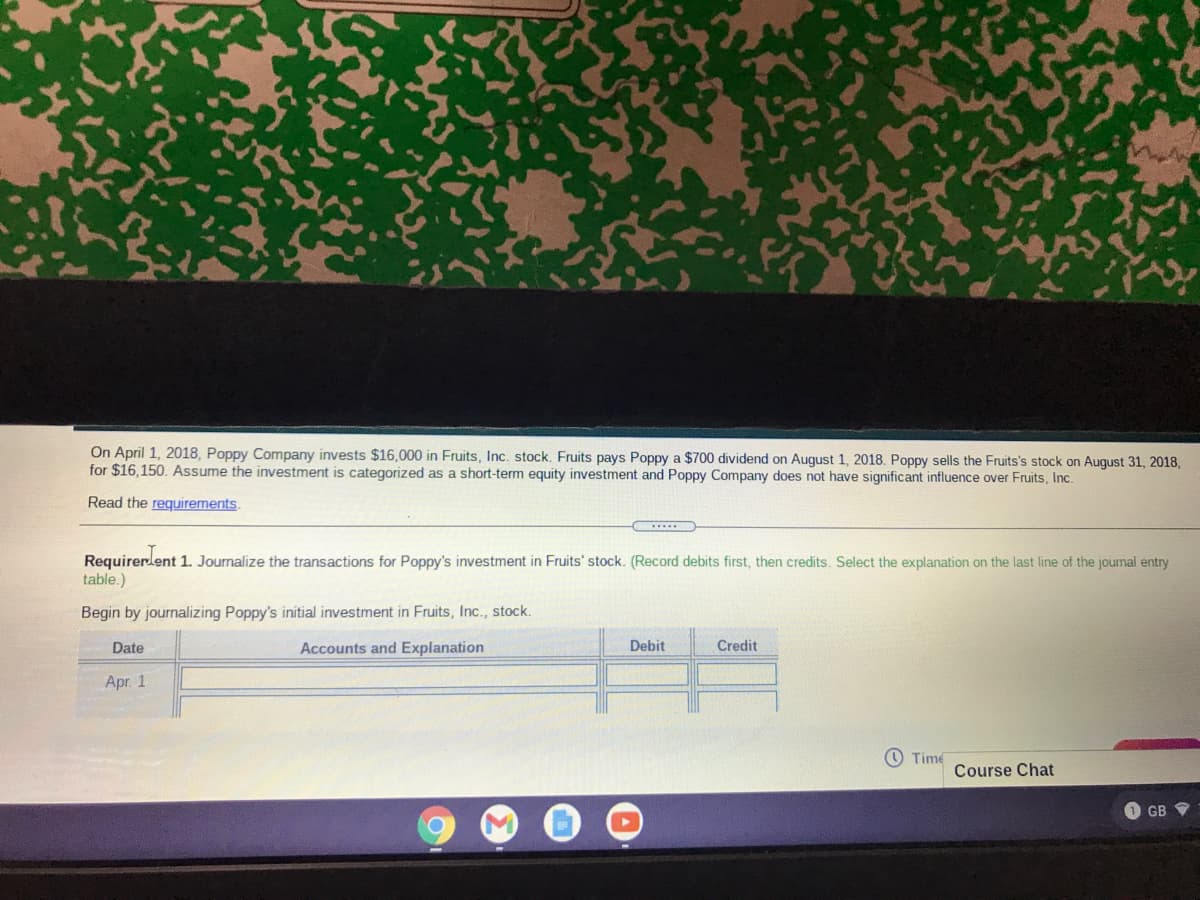

On April 1, 2018, Poppy Company invests $16,000 in Fruits, Inc. stock. Fruits pays Poppy a $700 dividend on August 1, 2018. Poppy sells the Fruits's stock on August 31, 201 for $16,150. Assume the investment is categorized as a short-term equity investment and Poppy Company does not have significant influence over Fruits, Inc. Read the requirements. Requirerlent 1. Journalize the transactions for Poppy's investment in Fruits' stock. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing Poppy's initial investment in Fruits, Inc., stock.

On April 1, 2018, Poppy Company invests $16,000 in Fruits, Inc. stock. Fruits pays Poppy a $700 dividend on August 1, 2018. Poppy sells the Fruits's stock on August 31, 201 for $16,150. Assume the investment is categorized as a short-term equity investment and Poppy Company does not have significant influence over Fruits, Inc. Read the requirements. Requirerlent 1. Journalize the transactions for Poppy's investment in Fruits' stock. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing Poppy's initial investment in Fruits, Inc., stock.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:On April 1, 2018, Poppy Company invests $16,000 in Fruits, Inc. stock. Fruits pays Poppy a $700 dividend on August 1, 2018. Poppy sells the Fruits's stock on August 31, 2018,

for $16,150. Assume the investment is categorized as a short-term equity investment and Poppy Company does not have significant influence over Fruits, Inc.

Read the requirements.

Requirerlent 1. Journalize the transactions for Poppy's investment in Fruits' stock. (Record debits first, then credits. Select the explanation on the last line of the journal entry

table.)

Begin by journalizing Poppy's initial investment in Fruits, Inc., stock.

Date

Accounts and Explanation

Debit

Credit

Apr. 1

O Time

Course Chat

GB

Transcribed Image Text:ril 1, 2018, Poppy Company inve

5,150. Assume the investment is

X he Fruits's stock on Au

e over Fruits, Inc.

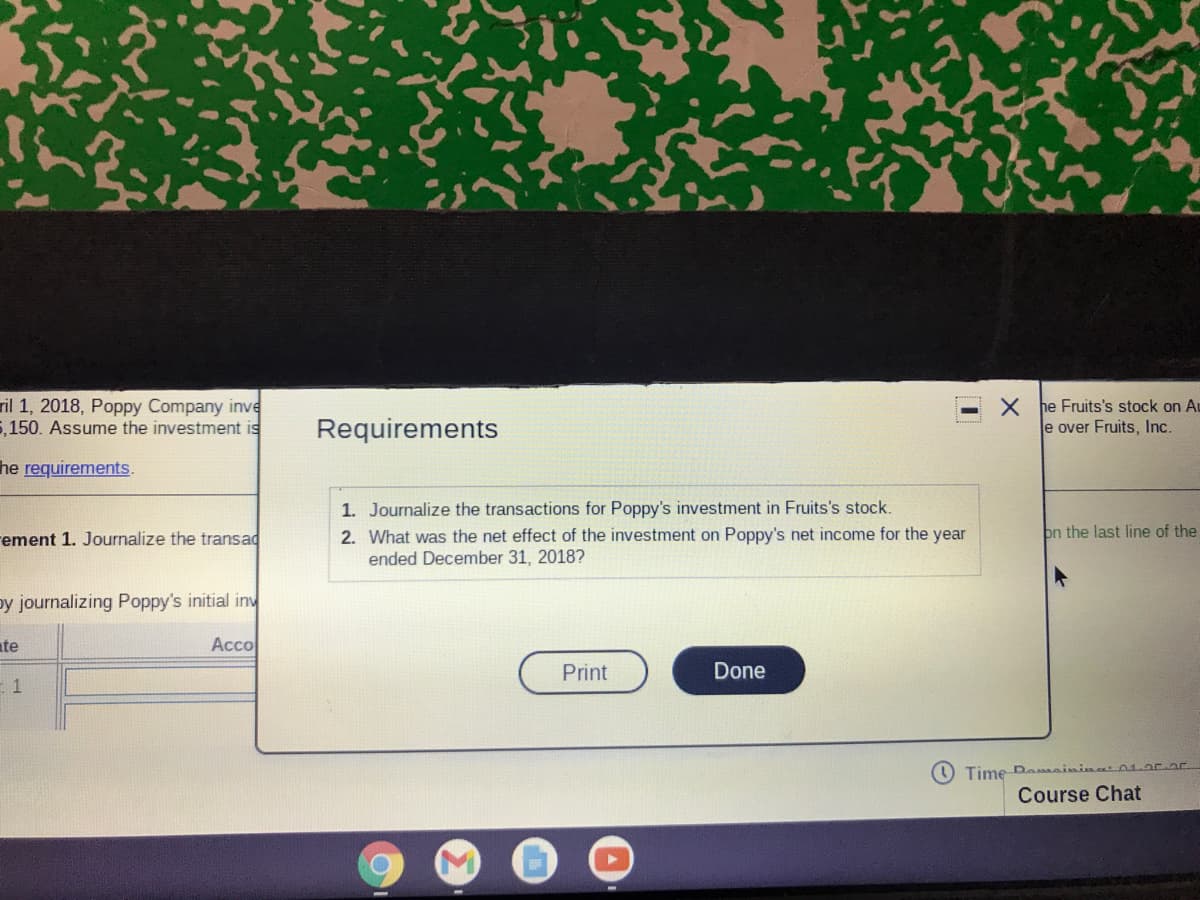

Requirements

he requirements.

1. Journalize the transactions for Poppy's investment in Fruits's stock.

2. What was the net effect of the investment on Poppy's net income for the year

ended December 31, 2018?

ement 1. Journalize the transad

on the last line of the

py journalizing Poppy's initial inv

ate

Acco

Print

Done

: 1

(O Time Demeininan19c.ar

Course Chat

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning