2. Using Excel to draw a scatter diagram. Treat the percentage change in the S&P500 as the independent variable and the percentage change in the stock you chose

2. Using Excel to draw a scatter diagram. Treat the percentage change in the S&P500 as the independent variable and the percentage change in the stock you chose

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 23PPS

Related questions

Question

Step by step solution for number 2 question.

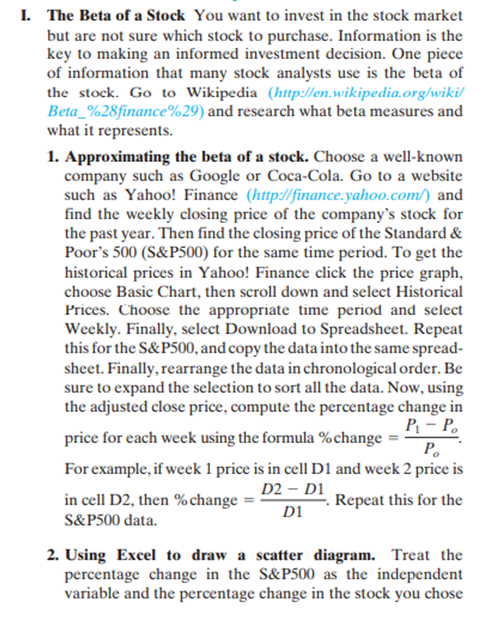

Transcribed Image Text:I. The Beta of a Stock You want to invest in the stock market

but are not sure which stock to purchase. Information is the

key to making an informed investment decision. One piece

of information that many stock analysts use is the beta of

the stock. Go to Wikipedia (http://en.wikipedia.org/wiki/

Beta_%28finance%29) and research what beta measures and

what it represents.

1. Approximating the beta of a stock. Choose a well-known

company such as Google or Coca-Cola. Go to a website

such as Yahoo! Finance (http://finance.yahoo.com/) and

find the weekly closing price of the company's stock for

the past year. Then find the closing price of the Standard &

Poor's 500 (S&P500) for the same time period. To get the

historical prices in Yahoo! Finance click the price graph,

choose Basic Chart, then scroll down and select Historical

Prices. Choose the appropriate time period and select

Weekly. Finally, select Download to Spreadsheet. Repeat

this for the S&P500, and copy the data into the same spread-

sheet. Finally, rearrange the data in chronological order. Be

sure to expand the selection to sort all the data. Now, using

the adjusted close price, compute the percentage change in

Р. - Р.

price for each week using the formula %change

P.

For example, if week 1 price is in cell D1 and week 2 price is

D2 – D1

in cell D2, then % change

Repeat this for the

Di

S&P500 data.

2. Using Excel to draw a scatter diagram. Treat the

percentage change in the S&P500 as the independent

variable and the percentage change in the stock you chose

Transcribed Image Text:as the dependent variable. The easiest way to draw a scatter

diagram in Excel is to place the two columns of data next

to each other (for example, have the percentage change in

the S&P500 in column F and the percentage change in the

stock you chose in column G). Then highlight the data and

select the Scatter Diagram icon under Insert. Comment on

the type of relation that appears to exist between the two

variables.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL