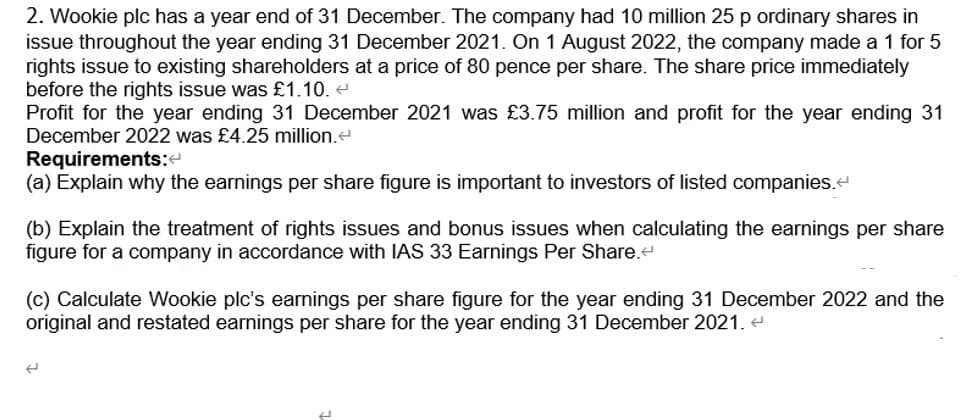

2. Wookie plc has a year end of 31 December. The company had 10 million 25 p ordinary shares in issue throughout the year ending 31 December 2021. On 1 August 2022, the company made a 1 for 5 rights issue to existing shareholders at a price of 80 pence per share. The share price immediately before the rights issue was £1.10.< Profit for the year ending 31 December 2021 was £3.75 million and profit for the year ending 31 December 2022 was £4.25 million. Requirements: (a) Explain why the earnings per share figure is important to investors of listed companies.< (b) Explain the treatment of rights issues and bonus issues when calculating the earnings per share figure for a company in accordance with IAS 33 Earnings Per Share.< (c) Calculate Wookie plc's earnings per share figure for the year ending 31 December 2022 and the original and restated earnings per share for the year ending 31 December 2021.<

2. Wookie plc has a year end of 31 December. The company had 10 million 25 p ordinary shares in issue throughout the year ending 31 December 2021. On 1 August 2022, the company made a 1 for 5 rights issue to existing shareholders at a price of 80 pence per share. The share price immediately before the rights issue was £1.10.< Profit for the year ending 31 December 2021 was £3.75 million and profit for the year ending 31 December 2022 was £4.25 million. Requirements: (a) Explain why the earnings per share figure is important to investors of listed companies.< (b) Explain the treatment of rights issues and bonus issues when calculating the earnings per share figure for a company in accordance with IAS 33 Earnings Per Share.< (c) Calculate Wookie plc's earnings per share figure for the year ending 31 December 2022 and the original and restated earnings per share for the year ending 31 December 2021.<

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 24E

Related questions

Question

Transcribed Image Text:2. Wookie plc has a year end of 31 December. The company had 10 million 25 p ordinary shares in

issue throughout the year ending 31 December 2021. On 1 August 2022, the company made a 1 for 5

rights issue to existing shareholders at a price of 80 pence per share. The share price immediately

before the rights issue was £1.10. <

Profit for the year ending 31 December 2021 was £3.75 million and profit for the year ending 31

December 2022 was £4.25 million.

Requirements:<

(a) Explain why the earnings per share figure is important to investors of listed companies.<

(b) Explain the treatment of rights issues and bonus issues when calculating the earnings per share

figure for a company in accordance with IAS 33 Earnings Per Share.<

(c) Calculate Wookie plc's earnings per share figure for the year ending 31 December 2022 and the

original and restated earnings per share for the year ending 31 December 2021.<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning