Peggy owns 100% of Delta Corporation's stock. She purchased her stock ten years ago, and her current basis for the stock is $215,000. On June 10, Peggy decided to liquidate Delta. Delta's balance sheet prior to the sale of the assets, payment of the liquidation expenses, and payment of federal income taxes, as well as some additional information is as follows: View the balance sheet. View the additional information. Read the requirements. Requirement a. What are the tax consequences of the liquidation to Peggy and Delta Corporation? Assume a 21% corporate tax rate. Let's begin by determining the tax consequences for Delta. Start by computing Delta's recognized gain or loss on each of the assets distributed to Peggy (and in total) as a result of the liquidation. (Complete all input fields. Enter a 0 in the "Recognized gain (loss)" column, and enter "N/A" in the "Character of gain or loss" column if no gain or loss is recognized by Delta.) Cash Assets Marketable securities Equipment Land Total assets Basis $ 260,000 $ 50,000 170,000 300,000 $ 780,000 $ FMV 260,000 37,000 230,000 610,000 1,137,000 Recognized gain (loss) C... Character of gain or loss

Peggy owns 100% of Delta Corporation's stock. She purchased her stock ten years ago, and her current basis for the stock is $215,000. On June 10, Peggy decided to liquidate Delta. Delta's balance sheet prior to the sale of the assets, payment of the liquidation expenses, and payment of federal income taxes, as well as some additional information is as follows: View the balance sheet. View the additional information. Read the requirements. Requirement a. What are the tax consequences of the liquidation to Peggy and Delta Corporation? Assume a 21% corporate tax rate. Let's begin by determining the tax consequences for Delta. Start by computing Delta's recognized gain or loss on each of the assets distributed to Peggy (and in total) as a result of the liquidation. (Complete all input fields. Enter a 0 in the "Recognized gain (loss)" column, and enter "N/A" in the "Character of gain or loss" column if no gain or loss is recognized by Delta.) Cash Assets Marketable securities Equipment Land Total assets Basis $ 260,000 $ 50,000 170,000 300,000 $ 780,000 $ FMV 260,000 37,000 230,000 610,000 1,137,000 Recognized gain (loss) C... Character of gain or loss

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 58P

Related questions

Question

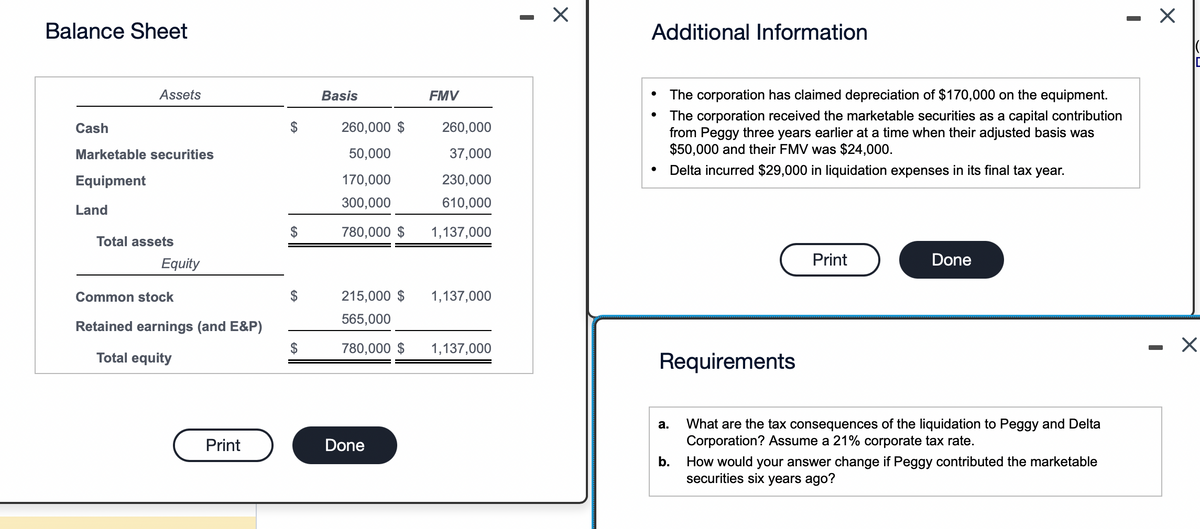

Transcribed Image Text:Balance Sheet

Cash

Assets

Marketable securities

Equipment

Land

Total assets

Equity

Common stock

Retained earnings (and E&P)

Total equity

Print

$

$

Basis

260,000 $

50,000

170,000

300,000

780,000 $

215,000 $

565,000

780,000 $

Done

FMV

260,000

37,000

230,000

610,000

1,137,000

1,137,000

1,137,000

- X

Additional Information

●

The corporation has claimed depreciation of $170,000 on the equipment.

The corporation received the marketable securities as a capital contribution

from Peggy three years earlier at a time when their adjusted basis was

$50,000 and their FMV was $24,000.

Delta incurred $29,000 in liquidation expenses in its final tax year.

Requirements

a.

b.

Print

Done

What are the tax consequences of the liquidation to Peggy and Delta

Corporation? Assume a 21% corporate tax rate.

How would your answer change if Peggy contributed the marketable

securities six years ago?

I

X

×

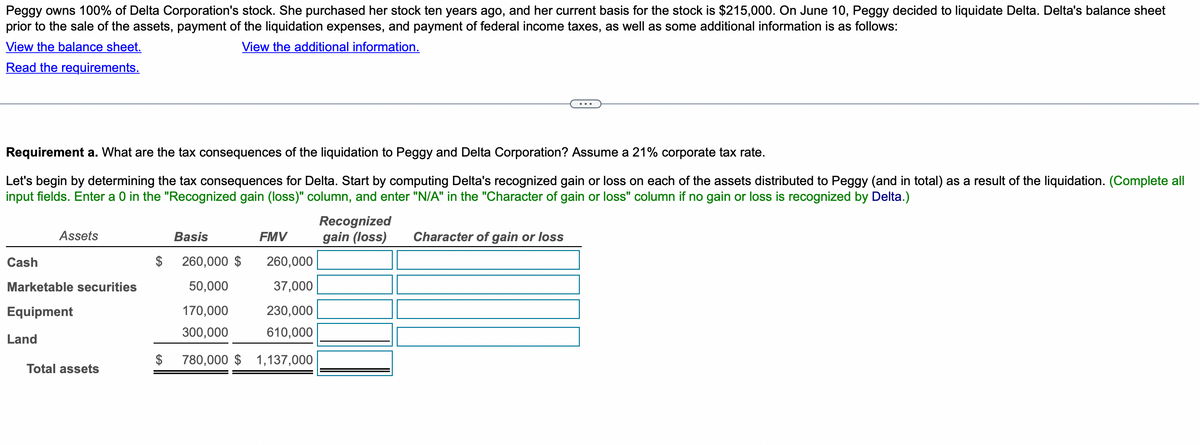

Transcribed Image Text:Peggy owns 100% of Delta Corporation's stock. She purchased her stock ten years ago, and her current basis for the stock is $215,000. On June 10, Peggy decided to liquidate Delta. Delta's balance sheet

prior to the sale of the assets, payment of the liquidation expenses, and payment of federal income taxes, as well as some additional information is as follows:

View the balance sheet.

View the additional information.

Read

the requirements.

Requirement a. What are the tax consequences of the liquidation to Peggy and Delta Corporation? Assume a 21% corporate tax rate.

Let's begin by determining the tax consequences for Delta. Start by computing Delta's recognized gain or loss on each of the assets distributed to Peggy (and in total) as a result of the liquidation. (Complete all

input fields. Enter a 0 in the "Recognized gain (loss)" column, and enter "N/A" in the "Character of gain or loss" column if no gain or loss is recognized by Delta.)

Cash

Assets

Marketable securities

Equipment

Land

Total assets

Basis

$ 260,000 $

260,000

50,000

37,000

170,000

230,000

300,000

610,000

$ 780,000 $ 1,137,000

FMV

Recognized

gain (loss)

Character of gain or loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you