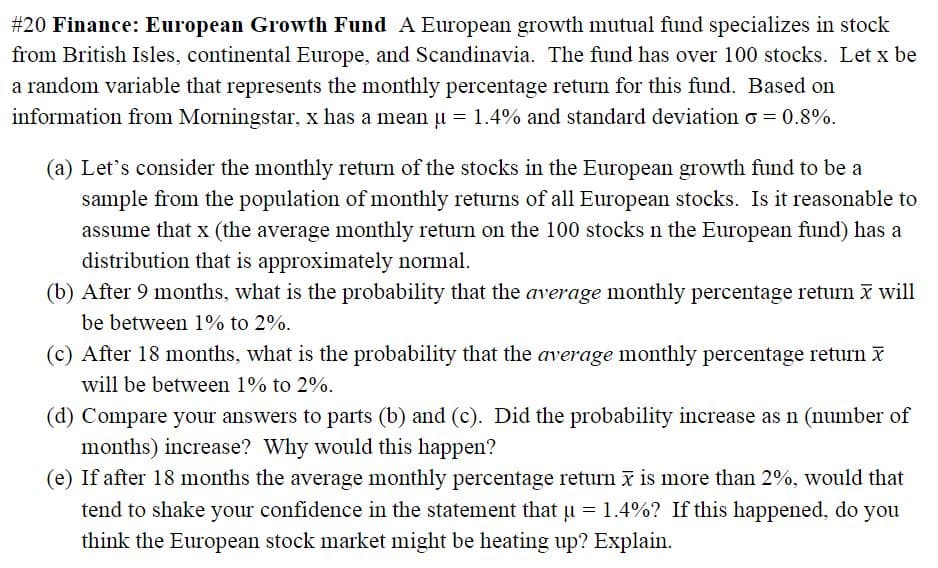

#20 Finance: European Growth Fund A European growth mutual fund specializes in stock from British Isles, continental Europe, and Scandinavia. The fund has over 100 stocks. Let x be a random variable that represents the monthly percentage return for this fund. Based on information from Morningstar, x has a mean u = 1.4% and standard deviation o = 0.8%. (a) Let's consider the monthly return of the stocks in the European growth fund to be a sample from the population of monthly returns of all European stocks. Is it reasonable to assume that x (the average monthly return on the 100 stocks n the European fund) has a distribution that is approximately normal. (b) After 9 months, what is the probability that the average monthly percentage return I will be between 1% to 2%. (c) After 18 months, what is the probability that the average monthly percentage return x will be between 1% to 2%. (d) Compare your answers to parts (b) and (c). Did the probability increase as n (number of months) increase? Why would this happen? (e) If after 18 months the average monthly percentage return ī is more than 2%, would that tend to shake your confidence in the statement that u = 1.4%? If this happened, do you think the European stock market might be heating up? Explain.

#20 Finance: European Growth Fund A European growth mutual fund specializes in stock from British Isles, continental Europe, and Scandinavia. The fund has over 100 stocks. Let x be a random variable that represents the monthly percentage return for this fund. Based on information from Morningstar, x has a mean u = 1.4% and standard deviation o = 0.8%. (a) Let's consider the monthly return of the stocks in the European growth fund to be a sample from the population of monthly returns of all European stocks. Is it reasonable to assume that x (the average monthly return on the 100 stocks n the European fund) has a distribution that is approximately normal. (b) After 9 months, what is the probability that the average monthly percentage return I will be between 1% to 2%. (c) After 18 months, what is the probability that the average monthly percentage return x will be between 1% to 2%. (d) Compare your answers to parts (b) and (c). Did the probability increase as n (number of months) increase? Why would this happen? (e) If after 18 months the average monthly percentage return ī is more than 2%, would that tend to shake your confidence in the statement that u = 1.4%? If this happened, do you think the European stock market might be heating up? Explain.

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter3: Matrices

Section3.7: Applications

Problem 44EQ

Related questions

Question

please answer especially D and E ! thank you

Transcribed Image Text:#20 Finance: European Growth Fund A European growth mutual fund specializes in stock

from British Isles, continental Europe, and Scandinavia. The fund has over 100 stocks. Let x be

a random variable that represents the monthly percentage return for this fund. Based on

information from Morningstar, x has a mean u = 1.4% and standard deviation o = 0.8%.

(a) Let's consider the monthly return of the stocks in the European growth fund to be a

sample from the population of monthly returns of all European stocks. Is it reasonable to

assume that x (the average monthly return on the 100 stocks n the European fund) has a

distribution that is approximately normal.

(b) After 9 months, what is the probability that the average monthly percentage return X will

be between 1% to 2%.

(c) After 18 months, what is the probability that the average monthly percentage return x

will be between 1% to 2%.

(d) Compare your answers to parts (b) and (c). Did the probability increase as n (number of

months) increase? Why would this happen?

(e) If after 18 months the average monthly percentage return i is more than 2%, would that

tend to shake your confidence in the statement that u = 1.4%? If this happened, do you

think the European stock market might be heating up? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill