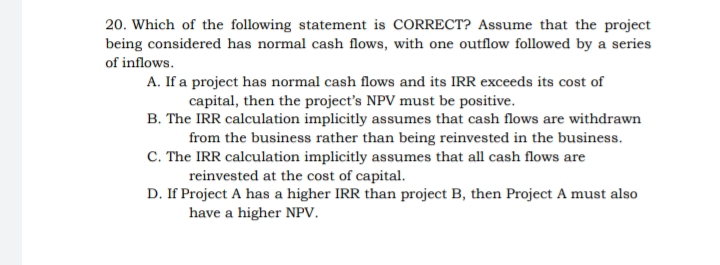

20. Which of the following statement is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. A. If a project has normal cash flows and its IRR exceeds its cost of capital, then the project's NPV must be positive. B. The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business. C. The IRR calculation implicitly assumes that all cash flows are reinvested at the cost of capital. D. If Project A has a higher IRR than project B, then Project A must also have a higher NPV.

20. Which of the following statement is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. A. If a project has normal cash flows and its IRR exceeds its cost of capital, then the project's NPV must be positive. B. The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business. C. The IRR calculation implicitly assumes that all cash flows are reinvested at the cost of capital. D. If Project A has a higher IRR than project B, then Project A must also have a higher NPV.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 20E

Related questions

Question

Transcribed Image Text:20. Which of the following statement is CORRECT? Assume that the project

being considered has normal cash flows, with one outflow followed by a series

of inflows.

A. If a project has normal cash flows and its IRR exceeds its cost of

capital, then the project's NPV must be positive.

B. The IRR calculation implicitly assumes that cash flows are withdrawn

from the business rather than being reinvested in the business.

C. The IRR calculation implicitly assumes that all cash flows are

reinvested at the cost of capital.

D. If Project A has a higher IRR than project B, then Project A must also

have a higher NPV.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT