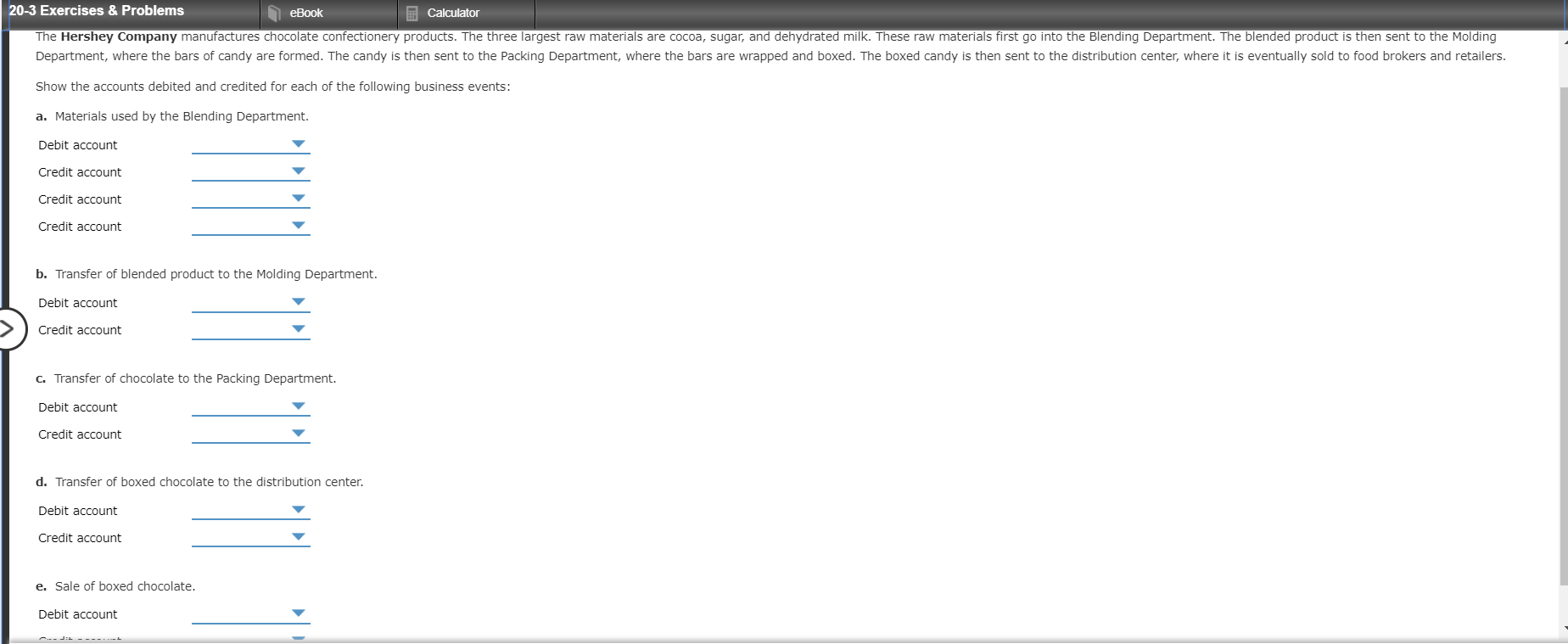

20-3 Exercises & Problems eBook Calculator The Hershey Company manufactures chocolate confectionery products. The three largest raw materials are cocoa, sugar, and dehydrated milk. These raw materials first go into the Blending Department. The blended product is then sent to the Molding Department, where the bars of candy are formed. The candy is then sent to the Packing Department,, where the bars are wrapped and boxed. The boxed candy is then sent to the distribution center, where it is eventually sold to food brokers and retailers. Show the accounts debited and credited for each of the following business events: a. Materials used by the Blending Department. Debit account Credit account Credit account Credit account b. Transfer of blended product to the Molding Department. Debit account Credit account c. Transfer of chocolate to the Packing Department. Debit account Credit account d. Transfer of boxed chocolate to the distribution center. Debit account Credit account e. Sale of boxed chocolate. Debit account

20-3 Exercises & Problems eBook Calculator The Hershey Company manufactures chocolate confectionery products. The three largest raw materials are cocoa, sugar, and dehydrated milk. These raw materials first go into the Blending Department. The blended product is then sent to the Molding Department, where the bars of candy are formed. The candy is then sent to the Packing Department,, where the bars are wrapped and boxed. The boxed candy is then sent to the distribution center, where it is eventually sold to food brokers and retailers. Show the accounts debited and credited for each of the following business events: a. Materials used by the Blending Department. Debit account Credit account Credit account Credit account b. Transfer of blended product to the Molding Department. Debit account Credit account c. Transfer of chocolate to the Packing Department. Debit account Credit account d. Transfer of boxed chocolate to the distribution center. Debit account Credit account e. Sale of boxed chocolate. Debit account

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter20: Process Cost Systems

Section: Chapter Questions

Problem 20.1EX: Entries for materials cost flows in a process cost system The Hershey Company manufactures chocolate...

Related questions

Question

100%

Hi i need help answering this question please! The last section got a bit cut off for part e but it is asking for the debit and credit accounts for the sale of boxed chocolate. Thanks!

Transcribed Image Text:20-3 Exercises & Problems

eBook

Calculator

The Hershey Company manufactures chocolate confectionery products. The three largest raw materials are cocoa, sugar, and dehydrated milk. These raw materials first go into the Blending Department. The blended product is then sent to the Molding

Department, where the bars of candy are formed. The candy is then sent to the Packing Department,, where the bars are wrapped and boxed. The boxed candy is then sent to the distribution center, where it is eventually sold to food brokers and retailers.

Show the accounts debited and credited for each of the following business events:

a. Materials used by the Blending Department.

Debit account

Credit account

Credit account

Credit account

b. Transfer of blended product to the Molding Department.

Debit account

Credit account

c. Transfer of chocolate to the Packing Department.

Debit account

Credit account

d. Transfer of boxed chocolate to the distribution center.

Debit account

Credit account

e. Sale of boxed chocolate.

Debit account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning