21. In your audit of the December 31, 2016, financial statements of CHICKEN, INC., you found the following inventory-related transactions. Goods costing P50,000 are on consignment with a customer. These goods were not included in the physical count on December 31, 2016. Goods costing P16,500 were delivered to Chicken, Inc. on January 4, 2017. The invoice for these goods was received and recorded on January 10, 2017. The invoice showed the shipment was made on December 29, 2016, FOB shipping point. Goods costing P21,640 were shipped FOB shipping point on December 31, 2016, and were received by the customer on January 2, 2017. Although the sale was recorded in 2016, these goods were included in the 2016 ending inventory. Goods costing P8,640 were shipped to a customer on December 31, 2016, FOB destination. These goods were delivered to the customer on January 5, 2017, and were not included in the inventory. The sale was properly taken up in 2017. Goods costing P8,600 shipped by a vendor under FOB destination term, were received January 3, 2017, and thus were not included in the physical inventor related invoice was received on December 31, 2016, this shipment was recorded as a purchase in 2016. Because the Goods valued at P51,000 were received from a vendor under consignment term. These goods were included in the physical count. Chicken, Inc. recorded as a 2016 sale a P64,300 shipment of goods to a customer on December 31, 2016, FOB destination. This shipment of goods costing P37,500 was received by the customer on January 5, 2017, and was not included in the ending inventory figure. Prior to any adjustments, Chicken, Inc.'s ending inventory is valued at P445,000 and the reported net income for the year is P1,648,000. Chicken's December 31, 2016, inventory should be increased by a. P8,000 b. P40,000 c. P66,000 d. P61,640

21. In your audit of the December 31, 2016, financial statements of CHICKEN, INC., you found the following inventory-related transactions. Goods costing P50,000 are on consignment with a customer. These goods were not included in the physical count on December 31, 2016. Goods costing P16,500 were delivered to Chicken, Inc. on January 4, 2017. The invoice for these goods was received and recorded on January 10, 2017. The invoice showed the shipment was made on December 29, 2016, FOB shipping point. Goods costing P21,640 were shipped FOB shipping point on December 31, 2016, and were received by the customer on January 2, 2017. Although the sale was recorded in 2016, these goods were included in the 2016 ending inventory. Goods costing P8,640 were shipped to a customer on December 31, 2016, FOB destination. These goods were delivered to the customer on January 5, 2017, and were not included in the inventory. The sale was properly taken up in 2017. Goods costing P8,600 shipped by a vendor under FOB destination term, were received January 3, 2017, and thus were not included in the physical inventor related invoice was received on December 31, 2016, this shipment was recorded as a purchase in 2016. Because the Goods valued at P51,000 were received from a vendor under consignment term. These goods were included in the physical count. Chicken, Inc. recorded as a 2016 sale a P64,300 shipment of goods to a customer on December 31, 2016, FOB destination. This shipment of goods costing P37,500 was received by the customer on January 5, 2017, and was not included in the ending inventory figure. Prior to any adjustments, Chicken, Inc.'s ending inventory is valued at P445,000 and the reported net income for the year is P1,648,000. Chicken's December 31, 2016, inventory should be increased by a. P8,000 b. P40,000 c. P66,000 d. P61,640

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 2CP

Related questions

Topic Video

Question

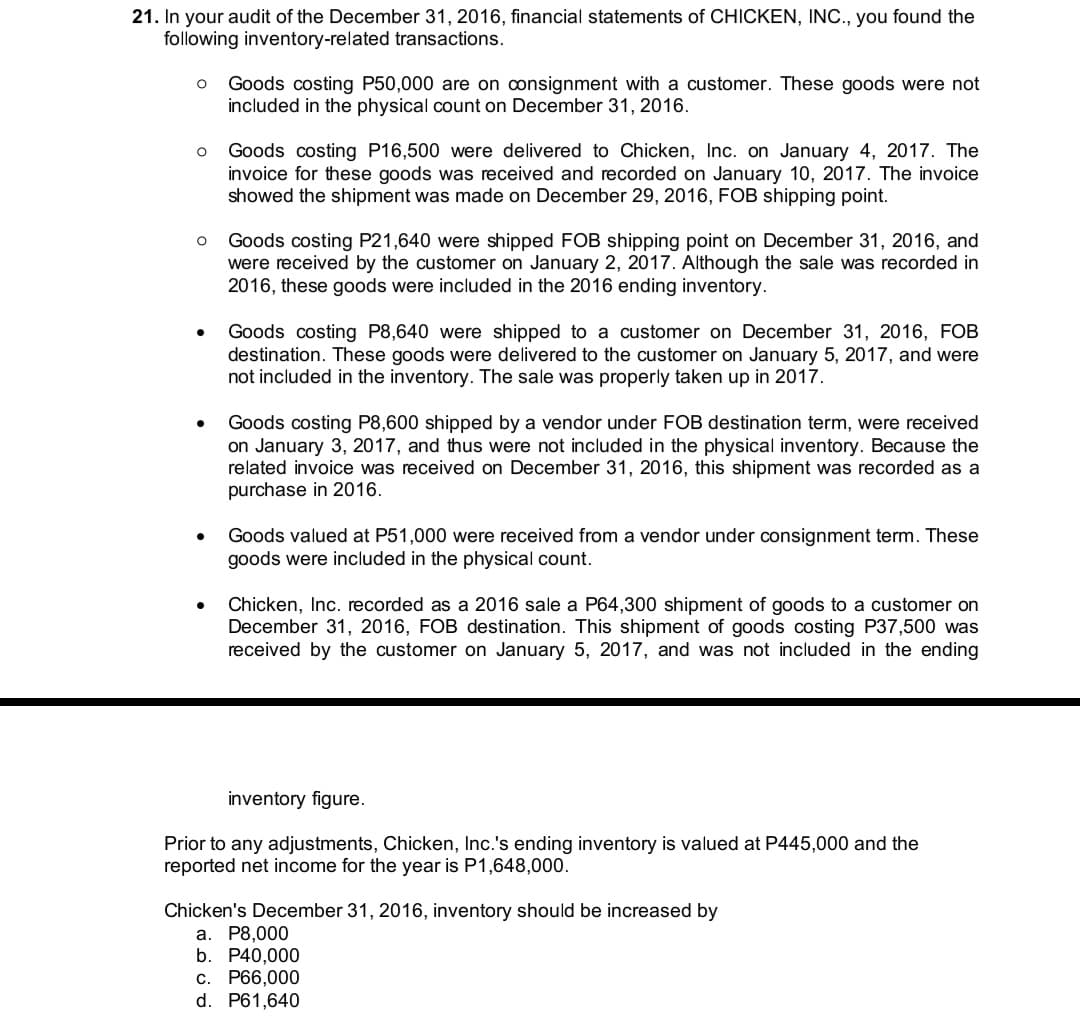

Transcribed Image Text:21. In your audit of the December 31, 2016, financial statements of CHICKEN, INC., you found the

following inventory-related transactions.

Goods costing P50,000 are on consignment with a customer. These goods were not

included in the physical count on December 31, 2016.

Goods costing P16,500 were delivered to Chicken, Inc. on January 4, 2017. The

invoice for these goods was received and recorded on January 10, 2017. The invoice

showed the shipment was made on December 29, 2016, FOB shipping point.

Goods costing P21,640 were shipped FOB shipping point on December 31, 2016, and

were received by the customer on January 2, 2017. Although the sale was recorded in

2016, these goods were included in the 2016 ending inventory.

Goods costing P8,640 were shipped to a customer on December 31, 2016, FOB

destination. These goods were delivered to the customer on January 5, 2017, and were

not included in the inventory. The sale was properly taken up in 2017.

Goods costing P8,600 shipped by a vendor under FOB destination term, were received

on January 3, 2017, and thus were not included in the physical inventory. Because the

related invoice was received on December 31, 2016, this shipment was recorded as a

purchase in 2016.

Goods valued at P51,000 were received from a vendor under consignment term. These

goods were included in the physical count.

Chicken, Inc. recorded as a 2016 sale a P64,300 shipment of goods to a customer on

December 31, 2016, FOB destination. This shipment of goods costing P37,500 was

received by the customer on January 5, 2017, and was not included in the ending

inventory figure.

Prior to any adjustments, Chicken, Inc.'s ending inventory is valued at P445,000 and the

reported net income for the year is P1,648,000.

Chicken's December 31, 2016, inventory should be increased by

a. P8,000

b. P40,000

c. P66,000

d. P61,640

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College