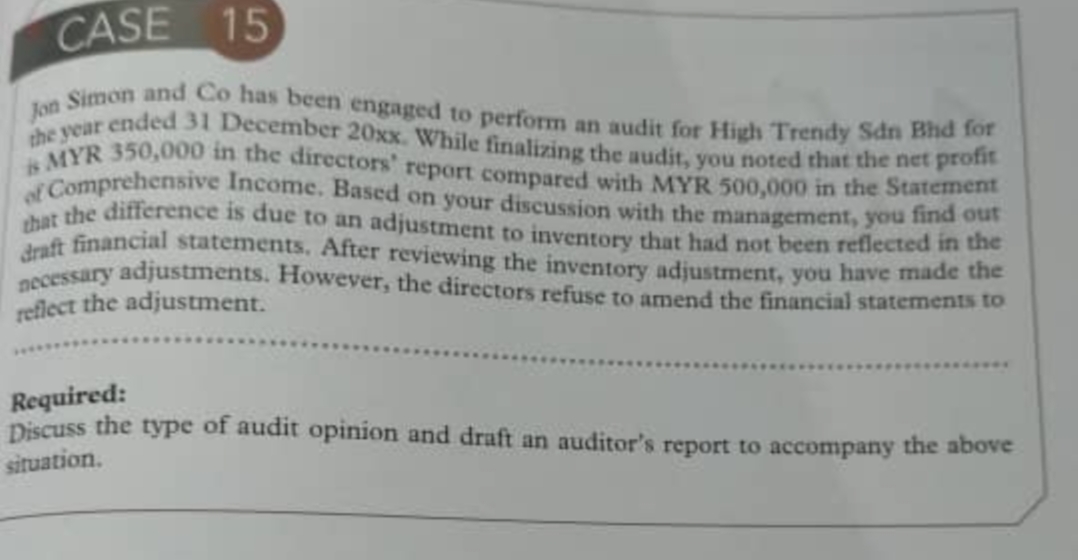

Jon Simon and Co has been engaged to perform an audit for High Trendy Sdn Bhd for the year ended 31 December 20xx. While finalizing the audit, you noted that the net profit s MYR 350,000 in the directors' report compared with MYR 500,000 in the Statement of Comprehensive Income. Based on your discussion with the management, you find out that the difference is due to an adjustment to inventory that had not been reflected in the draft financial statements. After reviewing the inventory adjustment, you have made the ocessary adjustments. However, the directors refuse to amend the financial statements to reflect the adjustment. Required: Discuss the type of audit opinion and draft an auditor's report to accompany the above situation.

Jon Simon and Co has been engaged to perform an audit for High Trendy Sdn Bhd for the year ended 31 December 20xx. While finalizing the audit, you noted that the net profit s MYR 350,000 in the directors' report compared with MYR 500,000 in the Statement of Comprehensive Income. Based on your discussion with the management, you find out that the difference is due to an adjustment to inventory that had not been reflected in the draft financial statements. After reviewing the inventory adjustment, you have made the ocessary adjustments. However, the directors refuse to amend the financial statements to reflect the adjustment. Required: Discuss the type of audit opinion and draft an auditor's report to accompany the above situation.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter16: Advanced Topics Concerning Complex Auditing Judgments

Section: Chapter Questions

Problem 39RSCQ

Related questions

Question

This help solve this

Transcribed Image Text:necessary adjustments. However, the directors refuse to amend the financial statements to

that the difference is due to an adjustment to inventory that had not been reflected in the

of Comprehensive Income. Based on your discussion with the management, you find out

is MYR 350,000 in the directors' report compared with MYR 500,000 in the Statement

the year ended 31 December 20xx. While finalizing the audit, you noted that the net profit

Jon Simon and Co has been engaged to perform an audit for High Trendy Sdn Bhd for

CASE 15

dnft financial statements, After reviewing the inventory adjustment, you have made the

reflect the adjustment.

Required:

Discuss the type of audit opinion and draft an auditor's report to accompany the above

situation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning