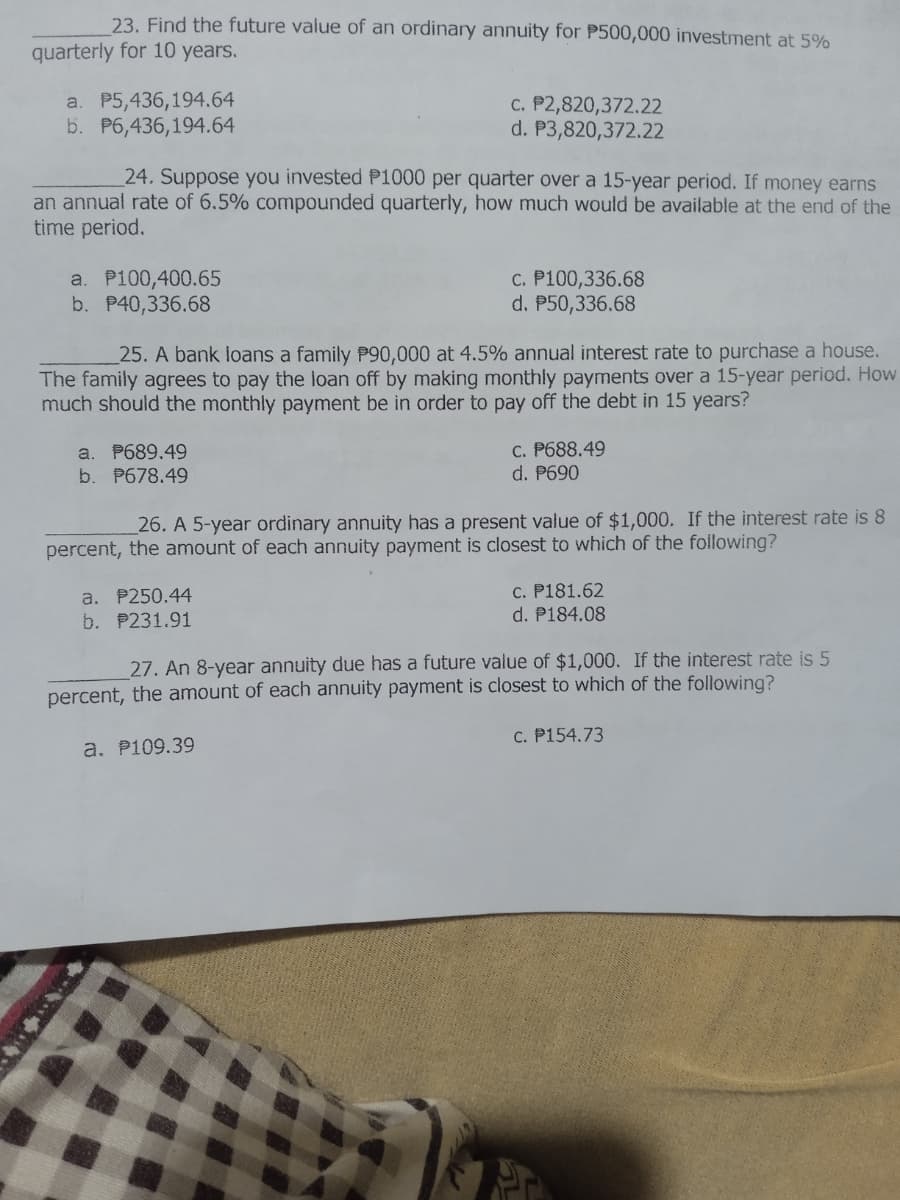

23. Find the future value of an ordinary annuity for P500,000 investment at 5% quarterly for 10 years. a. P5,436,194.64 b. P6,436,194.64 c. P2,820,372.22 P3,820,372.22 d. 24. Suppose you invested P1000 per quarter over a 15-year period. If money earns an annual rate of 6.5% compounded quarterly, how much would be available at the end of the time period. a. P100,400.65 c. P100,336.68 b. P40,336.68 d. P50,336.68 25. A bank loans a family P90,000 at 4.5% annual interest rate to purchase a house. The family agrees to pay the loan off by making monthly payments over a 15-year period. How much should the monthly payment be in order to pay off the debt in 15 years? a. P689.49 C. P688.49 d. P690 b. P678.49 26. A 5-year ordinary annuity has a present value of $1,000. If the interest rate is 8 percent, the amount of each annuity payment is closest to which of the following? a. P250.44 c. P181.62 d. P184.08 b. P231.91 27. An 8-year annuity due has a future value of $1,000. If the interest rate is 5 percent, the amount of each annuity payment is closest to which of the following? c. P154.73 a. P109.39

23. Find the future value of an ordinary annuity for P500,000 investment at 5% quarterly for 10 years. a. P5,436,194.64 b. P6,436,194.64 c. P2,820,372.22 P3,820,372.22 d. 24. Suppose you invested P1000 per quarter over a 15-year period. If money earns an annual rate of 6.5% compounded quarterly, how much would be available at the end of the time period. a. P100,400.65 c. P100,336.68 b. P40,336.68 d. P50,336.68 25. A bank loans a family P90,000 at 4.5% annual interest rate to purchase a house. The family agrees to pay the loan off by making monthly payments over a 15-year period. How much should the monthly payment be in order to pay off the debt in 15 years? a. P689.49 C. P688.49 d. P690 b. P678.49 26. A 5-year ordinary annuity has a present value of $1,000. If the interest rate is 8 percent, the amount of each annuity payment is closest to which of the following? a. P250.44 c. P181.62 d. P184.08 b. P231.91 27. An 8-year annuity due has a future value of $1,000. If the interest rate is 5 percent, the amount of each annuity payment is closest to which of the following? c. P154.73 a. P109.39

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 6MC: You want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years....

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

Transcribed Image Text:23. Find the future value of an ordinary annuity for P500,000 investment at 5%

quarterly for 10 years.

a. P5,436,194.64

b. P6,436,194.64

c. P2,820,372.22

P3,820,372.22

d.

24. Suppose you invested P1000 per quarter over a 15-year period. If money earns

an annual rate of 6.5% compounded quarterly, how much would be available at the end of the

time period.

a. P100,400.65

c. P100,336.68

b. P40,336.68

d. P50,336.68

25. A bank loans a family P90,000 at 4.5% annual interest rate to purchase a house.

The family agrees to pay the loan off by making monthly payments over a 15-year period. How

much should the monthly payment be in order to pay off the debt in 15 years?

a. P689.49

c. P688.49

d. P690

b. P678.49

26. A 5-year ordinary annuity has a present value of $1,000. If the interest rate is 8

percent, the amount of each annuity payment is closest to which of the following?

a. P250.44

c. P181.62

d. P184.08

b. P231.91

27. An 8-year annuity due has a future value of $1,000. If the interest rate is 5

percent, the amount of each annuity payment is closest to which of the following?

c. P154.73

a. P109.39

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning