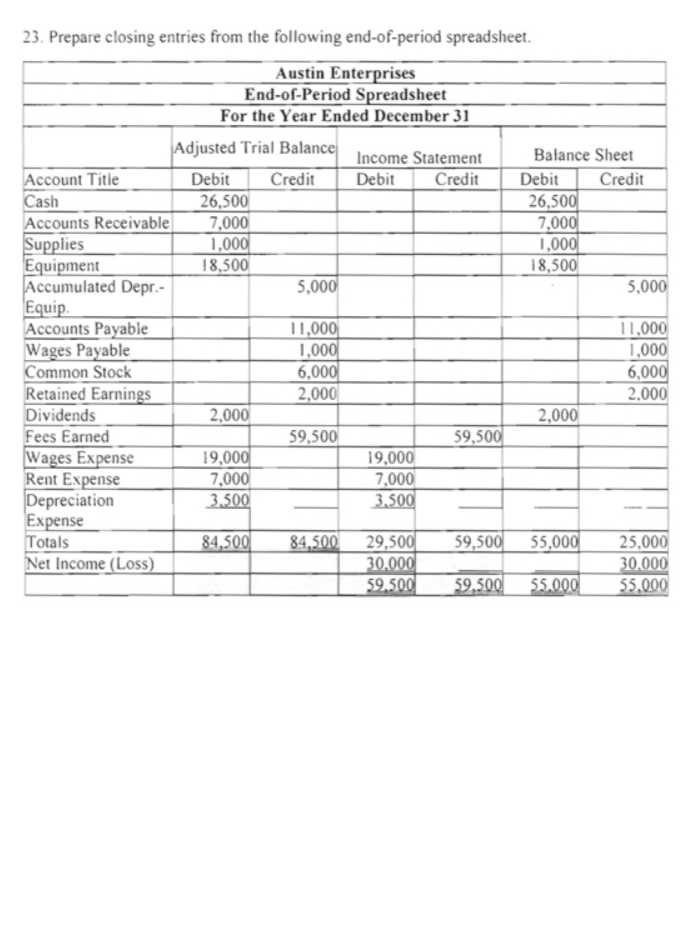

23. Prepare closing entries from the following end-of-period spreadsheet. Austin Enterprises End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Balance Sheet Income Statement Credit Account Title Cash Debit Credit Debit Debit Credit 26,500 7,000 1,000 18,500 26,500 7,000 1,000| 18,500 Accounts Receivable| Supplies Equipment Accumulated Depr.- Equip. Accounts Payable Wages Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Depreciation Expense Totals Net Income (Loss) 5,000 5,000 11,000| 1,000 6,000 2,000 11,000 1,000 6,000 2.000 2,000 2,000 59,500 59,500 19,000 7,000 3,500 19,000 7,000 3,500 84,500 29,500 30,000 59,500 59,500 25,000 30.000 55,000 84,500 55,000 59,500 55.000

23. Prepare closing entries from the following end-of-period spreadsheet. Austin Enterprises End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Balance Sheet Income Statement Credit Account Title Cash Debit Credit Debit Debit Credit 26,500 7,000 1,000 18,500 26,500 7,000 1,000| 18,500 Accounts Receivable| Supplies Equipment Accumulated Depr.- Equip. Accounts Payable Wages Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Depreciation Expense Totals Net Income (Loss) 5,000 5,000 11,000| 1,000 6,000 2,000 11,000 1,000 6,000 2.000 2,000 2,000 59,500 59,500 19,000 7,000 3,500 19,000 7,000 3,500 84,500 29,500 30,000 59,500 59,500 25,000 30.000 55,000 84,500 55,000 59,500 55.000

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11EB: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the...

Related questions

Question

Transcribed Image Text:23. Prepare closing entries from the following end-of-period spreadsheet.

Austin Enterprises

End-of-Period Spreadsheet

For the Year Ended December 31

Adjusted Trial Balance

Balance Sheet

Income Statement

Credit

Account Title

Cash

Debit

Credit

Debit

Debit

Credit

26,500

7,000

1,000

18,500

26,500

7,000

1,000|

18,500

Accounts Receivable|

Supplies

Equipment

Accumulated Depr.-

Equip.

Accounts Payable

Wages Payable

Common Stock

Retained Earnings

Dividends

Fees Earned

Wages Expense

Rent Expense

Depreciation

Expense

Totals

Net Income (Loss)

5,000

5,000

11,000|

1,000

6,000

2,000

11,000

1,000

6,000

2.000

2,000

2,000

59,500

59,500

19,000

7,000

3,500

19,000

7,000

3,500

84,500

29,500

30,000

59,500

59,500

25,000

30.000

55,000

84,500

55,000

59,500

55.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage