year. AMar SPaS Coral Seas Jewelry Company Budgeted Income Statement For the Coming Year ross margin ess: perating income What if Coral Seas had interest payments of $450,000 during the year? What effect would that have on operating income? On inco ore taxes? On net income? If no effect, select "no impact" and enter "0". perating income to $ come before taxes to s et income to $

year. AMar SPaS Coral Seas Jewelry Company Budgeted Income Statement For the Coming Year ross margin ess: perating income What if Coral Seas had interest payments of $450,000 during the year? What effect would that have on operating income? On inco ore taxes? On net income? If no effect, select "no impact" and enter "0". perating income to $ come before taxes to s et income to $

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 10CE: Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects...

Related questions

Question

1

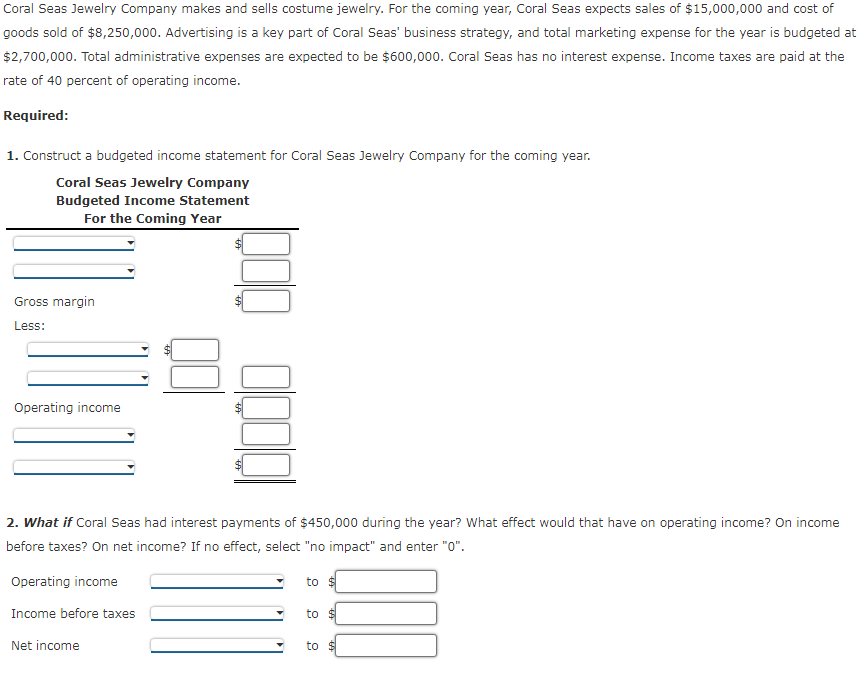

Transcribed Image Text:Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of $15,000,000 and cost of

goods sold of $8,250,000. Advertising is a key part of Coral Seas' business strategy, and total marketing expense for the year is budgeted at

$2,700,000. Total administrative expenses are expected to be $600,000. Coral Seas has no interest expense. Income taxes are paid at the

rate of 40 percent of operating income.

Required:

1. Construct a budgeted income statement for Coral Seas Jewelry Company for the coming year.

Coral Seas Jewelry Company

Budgeted Income Statement

For the Coming Year

Gross margin

Less:

Operating income

2. What if Coral Seas had interest payments of $450,000 during the year? What effect would that have on operating income? On income

before taxes? On net income? If no effect, select "no impact" and enter "0".

Operating income

to $

Income before taxes

to $

Net income

to $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning