3-Jan Issued a check to establish a petty cash fund of $4,500 Replenished the petty cash fund, based on the following summary of petty ash receipts: office supplies $1,680; 26-Feb miscellaneous selling expense, $570; miscellaneous administrative expense, $880 14-Apr Purchased $31,300 of merchandise on account, terms n/30. The perpetual inventory system is used to account for inventory 13-May Paid the invoices of April 14 17-May Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240. 2-Jun Received a 6--day, 8% note for $180,000 on the Ryanair account Received amount owed on June 2 note, plus interest the maturity date. Record the transaction in the general journal. 1-Aug Use a 360-day year to simplify the interest calculation Received $7,600 on the Finley account and wrote off the remainder owed on a $9,000 accounts receivable balance. (The 24-Aug allowance method is used in accounting for uncollectible receivables) 15-Sep Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment Purchased land by issuing a $670,000, 90-day note to Zahorik Co., which discouted it a 9%. (Record the transaction in the 15-Sep general journal. Usa a 360 day year to simplify the interest calculation. Sold office equipment in exchange for $135,000 cash plus receipt of $100,000. 90-day, 9% note. The equipment had a cost 17-Oct of $320,000 and accumulated depreciation of $64,000 as of October 17 salaries $135,00; Offie Salaries $77, 250. Deduction: Income ta withheld $39,266; Social security tax withheld $12,735; 30-Nov Medicare tax withheld $3,184; Credit Salaries Payable Journalized the employer's payroll taxes on the payroll. Social Security tax $12,735; Medicare tax $3,184. Unemployment 30-Nov taxes: State unemployment; 5.4% on $5,000 of wages; Federal Unemployment: 0.8% on $5,000 of wages 14-Dec Paid the September 15 note at maturity. 31-Dec The pension cost for the year was $190,400, of which $139.700 was paid to the pension plan trustee

3-Jan Issued a check to establish a petty cash fund of $4,500 Replenished the petty cash fund, based on the following summary of petty ash receipts: office supplies $1,680; 26-Feb miscellaneous selling expense, $570; miscellaneous administrative expense, $880 14-Apr Purchased $31,300 of merchandise on account, terms n/30. The perpetual inventory system is used to account for inventory 13-May Paid the invoices of April 14 17-May Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240. 2-Jun Received a 6--day, 8% note for $180,000 on the Ryanair account Received amount owed on June 2 note, plus interest the maturity date. Record the transaction in the general journal. 1-Aug Use a 360-day year to simplify the interest calculation Received $7,600 on the Finley account and wrote off the remainder owed on a $9,000 accounts receivable balance. (The 24-Aug allowance method is used in accounting for uncollectible receivables) 15-Sep Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment Purchased land by issuing a $670,000, 90-day note to Zahorik Co., which discouted it a 9%. (Record the transaction in the 15-Sep general journal. Usa a 360 day year to simplify the interest calculation. Sold office equipment in exchange for $135,000 cash plus receipt of $100,000. 90-day, 9% note. The equipment had a cost 17-Oct of $320,000 and accumulated depreciation of $64,000 as of October 17 salaries $135,00; Offie Salaries $77, 250. Deduction: Income ta withheld $39,266; Social security tax withheld $12,735; 30-Nov Medicare tax withheld $3,184; Credit Salaries Payable Journalized the employer's payroll taxes on the payroll. Social Security tax $12,735; Medicare tax $3,184. Unemployment 30-Nov taxes: State unemployment; 5.4% on $5,000 of wages; Federal Unemployment: 0.8% on $5,000 of wages 14-Dec Paid the September 15 note at maturity. 31-Dec The pension cost for the year was $190,400, of which $139.700 was paid to the pension plan trustee

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 2PA: On May 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare...

Related questions

Question

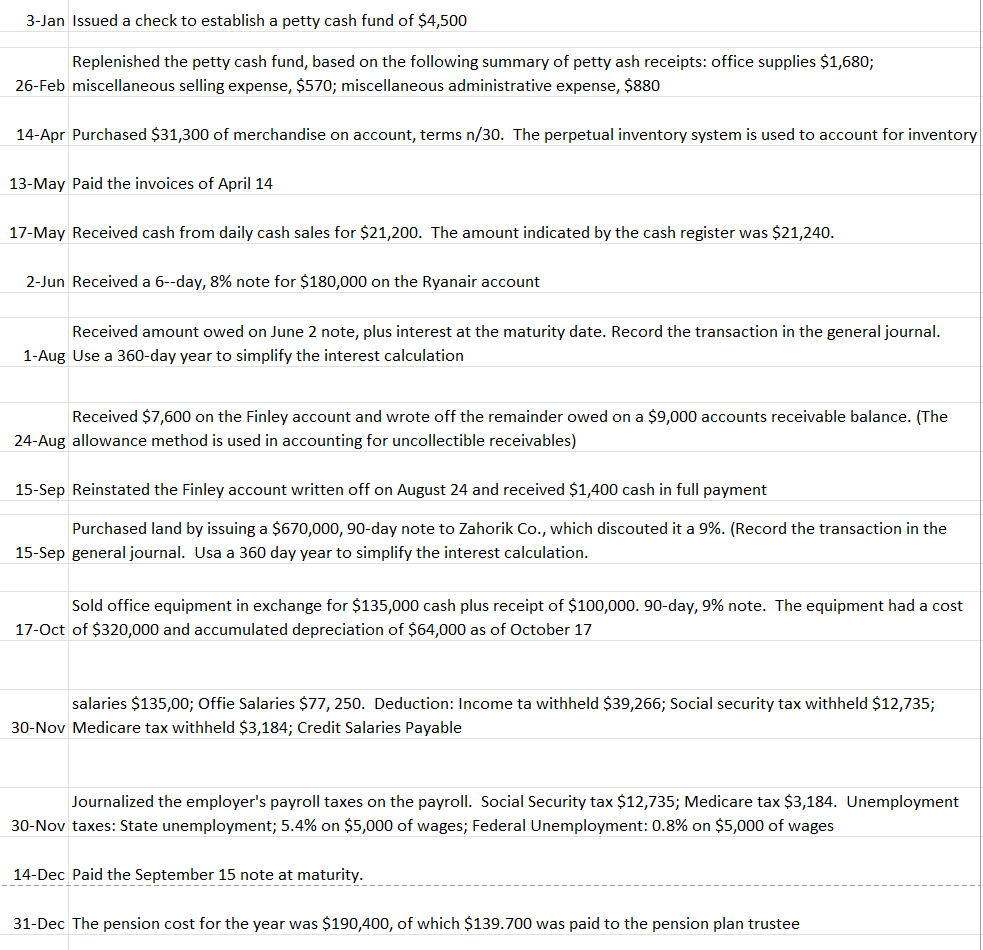

Journalize the selected transactions

Transcribed Image Text:3-Jan Issued a check to establish a petty cash fund of $4,500

Replenished the petty cash fund, based on the following summary of petty ash receipts: office supplies $1,680;

26-Feb miscellaneous selling expense, $570; miscellaneous administrative expense, $880

14-Apr Purchased $31,300 of merchandise on account, terms n/30. The perpetual inventory system is used to account for inventory

13-May Paid the invoices of April 14

17-May Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240.

2-Jun Received a 6--day, 8% note for $180,000 on the Ryanair account

Received amount owed on June 2 note, plus interest at the maturity date. Record the transaction in the general journal.

1-Aug Use a 360-day year to simplify the interest calculation

Received $7,600 on the Finley account and wrote off the remainder owed on a $9,000 accounts receivable balance. (The

24-Aug allowance method is used in accounting for uncollectible receivables)

15-Sep Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment

Purchased land by issuing a $670,000, 90-day note to Zahorik Co., which discouted it a 9%. (Record the transaction in the

15-Sep general journal. Usa a 360 day year to simplify the interest calculation.

Sold office equipment in exchange for $135,000 cash plus receipt of $100,000. 90-day, 9% note. The equipment had a cost

17-Oct of $320,000 and accumulated depreciation of $64,000 as of October 17

salaries $135,00; Offie Salaries $77, 250. Deduction: Income ta withheld $39,266; Social security tax withheld $12,735;

30-Nov Medicare tax withheld $3,184; Credit Salaries Payable

Journalized the employer's payroll taxes on the payroll. Social Security tax $12,735; Medicare tax $3,184. Unemployment

30-Nov taxes: State unemployment; 5.4% on $5,000 of wages; Federal Unemployment: 0.8% on $5,000 of wages

14-Dec Paid September 15 note at maturity.

31-Dec The pension cost for the year was $190,400, of which $139.700 was paid to the pension plan trustee

Transcribed Image Text:Classification

Assets

Assets

Assets

Assets

Assets

Assets

Assets

Assets

Assets

Assets

Long Term Assets

Long-Term Assets

Long-Term Assets

Long-Term Assets

Long-Term Assets

Long-Term Assets

Long-Term Assets

Long Term Assets

Long Term Assets

Long Term Assets

Long-Term Assets

Liabilities

Liabilities

Liabilities

Liabilities

Liabilities

Liabilities

Liabilitics

Liabilities

Liabilities

Liabilities

Liabilities

Liabilities

Long Term Liabilities

Long Term Liabilities

Equity

Equity

Equity

Equity

Equity

Revenue

Revenue

Cost

Cust

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Expenses

Other Expenses

Other Expenses

Other Expenses

Other Revenue

Other Revenue

Other Revenue

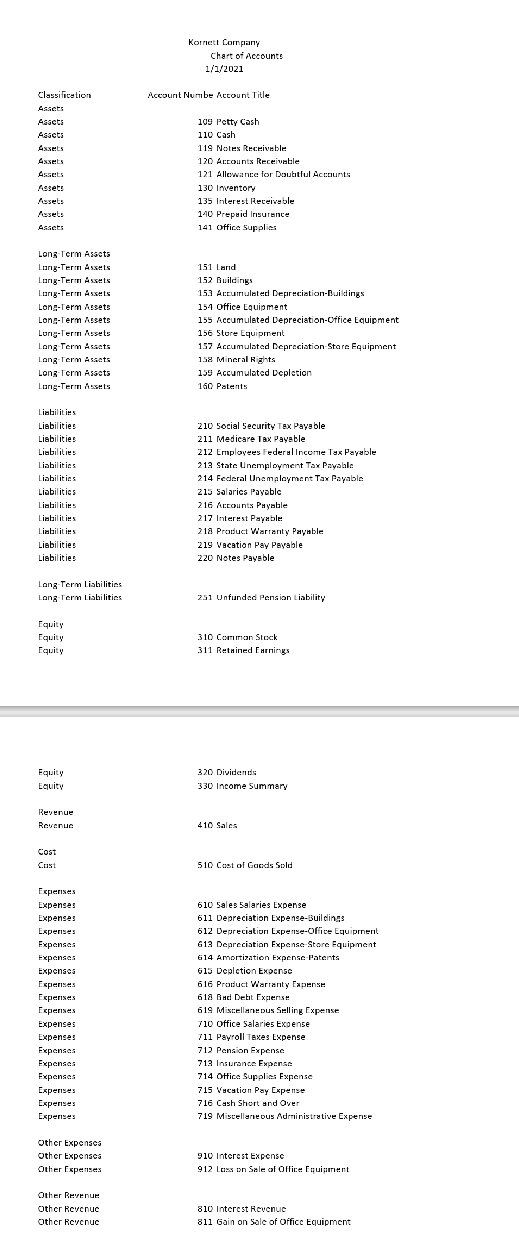

Kornett Company

Chart of Accounts

1/1/2021

Account Numbe Account Title

109 Petty Cash

110 Cash

119 Notes Receivable

120 Accounts Receivable

121 Allowance for Doubtful Accounts

130 Inventory

135 Interest Receivable

140 Prepaid Insurance

141 Office Supplies

151 Land

152 Buildings

153 Accumulated Depreciation-Buildings

154 Office Equipment

155 Accumulated Depreciation-Office Equipment

156 Stare Equipment

157 Accumulated Depreciation Store Equipment

158 Mineral Rights

159 Accumulated Depletion

160 Patents

210 Social Security Tax Payable

211 Medicare Tax Payable

212 Employees Federal Income Tax Payable

213 State Unemployment Tax Payable

214 Federal Unemployment Tax Payable

215 Salaries Payable

216 Accounts Payable

217 Interest Payable

218 Product Warranty Payable

219 Vacation Pay Payable

220 Notes Payable

251 Unfunded Pension Liability

310 Comman Stock

311 Retained Earnings

320 Dividends

330 Income Summary

410 Sales

510 Cost of Goods Sold

610 Sales Salaries Expense

611 Depreciation Expense-Buildings

612 Depreciation Expense-Office Equipment

613 Depreciation Expense-Store Equipment

614 Amortization Expense-Patents

615 Depletion Expense

616 Product Warranty Expense

618 Bad Debt Expense

619 Miscellaneous Selling Expense

710 Office Salaries Expense

711 Payroll Taxes Expense

712 Pension Expense

713 Insurance Expense

714 Office Supplies Expense

715 Vacation Pay Expense

716 Cash Short and Over

719 Miscellaneous Administrative Expense

910 Interest Expense

912 Loss on Sale of Office Equipment

810 Interest Revenue

811 Gain on Sale of Office Equipment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning