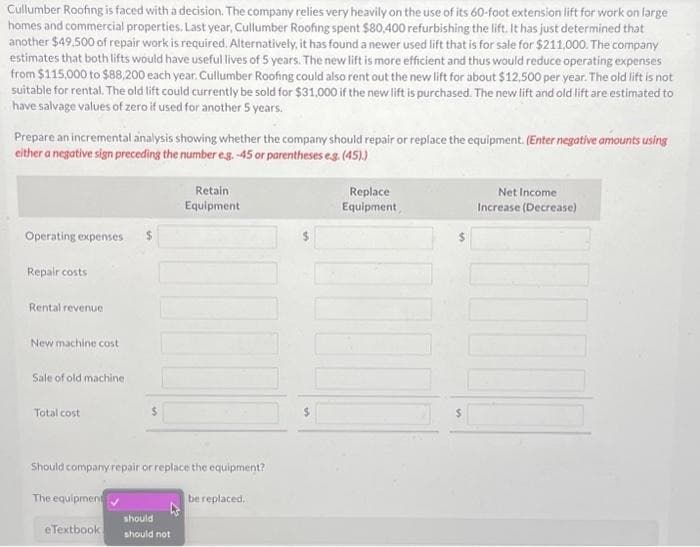

Cullumber Roofing is faced with a decision. The company relies very heavily on the use of its 60-foot extension lift for work on large homes and commercial properties. Last year, Cullumber Roofing spent $80,400 refurbishing the lift. It has just determined that another $49.500 of repair work is required. Alternatively, it has found a newer used lift that is for sale for $211,000. The company estimates that both lifts would have useful lives of 5 years. The new lift is more efficient and thus would reduce operating expenses from $115,000 to $88,200 each year. Cullumber Roofing could also rent out the new lift for about $12,500 per year. The old lift is not suitable for rental. The old lift could currently be sold for $31,000 if the new lift is purchased. The new lift and old lift are estimated to have salvage values of zero if used for another 5 years. Prepare an incremental analysis showing whether the company should repair or replace the equipment. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45).) Operating expenses Repair costs Rental revenue. New machine cost Sale of old machine Total cost Should company repair or replace the equipment? The equipment eTextbook. Retain Equipment should should not be replaced. Replace Equipment Net Income Increase (Decrease)

Cullumber Roofing is faced with a decision. The company relies very heavily on the use of its 60-foot extension lift for work on large homes and commercial properties. Last year, Cullumber Roofing spent $80,400 refurbishing the lift. It has just determined that another $49.500 of repair work is required. Alternatively, it has found a newer used lift that is for sale for $211,000. The company estimates that both lifts would have useful lives of 5 years. The new lift is more efficient and thus would reduce operating expenses from $115,000 to $88,200 each year. Cullumber Roofing could also rent out the new lift for about $12,500 per year. The old lift is not suitable for rental. The old lift could currently be sold for $31,000 if the new lift is purchased. The new lift and old lift are estimated to have salvage values of zero if used for another 5 years. Prepare an incremental analysis showing whether the company should repair or replace the equipment. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45).) Operating expenses Repair costs Rental revenue. New machine cost Sale of old machine Total cost Should company repair or replace the equipment? The equipment eTextbook. Retain Equipment should should not be replaced. Replace Equipment Net Income Increase (Decrease)

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage...

Related questions

Question

Kmu

Transcribed Image Text:Cullumber Roofing is faced with a decision. The company relies very heavily on the use of its 60-foot extension lift for work on large

homes and commercial properties. Last year, Cullumber Roofing spent $80,400 refurbishing the lift. It has just determined that

another $49.500 of repair work is required. Alternatively, it has found a newer used lift that is for sale for $211,000. The company

estimates that both lifts would have useful lives of 5 years. The new lift is more efficient and thus would reduce operating expenses

from $115,000 to $88,200 each year. Cullumber Roofing could also rent out the new lift for about $12,500 per year. The old lift is not

suitable for rental. The old lift could currently be sold for $31,000 if the new lift is purchased. The new lift and old lift are estimated to

have salvage values of zero if used for another 5 years.

Prepare an incremental analysis showing whether the company should repair or replace the equipment. (Enter negative amounts using

either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Operating expenses

Repair costs

Rental revenue

New machine cost

Sale of old machine

Total cost

$

eTextbook

Should company repair or replace the equipment?

The equipment

Retain

Equipment

should

should not

be replaced.

Replace

Equipment

Net Income

Increase (Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning