3) The following two sets of Excel output use are from the same data set as described above, but the first set of output is for the set of 35 CEO’s that earn the lowest total compensation and the second set of output is for a set of 40 CEO’s that earn the highest total compensation. a) What is heteroscedasticity? b) Why is heteroscedasticity a problem? c) Based on a comparison of the two sets of output, does it appear that there is heteroscedasticity in the data set? Explain.

3) The following two sets of Excel output use are from the same data set as described above, but the first set of output is for the set of 35 CEO’s that earn the lowest total compensation and the second set of output is for a set of 40 CEO’s that earn the highest total compensation. a) What is heteroscedasticity? b) Why is heteroscedasticity a problem? c) Based on a comparison of the two sets of output, does it appear that there is heteroscedasticity in the data set? Explain.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 27PPS

Related questions

Question

3) The following two sets of Excel output use are from the same data set as described above, but the first set of output is for the set of 35 CEO’s that earn the lowest total compensation and the second set of output is for a set of 40 CEO’s that earn the highest total compensation.

a) What is heteroscedasticity?

b) Why is heteroscedasticity a problem?

c) Based on a comparison of the two sets of output, does it appear that there is heteroscedasticity in the data set? Explain.

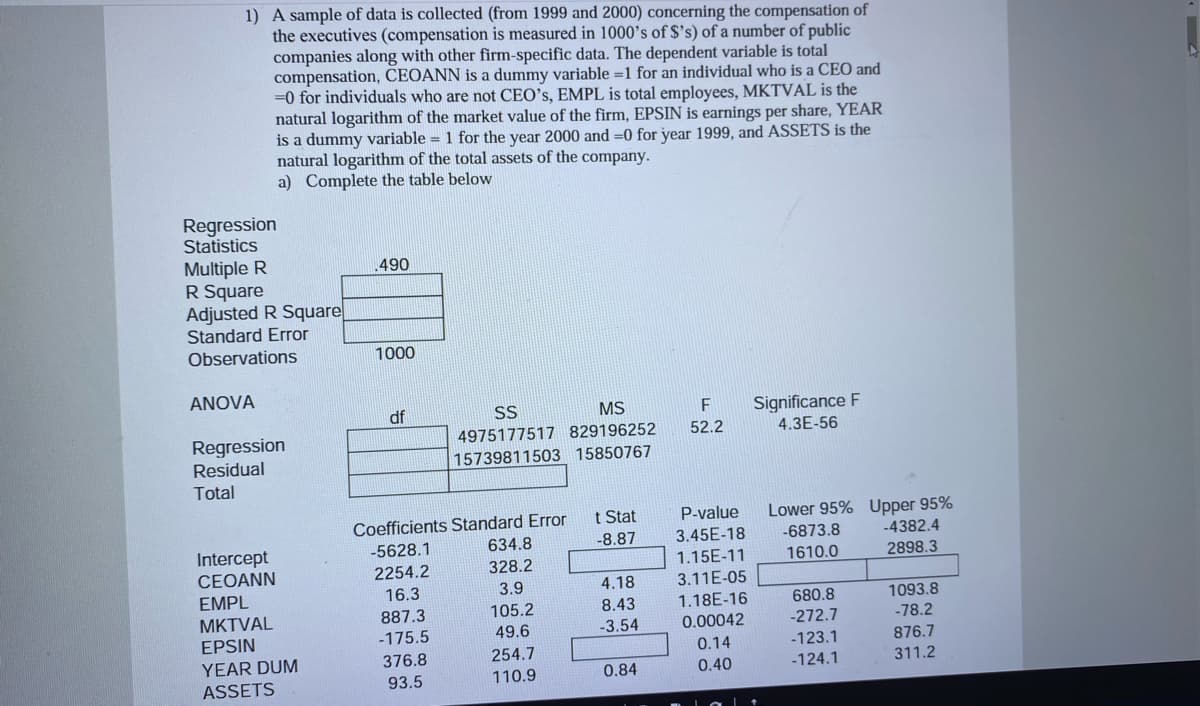

Transcribed Image Text:1) A sample of data is collected (from 1999 and 2000) concerning the compensation of

the executives (compensation is measured in 1000's of $'s) of a number of public

companies along with other firm-specific data. The dependent variable is total

compensation, CEOANN is a dummy variable =1 for an individual who is a CEO and

=0 for individuals who are not CEO's, EMPL is total employees, MKTVAL is the

natural logarithm of the market value of the firm, EPSIN is earnings per share, YEAR

is a dummy variable = 1 for the year 2000 and =0 for year 1999, and ASSETS is the

natural logarithm of the total assets of the company.

a) Complete the table below

Regression

Statistics

Multiple R

R Square

Adjusted R Square

Standard Error

Observations

490

1000

ANOVA

df

SS

MS

Significance F

4.3E-56

Regression

Residual

4975177517 829196252

52.2

15739811503 15850767

Total

Lower 95% Upper 95%

-4382.4

t Stat

P-value

Coefficients Standard Error

634.8

3.45E-18

1.15E-11

3.11E-05

1.18E-16

-5628.1

-8.87

-6873.8

Intercept

CEOANN

EMPL

МKTVAL

EPSIN

2254.2

328.2

1610.0

2898.3

16.3

3.9

4.18

680.8

1093.8

8.43

-3.54

887.3

105.2

49.6

0.00042

-272.7

-78.2

-175.5

0.14

-123.1

876.7

376.8

254.7

YEAR DUM

ASSETS

0.84

0.40

-124.1

311.2

93.5

110.9

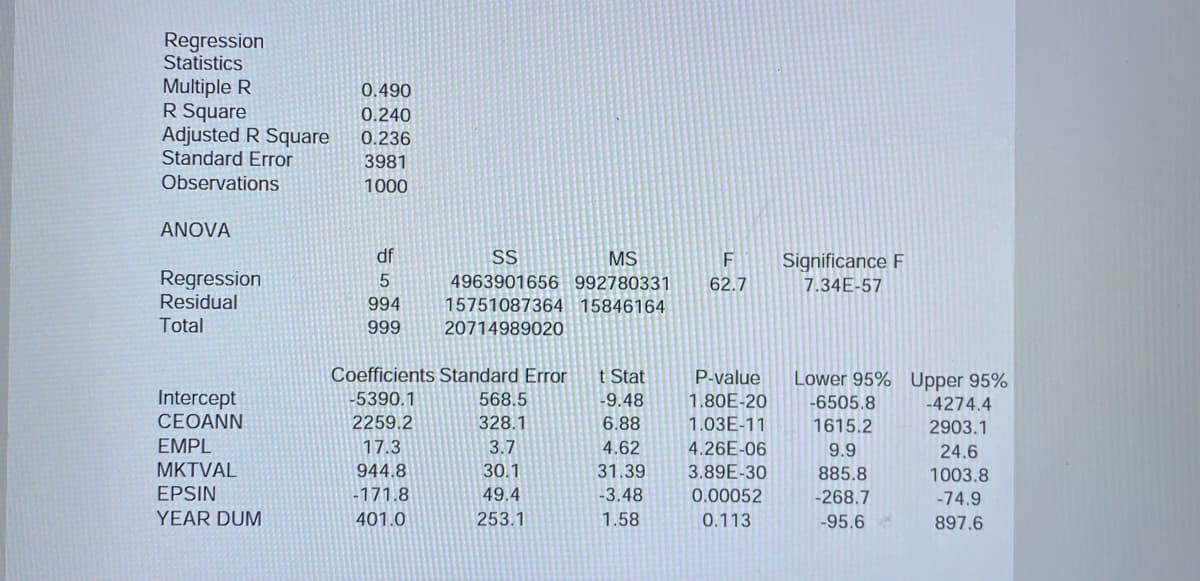

Transcribed Image Text:Regression

Statistics

Multiple R

R Square

Adjusted R Square

Standard Error

Observations

0.490

0.240

0.236

3981

1000

ANOVA

df

SS

MS

Significance F

Regression

Residual

4963901656 992780331

62.7

7.34E-57

994

15751087364 15846164

Total

999

20714989020

Coefficients Standard Error

t Stat

P-value

Lower 95% Upper 95%

Intercept

CEOANN

-5390.1

568.5

-9.48

1.80E-20

-6505.8

-4274.4

2259.2

328.1

6.88

1.03E-11

1615.2

2903.1

EMPL

17.3

3.7

4.62

4.26E-06

9.9

24.6

MKTVAL

944.8

30.1

31.39

3.89E-30

885.8

1003.8

EPSIN

-171.8

49.4

-3.48

0.00052

-268.7

-74.9

YEAR DUM

401.0

253.1

1.58

0.113

-95.6

897.6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning