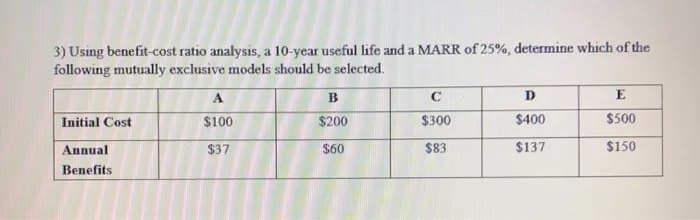

3) Using benefit-cost ratio analysis, a 10-year useful life and a MARR of 25%, determine which of the following mutually exclusive models should be selected. A B C D E Initial Cost $100 $200 $300 $400 $500 Annual $37 $60 $83 $137 $150 Benefits

Q: What kind of monetary policy rule did Milton Friedman advocate? Select one: a. Long-run economic…

A: According to Milton Friedman, the money supply rate should be equal to the real GDP growth rate.

Q: Which of the following are reasons the aggregate demand curve is downward sloping? Chelk all that…

A: Aggregate demand curve shows the total demand for final goods and services in an economy. It can be…

Q: If MLR 1-4 hold, then OLS estimators are correct are unbiased and inconsistent…

A: In regression analysis, if the multiple variables regression (MLR) holds 1-4, then it implies that…

Q: A manufacturer's total cost equation per day is given by the equation TC = 440 + 4q+,00010². If each…

A: Here TC=440+4Q+0.001Q2 Marginal cost=MC=4+0.002Q Price=P=10-0.0004Q

Q: A manufacturing company leases a building for $110,000 per year for its manufacturing facilities. In…

A: A firm's profit remains after all of its expenses have been paid. A corporation's top-line revenue…

Q: Production technology is q = K1/2L. What is the short-run cost function C if K =4, w = 6 and r = 2…

A: We have production function q= k1/2L and K=4

Q: A musical Disc is being produced by a music recording studio, and the company estimates that it will…

A: Answer: Given, Fixed cost (FC)=$100,000Variable cost per unit (VC)=$6.75 per unitPrice of disc…

Q: Finance When a yield curve has a positive slope: Select one: a. long-term yields are higher than…

A: A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but…

Q: Suppose the annual interest rate in Australia is 1.5% and the interest rate in the United States is…

A: Exchange rate is the rate at which one country change their currency in foreign currency , every…

Q: Jake is a full-time worker. Today, he is fired from his job, and he suddenly decides to retire. Due…

A: Here, jr is given that that an lost his job and become unemployed, but at the same time, he decides…

Q: A savings account earns interest at the rate of 6% per year, compounded continuously. How much money…

A: The information being given to us is:- Interest rate of savings account = 6% per year First…

Q: In the July 29, 2001, issue of The Journal News (Hamilton, Ohio), Lynn Elber of the Associated Press…

A: Probability is the extension of mathematics involving numerical definitions of how probable a…

Q: QUESTION 5 Player 2 Left P1: $12 P2: $45 P1: $10 P2:$10 Player 2 Left P1: $22 Player 1 Up P2: $22…

A: Answer (5): Dominant strategy: dominant strategy refers to the strategy always chosen by a player no…

Q: The organization responsible for conducting monetary policy and ensuring that a nation's financial…

A: Monetary policy is the policy of the Monetary Authority of the country that aims to control the…

Q: U = 5x11/2 + 2x2. What is the marginal rate of substitution at (1, 4)? Round your answer to two…

A:

Q: Suppose the demand for shoes is given by: Qp= 210-2P. The supply of shoes is given by Q = 9P-120.…

A: Economic surplus refers to two related quantities: consumer surplus and producer surplus. The…

Q: Costs of production for each competitive firm is given by: C(q) = 1 + q2. Market demand is Qd =…

A: In a perfectly competitive market, there are large number of firms producing similar and identical…

Q: T S A 3,1 5,6 B 2,5 3,4 C 4,2 6,3 Consider the following repeated game. The simultaneous move game…

A: Given pay off matrix Player 1 has 3 strategy : {A,B,C} Player 2 has 2 strategy :{ T,S)

Q: demonstrate and explain how costs concepts help in managing production between the shortrun and…

A: When businesses change output levels over time in response to anticipated economic gains or losses,…

Q: Suppose that the market for black sweaters is a competitive market. The following graph shows the…

A: Profit maximization occurs at the point where the marginal revenue and marginal cost are equal.…

Q: Describe three steps of Dynamics of Financial Crises in Emerging Market Economies.

A:

Q: 1) The principle that "More is better" results in indifference curves A) not intersecting. B)…

A: An indifference curve shows a blend of two merchandise that give a buyer equivalent fulfillment and…

Q: Suppose that the income tax in a certain nation is computed as a flat rate of 5 percent, but no tax…

A: The amount of a person's income or total amount of money that must be paid in taxes is referred to…

Q: 6) Which of the following transactions represents debit on the current account section of the US's…

A: Introduction The balance of payment is considered a country statement that includes all the…

Q: Debit/credit card are considered to be Question 12 options: Line of credit M1 money…

A: Debit cards allow you to spend money by drawing on funds you have deposited at the bank. Credit…

Q: You must write down all steps in your working. 1. In 2010, M1 was $1,832.2 billion, M2 was $8,816.4…

A:

Q: Please explain why customer research should be done. Give at least two examples for different types…

A: Customers are the people who buy the goods and services of the business. It is very important to…

Q: Suppose that you are given the following production function: Q=100K0.6L0.4 etermine the marginal…

A:

Q: To facilitate balanced growth of trade and to contribute, thereby to the promotion and maintain high…

A: The International Monetary Fund is an organisation of 190 countries that works to foster global…

Q: A car rental agency is considering a modification in its oil change procedure. Currently, it uses a…

A: Following is the given values: Cost of type X filter = $4.75Filter changed every = 9000 miles Number…

Q: Revenue and cost (dollars per unit) $20 11 10 6 d MC ATC AVC b 0 200 250 300 At the profit…

A: Here, the given graph shows the the revenue and cost curves of a firm to explain the market…

Q: urrent income tax rate. non-IRA account has to pay income taxes on the funds deposited and on inte s…

A: *Answer: Given, Bonus amount, P=$10,000 Interest rate, r=10% Tax bracket, t=30% Number of years,…

Q: MEASURING OUTPUT AND INCOME This question examines the expenditures approach to calculating GDP. You…

A: (1). Value of consumption calculation: Consumption=Durable Goods + Nondurable Goods +…

Q: 1. The following prices and quantities produced were recorded in computer land during the years…

A: Nominal GDP = Price of Mousepads * Quantity of Mousepads + Price of Maps * Quantity of Maps + Price…

Q: al Saving of dollars) 55 50 45 40 Domestic Investment (Billions of dollars) 30 40 50 60 70 Net…

A: Below table represents the computation of investment + net capital outflow Real interest rate…

Q: While the term short straddle is removed from insurance company, insurer is in the position similar…

A: Introduction Short straddle is an option strategy consisting of selling both call and put options at…

Q: Import tariff on a manufactured product in a country Y equals 15 % while tariff on imported raw…

A: Introduction The effective rate of protection (ERP) is the rate of absolute impact of the entire…

Q: If a society allocates resources so that it produces eficiently, then it is producing at a point A…

A: The answer is - A. On its production possibility frontier that is most desirable.

Q: U= 5x1 1/2 + 2x2. What is the marginal rate of substitution at (1, 4)? Round your answer to two…

A: Answer: Note: we are not allowed to provide handwritten solutions. Given, Utility function:…

Q: According to your graph, the equilibrium value of money is therefore the equilibrium price level is…

A: The measure that depicts the total amount of money that the population of an economy is willing to…

Q: In the writings of Karl Marx, the bourgeoisie referred to the proletariat referred to the…

A: Karl Marx view on bourgeoisie the people of capitalist society who own and control the means of…

Q: Economics

A: Amartya Sen has been known as the Mother Teresa of Economics for his work on starvation, human turn…

Q: Identify the segment that represents the corresponding letter) Ű A D Firms B C payment for factors…

A: An economic system that depicts the movement of money through into the economy is the circular flow…

Q: The table below provides the total variable cost for a firm. Quantity of Output Total Variable Cost…

A: Average total cost is the summation of average fixed cost and average variable cost. The average…

Q: Firm A High Price Low Price A = $250 A $325 B = $250 B = $200 A = $200 A $175 B = $325 B = $175…

A: Game theory is concerned with the choice of an optimal strategy in conflict situations.

Q: Suppose the economy begins with output equal to its natural level. Then, there is a reduction in…

A: The equilibrium level of income in the economy is determined by the intersection of the aggregate…

Q: Conduct the Five forces analysis for the company "Under Armour".

A: The Porter's Five Forces Model has been a useful tool for prospective investors to examine the…

Q: According to the substitution effect of labor supply, when the wage rate goes up: O A. the…

A: Rather than the industry labor supply curve, the substitution effect is applicable to the individual…

Q: The following function relates price to quantity demanded: price = 100 - 3q And note that when price…

A: Price elasticity of demand is a measurement of how a product's demand changes in response to price…

Q: How does the ability to discriminate correctly affect his or her earnings?

A: The law of supply and demand governs how much a product costs. In a perfect or free market,…

Urgently needed....

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Engineering economy - ENGR 3322 A new municipal refuse-collection truck can be purchased for $84,000. Its expected useful life is six years, at which time its market value will be zero. Annual receipts less expenses will be approximately $18,000 per year over the six-year study period. At MARR of 19%, calculate the benefit-cost ratio of the project a. 53 b. 63 c. 73 d. None of the choicesCalculate the conventional benefit-cost ratio for the alternative: Initial Investment 250000 Revenues 80000 Costs 22000 Salvage Value 50000 Useful life 9 MARR 0.1.Determine the present worth, future worth, and annual worth of the following engineering project when the MARR is 15% per year. Is the project acceptable? Investment cost $10,000Expected life 5 yearsMarket (salvage) value $1,000Annual receipts $8,000Annual expenses $4,000

- The Logan Well Services Group is considering two sites for storage and recovery of reclaimed water. The mountain site (MS) will use injection wells that cost $4.2 million to develop and $280,000 per year for M&O. This site will be able to accommodate 150 million gallons per year. The valley site (VS) will involve recharge basins that cost $11 million to construct and $400,000 per year to operate and maintain. At this site, 720 million gallons can be injected each year. If the value of the injected water is $3.00 per thousand gallons, which alternative, if either, should be selected according to the B/C ratio method? Use an interest rate of 8% per year and a 20-year study period. The B/C ratio is . Select alternative (Click to select) neither of the alternatives mountain site valley site .Which one of the following descriptions is correct according to this extensive form? (I think it's 3rd option but unsure)USE PRESENT WORTH. Show complete solution and cash flow diagram There is a continuing requirement for stand by electrical power at a public utilityservice facility. Alternative A involves an initial cost of $72,000, a 3-year useful life.and an annual cost of $2,200 the first year and increasing $300 per year thereafterand a net salvage value of $8,400 at the end of the useful life. Alternative B has aninitial cost of $90,000. a six-year useful life, and annual cost of 2,100 and a netsalvage value of $13,000. The current interest rate is 10% annually. Whatalternative are you going to recommend if you use the repeatability (studyperiod is 6 years) and co terminated (study period is 3 years, epsilon = 10%) assumptions?

- Solve the Engineering Economics Problem: Project Feasibility Indicator Which alternative should be selected based on BCR? Assume i=7% and a study period of 10 years. Sensor A: First cost: Php 87,000 Annual M&O: Php 64,000 Annual Benefits: Php 160,000 Annual Disbenefits: --- Sensor B First cost: Php 38,000 Annual M&O: Php 49,000 Annual Benefits: Php 110,000 Annual Disbenefits: Php 26,000Which statement is not true with respect to estimating the economic impacts of proposed engineering projects? (a) Order-of-magnitude estimates are used for high-level planning. (b) Order-of-magnitude estimates are the most accurate type at about –3 to 5%. (c) Increasing the accuracy of estimates requires added time and resources. (d) Estimators tend to underestimate the magnitude of costs and to overestimate benefits.Which among these pairs would provide a good market feasibility judgment on a given project?a. Benefit-Cost Ratio method and breakeven pointb. External Rate of Return method and Internal Rate of Return methodc. Benefit-Cost Ratio method and payback periodd. Minimum Attractive Rate of Return and Present Worth method

- A dyeing and finishing plant is interested in acquiring a dyeing machine for the production of a new product. Three alternatives are being considered assummarized below. Which alternative should be recommended if the plant’sMARR (hurdle rate) is 15% per year using (a) the IRR method and (b) the annual worth method?■Consider the following four mutually exclusive alternatives, each with a 10-yr life. X Y Z $4,000 $1,500 $750 710 300 167.5 Cost If the MARR is 10%, which alternative should be selected? Solve the problem by using: Uniform annual benefit a) The payback period b) Benefit-cost ratio analysisA one-mile section of a roadway in Florida has been washed out by heavy rainfall. The county is considering two options for rebuilding the road. Pertinent data are presented below. If the county's MARR for this type of project is 9% per year, which replacement option should be chosen? Assume repeatability. 1) The equivalent uniform annual cost for the asphalt option is $ ? 2) The equivalent uniform annual cost for the concrete option is $ ? 3) Select the ? option.