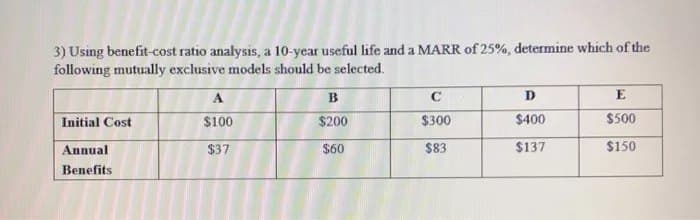

3) Using benefit-cost ratio analysis, a 10-year useful life and a MARR of 25%, determine which of the following mutually exclusive models should be selected. Initial Cost Annual Benefits A $100 $37 B $200 $60 C $300 $83 D $400 $137 E $500 $150

3) Using benefit-cost ratio analysis, a 10-year useful life and a MARR of 25%, determine which of the following mutually exclusive models should be selected. Initial Cost Annual Benefits A $100 $37 B $200 $60 C $300 $83 D $400 $137 E $500 $150

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

Determine which model is to selected.... Without plagiarism

Transcribed Image Text:3) Using benefit-cost ratio analysis, a 10-year useful life and a MARR of 25%, determine which of the

following mutually exclusive models should be selected.

Initial Cost

Annual

Benefits

A

$100

$37

B

$200

$60

C

$300

$83

D

$400

$137

E

$500

$150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning