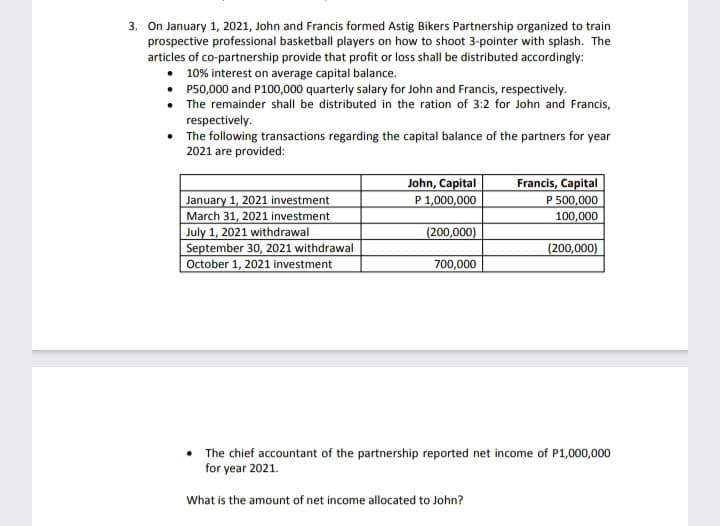

3. On January 1, 2021, John and Francis formed Astig Bikers Partnership organized to train prospective professional basketball players on how to shoot 3-pointer with splash. The articles of co-partnership provide that profit or loss shall be distributed accordingly: • 10% interest on average capital balance. • P50,000 and P100,000 quarterly salary for John and Francis, respectively. • The remainder shall be distributed in the ration of 3:2 for John and Francis, respectively. • The following transactions regarding the capital balance of the partners for year 2021 are provided: John, Capital Francis, Capital P 500,000 100,000 January 1, 2021 investment March 31, 2021 investment July 1, 2021 withdrawal September 30, 2021 withdrawal October 1, 2021 investment P1,000,000 (200,000) (200,000) 700,000 The chief accountant of the partnership reported net income of P1,000,000 for year 2021. What is the amount of net income allocated to John?

3. On January 1, 2021, John and Francis formed Astig Bikers Partnership organized to train prospective professional basketball players on how to shoot 3-pointer with splash. The articles of co-partnership provide that profit or loss shall be distributed accordingly: • 10% interest on average capital balance. • P50,000 and P100,000 quarterly salary for John and Francis, respectively. • The remainder shall be distributed in the ration of 3:2 for John and Francis, respectively. • The following transactions regarding the capital balance of the partners for year 2021 are provided: John, Capital Francis, Capital P 500,000 100,000 January 1, 2021 investment March 31, 2021 investment July 1, 2021 withdrawal September 30, 2021 withdrawal October 1, 2021 investment P1,000,000 (200,000) (200,000) 700,000 The chief accountant of the partnership reported net income of P1,000,000 for year 2021. What is the amount of net income allocated to John?

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:3. On January 1, 2021, John and Francis formed Astig Bikers Partnership organized to train

prospective professional basketball players on how to shoot 3-pointer with splash. The

articles of co-partnership provide that profit or loss shall be distributed accordingly:

• 10% interest on average capital balance.

• P50,000 and P100,000 quarterly salary for John and Francis, respectively.

• The remainder shall be distributed in the ration of 3:2 for John and Francis,

respectively.

• The following transactions regarding the capital balance of the partners for year

2021 are provided:

John, Capital

P1,000,000

Francis, Capital

P 500,000

100,000

January 1, 2021 investment

March 31, 2021 investment

July 1, 2021 withdrawal

September 30, 2021 withdrawal

October 1, 2021 investment

(200,000)

(200,000)

700,000

The chief accountant of the partnership reported net income of P1,000,000

for year 2021.

What is the amount of net income allocated to John?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you