3. On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of $225,000 and a fair value of $208,000. What would the company report on the income statement (account and amount) regarding the patent on January 1, 2022?

3. On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of $225,000 and a fair value of $208,000. What would the company report on the income statement (account and amount) regarding the patent on January 1, 2022?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8P: Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of...

Related questions

Question

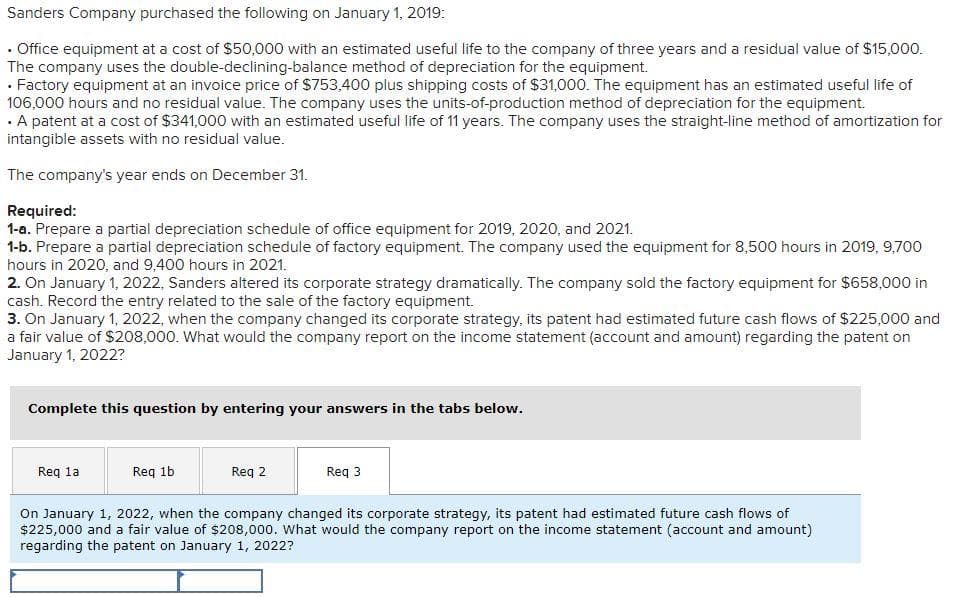

Transcribed Image Text:Sanders Company purchased the following on January 1, 2019:

• Office equipment at a cost of $50,000 with an estimated useful life to the company of three years and a residual value of $15,000.

The company uses the double-declining-balance method of depreciation for the equipment.

· Factory equipment at an invoice price of $753,400 plus shipping costs of $31,000. The equipment has an estimated useful life of

106,000 hours and no residual value. The company uses the units-of-production method of depreciation for the equipment.

· A patent at a cost of $341,000 with an estimated useful life of 11 years. The company uses the straight-line method of amortization for

intangible assets with no residual value.

The company's year ends on December 31.

Required:

1-a. Prepare a partial depreciation schedule of office equipment for 2019, 2020, and 2021.

1-b. Prepare a partial depreciation schedule of factory equipment. The company used the equipment for 8,500 hours in 2019, 9,700

hours in 2020, and 9,400 hours in 2021.

2. On January 1, 2022, Sanders altered its corporate strategy dramatically. The company sold the factory equipment for $658,000 in

cash. Record the entry related to the sale of the factory equipment.

3. On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of $225,000 and

a fair value of $208,000. What would the company report on the income statement (account and amount) regarding the patent on

January 1, 2022?

Complete this question by entering your answers in the tabs below.

Req la

Reg 1b

Reg 2

Req 3

On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of

$225,000 and a fair value of $208,000. What would the company report on the income statement (account and amount)

regarding the patent on January 1, 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning