Illustration 2. Business Combination Achieved in Stages and without transfer of consideration On January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL). Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows: a. The previously held interest of Tatay are currently quoted at 20% higher than its book value. b. The assets and liabilities of Walanay are all equivalent to their market values. c. Tatay elected to measure NCI at ‘proportionate share’. Case 2: the Investment Held for Trading Securities account in the book of Tatay (acquired in 2020) represents 30% ownership interest in Walanay, Inc. Walanay subsequently reacquires 50% of its outstanding shares from other investors. The previously held equity of Tatay have a fair value of three times its book value now. Tatay elected to measure NCI at ‘proportionate share’. With the stated facts, answer the following: 10.How much is the Consideration Transferred? a. P 1,350,000.00 b. P 1,900,000.00 c. P 1,750,000.00 d. P 1,800,000.00 11.How much is the Non-Controlling Interest in the acquiree? a. P 0.00 b. P 150,000.00 c. P 684,000.00 d. P 1,200,000.00 12.How much is the Fair Value of the previously held equity interest in the acquiree? a. P 0.00

Illustration 2. Business Combination Achieved in Stages and without transfer of consideration

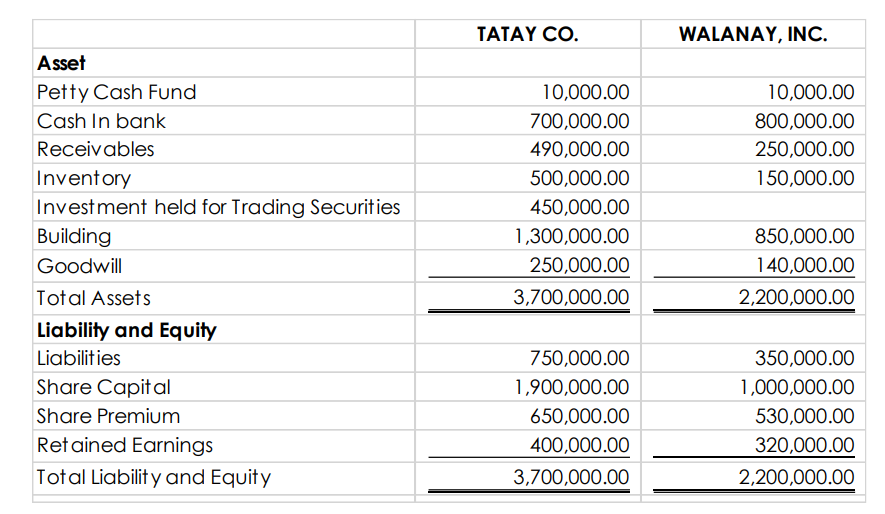

On January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values

of the assets, liabilities and equity of Tatay and Walanay before the business combination are

as follows:

Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc.

for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL).

Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an

additional 10% ownership interest in Walanay, Inc. The following relevant Information follows:

a. The previously held interest of Tatay are currently quoted at 20% higher than its book

value.

b. The assets and liabilities of Walanay are all equivalent to their market values.

c. Tatay elected to measure NCI at ‘proportionate share’.

Case 2: the Investment Held for Trading Securities account in the book of Tatay (acquired in

2020) represents 30% ownership interest in Walanay, Inc. Walanay subsequently reacquires

50% of its outstanding shares from other investors. The previously held equity of Tatay have a

fair value of three times its book value now. Tatay elected to measure NCI at ‘proportionate

share’.

With the stated facts, answer the following:

10.How much is the Consideration Transferred?

a. P 1,350,000.00

b. P 1,900,000.00

c. P 1,750,000.00

d. P 1,800,000.00

11.How much is the Non-Controlling Interest in the acquiree?

a. P 0.00

b. P 150,000.00

c. P 684,000.00

d. P 1,200,000.00

12.How much is the Fair Value of the previously held equity interest in the acquiree?

a. P 0.00

b. P 540,000.00

c. P 450,000.00

d. P 500,000.00

Step by step

Solved in 4 steps