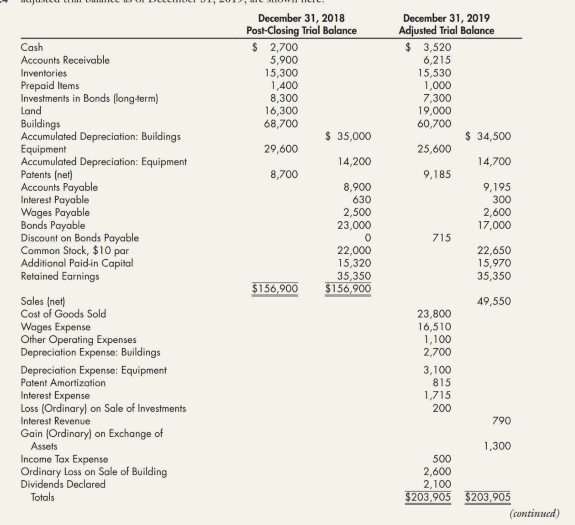

December 31, 2018 Post-Closing Trial Balance $ 2,700 5,900 December 31, 2019 Adjusted Trial Balance $ 3,520 6,215 15,530 1,000 7,300 19,000 60,700 Cash Accounts Receivable Inventories Prepaid Items Investments in Bonds (long-term) Land 15,300 1,400 8,300 16,300 68,700 Buildings Accumulated Depreciation: Buildings Equipment Accumulated Depreciation: Equipment Patents (net) Accounts Payable Interest Payable Wages Payable Bonds Payable Discount on Bonds Payable Common Stock, $10 par Additional Paidin Capital Retained Earnings $ 35,000 $ 34,500 29,600 25,600 14,200 14,700 8,700 9,185 8,900 630 9,195 300 2,600 17,000 2,500 23,000 715 22,000 15,320 35,350 $156,900 22,650 15,970 35,350 $156,900 Sales (net) Cost of Goods Sold Wages Expense Other Operating Expenses Depreciation Expense: Buildings 49,550 23,800 16,510 1,100 2,700 Depreciation Expense: Equipment Patent Amortization Interest Expense Loss (Ordinary) on Sale of Investments 3,100 815 1,715 200 Interest Revenue 790 Gain (Ordinary) on Exchange of Assets 1,300 Income Tax Expense Ordinary Loss on Sale of Building Dividends Declared 500 2,600 2,100 $203,905 $203,905 Totals (continued)

Heinz Company’s post-closing

A review of the accounting records reveals the following additional information:

a. Bonds payable with a face value, book value, and market value of $14,000 were retired On June 30, 2019. b. Bonds payable with a face value of $8,000 were issued at 90.25 On August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount. c. The company sold a building that had an original cost of $8,000 and a book value of $4,800. The company received $2,200 in cash for the building and recorded a loss of $2,600. d. Equipment with a cost of $4,000 and a book value of $1,400 was exchanged for an acre of land valued at $2,700. No cash was exchanged. e. Long-term investments in bonds being held to maturity with a cost of $1,000 were sold for $800. f. Sixty-five shares of common stock( were exchanged for a patent. The common stock was selling for $20 per share at the time of the exchange.

Prepare a spreadsheet to support a statement of cash flows for 2019.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps