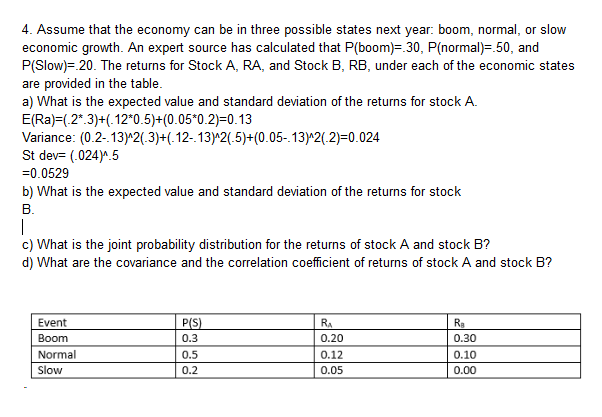

4. Assume that the economy can be in three possible states next year: boom, normal, or slow economic growth. An expert source has calculated that P(boom)F.30, P(normal).50, and P(Slow 20. The returns for Stock A, RA, and Stock B, RB, under each of the economic states are provided in the table a) What is the expected value and standard deviation of the returns for stock A. E(Ra) (2*.3)(12*0.5)+(0.05*0.2)F0.13 Variance: (0.2-132(.3)+(12-.132(5)+(0.05-.132(.2)-0.024 St dev- (.024)A.5 0.0529 b) What is the expected value and standard deviation of the returns for stock c) What is the joint probability distribution for the returns of stock A and stock B? d) What are the covariance and the correlation coefficient of returns of stock A and stock B? Event Boom Normal Slow 0.3 0.5 0.2 0.20 0.12 0.05 0.30 0.10 0.00

4. Assume that the economy can be in three possible states next year: boom, normal, or slow economic growth. An expert source has calculated that P(boom)F.30, P(normal).50, and P(Slow 20. The returns for Stock A, RA, and Stock B, RB, under each of the economic states are provided in the table a) What is the expected value and standard deviation of the returns for stock A. E(Ra) (2*.3)(12*0.5)+(0.05*0.2)F0.13 Variance: (0.2-132(.3)+(12-.132(5)+(0.05-.132(.2)-0.024 St dev- (.024)A.5 0.0529 b) What is the expected value and standard deviation of the returns for stock c) What is the joint probability distribution for the returns of stock A and stock B? d) What are the covariance and the correlation coefficient of returns of stock A and stock B? Event Boom Normal Slow 0.3 0.5 0.2 0.20 0.12 0.05 0.30 0.10 0.00

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter10: Sequences, Series, And Probability

Section10.8: Probability

Problem 29E

Related questions

Question

Part D

Transcribed Image Text:4. Assume that the economy can be in three possible states next year: boom, normal, or slow

economic growth. An expert source has calculated that P(boom)F.30, P(normal).50, and

P(Slow 20. The returns for Stock A, RA, and Stock B, RB, under each of the economic states

are provided in the table

a) What is the expected value and standard deviation of the returns for stock A.

E(Ra) (2*.3)(12*0.5)+(0.05*0.2)F0.13

Variance: (0.2-132(.3)+(12-.132(5)+(0.05-.132(.2)-0.024

St dev- (.024)A.5

0.0529

b) What is the expected value and standard deviation of the returns for stock

c) What is the joint probability distribution for the returns of stock A and stock B?

d) What are the covariance and the correlation coefficient of returns of stock A and stock B?

Event

Boom

Normal

Slow

0.3

0.5

0.2

0.20

0.12

0.05

0.30

0.10

0.00

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning