4. Assuming a discount rate of 6%, what is the net present value if Brisbane replaces its current system? Submit Answer

4. Assuming a discount rate of 6%, what is the net present value if Brisbane replaces its current system? Submit Answer

Essentials Of Business Analytics

1st Edition

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Camm, Jeff.

Chapter11: Monte Carlo Simulation

Section: Chapter Questions

Problem 3P

Related questions

Question

just need help with the last part

part 4

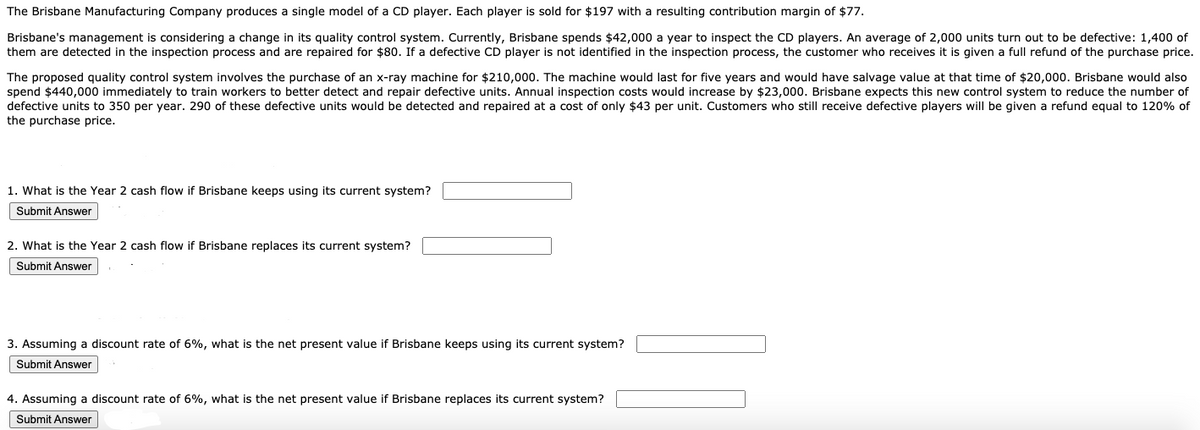

Transcribed Image Text:The Brisbane Manufacturing Company produces a single model of a CD player. Each player is sold for $197 with a resulting contribution margin of $77.

Brisbane's management is considering a change in its quality control system. Currently, Brisbane spends $42,000 a year to inspect the CD players. An average of 2,000 units turn out to be defective: 1,400 of

them are detected in the inspection process and are repaired for $80. If a defective CD player is not identified in the inspection process, the customer who receives it is given a full refund of the purchase price.

The proposed quality control system involves the purchase of an x-ray machine for $210,000. The machine would last for five years and would have salvage value at that time of $20,000. Brisbane would also

spend $440,000 immediately to train workers to better detect and repair defective units. Annual inspection costs would increase by $23,000. Brisbane expects this new control system to reduce the number of

defective units to 350 per year. 290 of these defective units would be detected and repaired at a cost of only $43 per unit. Customers who still receive defective players will be given a refund equal to 120% of

the purchase price.

1. What is the Year 2 cash flow if Brisbane keeps using its current system?

Submit Answer

2. What is the Year 2 cash flow if Brisbane replaces its current system?

Submit Answer

3. Assuming a discount rate of 6%, what is the net present value if Brisbane keeps using its current system?

Submit Answer

4. Assuming a discount rate of 6%, what is the net present value if Brisbane replaces its current system?

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College