4. Based on the following information Calculate Rate of Return if State Occurs Stock B State of Economy Probability of State of Economy Stock A Recession 0.20 0.05 -0.17 Normal 0.55 0.08 0.12 Вoom 0.25 0.13 0.29

4. Based on the following information Calculate Rate of Return if State Occurs Stock B State of Economy Probability of State of Economy Stock A Recession 0.20 0.05 -0.17 Normal 0.55 0.08 0.12 Вoom 0.25 0.13 0.29

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

Transcribed Image Text:Fnan301FinalExamFall2021 - Microsoft Word

File

Home

Insert

Page Layout

References

Mailings

Review

View

ది

第Find ▼

AA

Cut

Calibri (Body) - 11

Aa

三,三, 章 T

AaBbCcDc AaBbCcDc AaBbC AaBbCc AABI AaBbCcl AaBbCcD

E Copy

a Replace

Paste

в г

U - abe x, x'

I Normal

1 No Spaci...

Change

Styles

VFormat Painter

Heading 1

Heading 2

Title

Subtitle

Subtle Em...

A Select -

Clipboard

Font

Paragraph

Styles

Editing

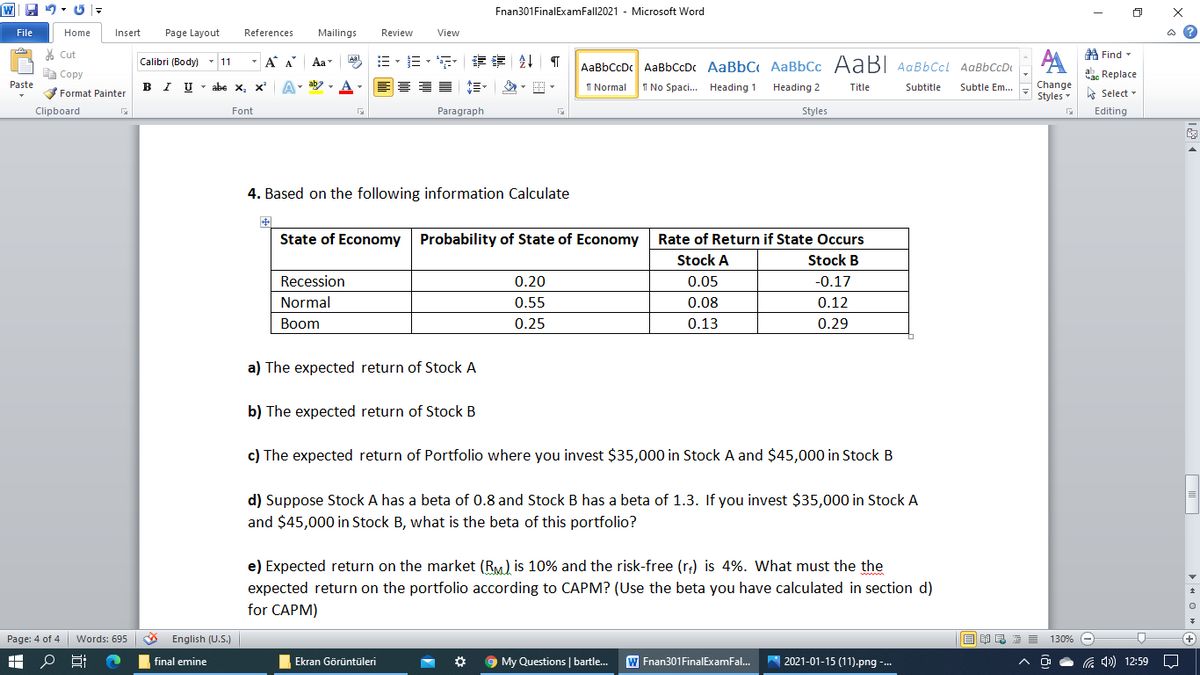

4. Based on the following information Calculate

State of Economy

Probability of State of Economy

Rate of Return if State Occurs

Stock A

Stock B

Recession

0.20

0.05

-0.17

Normal

0.55

0.08

0.12

Вoom

0.25

0.13

0.29

a) The expected return of Stock A

b) The expected return of Stock B

c) The expected return of Portfolio where you invest $35,000 in Stock A and $45,000 in Stock B

d) Suppose Stock A has a beta of 0.8 and Stock B has a beta of 1.3. If you invest $35,000 in Stock A

and $45,000 in Stock B, what is the beta of this portfolio?

e) Expected return on the market (RM) is 10% and the risk-free (r;) is 4%. What must the the

expected return on the portfolio according to CAPM? (Use the beta you have calculated in section d)

for CAPM)

Page: 4 of 4 Words: 695

English (U.S.)

130% -

final emine

Ekran Görüntüleri

9 My Questions | bartle...

W Fnan301FinalExamFal.

A 2021-01-15 (11).png -.

a 4)) 12:59

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you