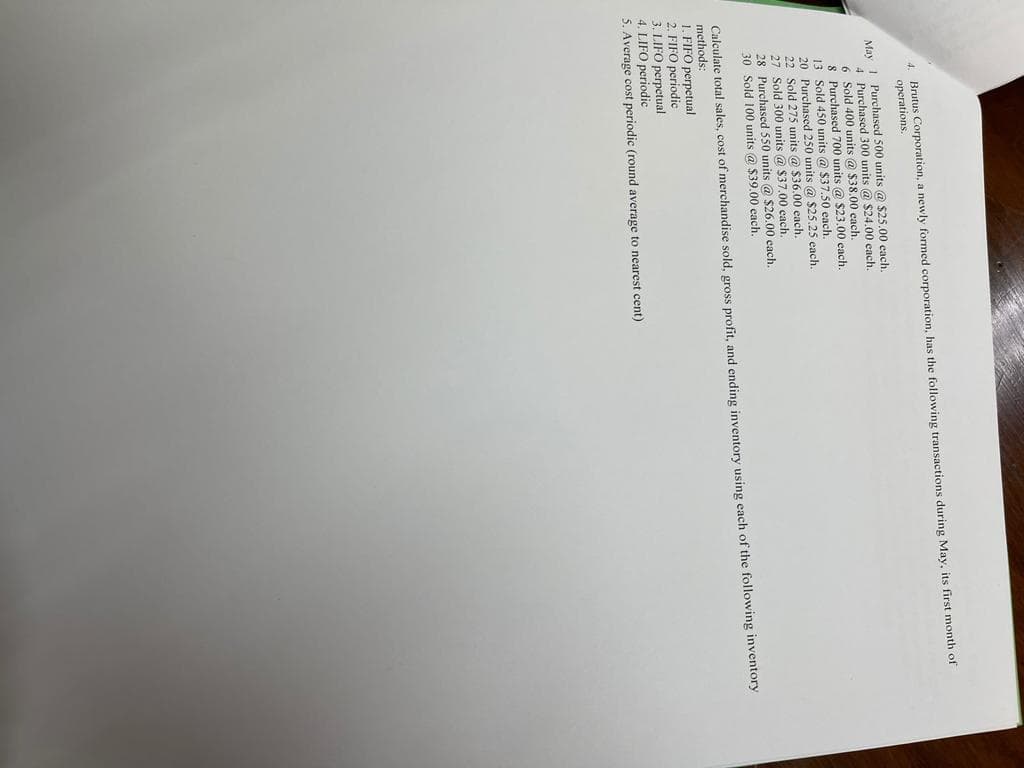

4. Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations. May 1 Purchased 500 units @ $25.00 cach. 4 Purchased 300 units @ $24.00 each. 6 Sold 400 units @ $38.00 each. 8 Purchased 700 units @ $23.00 cach. 13 Sold 450 units @ $37.50 each. 20 Purchased 250 units @ $25.25 each. 22 Sold 275 units @ $36.00 each. 27 Sold 300 units @ $37.00 cach. 28 Purchased 550 units @ $26.00 cach. 30 Sold 100 units @ $39.00 cach. Calculate total sales, cost of merchandise sold, gross profit, and ending inventory using each of the following inventory methods: 1. FIFO perpetual 2. FIFO periodic 3. LIFO perpetual 4. LIFO periodic 5. Average cost periodic (round average to nearest cent)

4. Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations. May 1 Purchased 500 units @ $25.00 cach. 4 Purchased 300 units @ $24.00 each. 6 Sold 400 units @ $38.00 each. 8 Purchased 700 units @ $23.00 cach. 13 Sold 450 units @ $37.50 each. 20 Purchased 250 units @ $25.25 each. 22 Sold 275 units @ $36.00 each. 27 Sold 300 units @ $37.00 cach. 28 Purchased 550 units @ $26.00 cach. 30 Sold 100 units @ $39.00 cach. Calculate total sales, cost of merchandise sold, gross profit, and ending inventory using each of the following inventory methods: 1. FIFO perpetual 2. FIFO periodic 3. LIFO perpetual 4. LIFO periodic 5. Average cost periodic (round average to nearest cent)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 3RE: Shaquille Corporation began the current year with inventory of 50,000. During the year, its...

Related questions

Question

Transcribed Image Text:4. Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of

operations.

May 1 Purchased 500 units @ $25.00 cach.

4 Purchased 300 units @ S24.00 each.

6 Sold 400 units @ $38.00 each

8 Purchased 700 units @ $23.00 each.

13 Sold 450 units @ $37.50 each.

20 Purchased 250 units @ $25.25 each.

22 Sold 275 units @ $36.00 each.

27 Sold 300 units @ $37.00 cach.

28 Purchased 550 units @ $26.00 each.

30 Sold 100 units @ $39.00 each.

Calculate total sales, cost of merchandise sold, gross profit, and ending inventory using each of the following inventory

methods:

1. FIFO perpetual

2. FIFO periodic

3. LIFO perpetual

4. LIFO periodic

5. Average cost periodic (round average to nearest cent)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning