The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations. January 20 April 21 July 25 September 19 Purchased 400 units es 8 Purchased 20e units e s1e Purchased 28e units e $13 Purchased 9e units e $15 $3, 200 2,e00 3,640 1,350 During the year, The Shirt Shop sold 810 T-shirts for $20 each.

The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations. January 20 April 21 July 25 September 19 Purchased 400 units es 8 Purchased 20e units e s1e Purchased 28e units e $13 Purchased 9e units e $15 $3, 200 2,e00 3,640 1,350 During the year, The Shirt Shop sold 810 T-shirts for $20 each.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 1MP

Related questions

Question

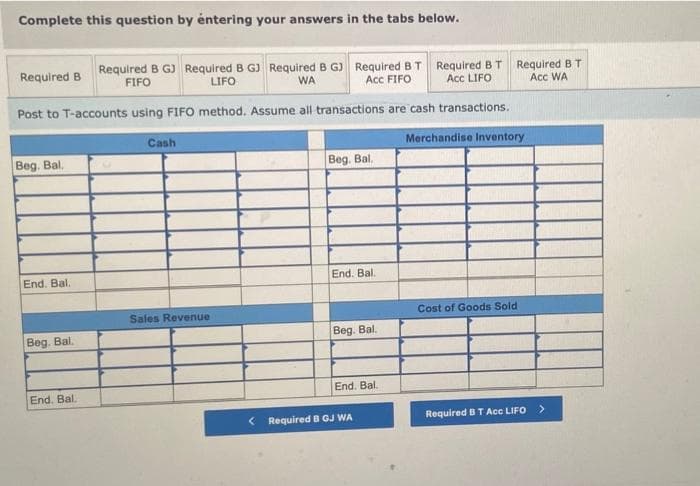

Transcribed Image Text:Complete this question by éntering your answers in the tabs below.

Required B GJ Required B GJ Required B G) Required BT Required BT Required BT

FIFO

Required B

LIFO

WA

Acc FIFO

Acc LIFO

Acc WA

Post to T-accounts using FIFO method. Assume all transactions are cash transactions.

Cash

Merchandise Inventory

Beg. Bal.

Beg. Bal.

End. Bal.

End. Bal.

Sales Revenue

Cost of Goods Sold

Beg. Bal.

Beg. Bal.

End. Bal.

End. Bal.

Required B GJ WA

Required BTACC LIFO >

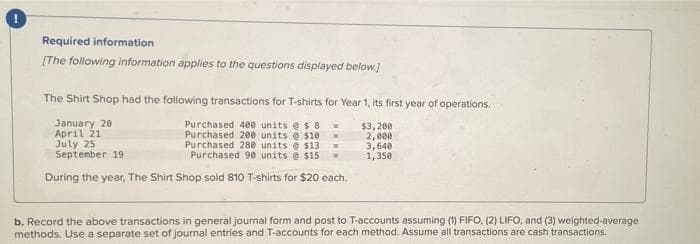

Transcribed Image Text:Required information

(The following information applies to the questions displayed below.)

The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations.

January 20

April 21

July 25

September 19

Purchased 4800 units es 8

Purchased 200 units e $10

Purchased 280 units @ $13

Purchased 90 units @ $15

$3, 200

2, e00

3,640

1,350

During the year, The Shirt Shop sold 810 T-shirts for $20 each.

b. Record the above transactions in general journal form and post to T-accounts assuming (1) FIFO, (2) LIFO, and (3) weighted-average

methods. Use a separate set of journal entries and T-accounts for each method. Assume all transactions are cash transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning