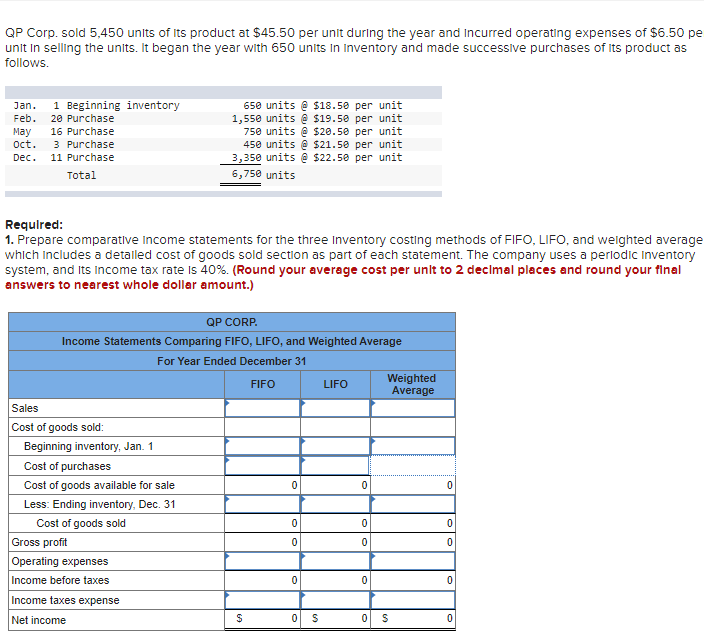

QP Corp. sold 5,450 units of Its product at $45.50 per unit during the year and incurred operating expenses of $6.50 pe unit in selling the units. It began the year with 650 units in inventory and made successive purchases of Its product as follows. 1 Beginning inventory 650 units e s18.50 per unit 1,550 units e s19.50 per unit 750 units e s20.50 per unit 450 units e $21.50 per unit 3,350 units e s22.50 per unit Jan. Feb. 20 Purchase 16 Purchase Мay oct. 3 Purchase 11 Purchase Dec. Total 6,750 units Required: 1. Prepare comparative income statements for the three inventory costing methods of FIFO, LIFO, and weighted average which Includes a detalled cost of goods sold section as part of each statement. The company uses a periodic Inventory system, and Its income tax rate Is 40%. (Round your average cost per unit to 2 decimal places and round your final answers to nearest whole dollar amount.)

QP Corp. sold 5,450 units of Its product at $45.50 per unit during the year and incurred operating expenses of $6.50 pe unit in selling the units. It began the year with 650 units in inventory and made successive purchases of Its product as follows. 1 Beginning inventory 650 units e s18.50 per unit 1,550 units e s19.50 per unit 750 units e s20.50 per unit 450 units e $21.50 per unit 3,350 units e s22.50 per unit Jan. Feb. 20 Purchase 16 Purchase Мay oct. 3 Purchase 11 Purchase Dec. Total 6,750 units Required: 1. Prepare comparative income statements for the three inventory costing methods of FIFO, LIFO, and weighted average which Includes a detalled cost of goods sold section as part of each statement. The company uses a periodic Inventory system, and Its income tax rate Is 40%. (Round your average cost per unit to 2 decimal places and round your final answers to nearest whole dollar amount.)

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 1MP

Related questions

Question

Transcribed Image Text:QP Corp. sold 5,450 units of Its product at $45.50 per unit during the year and Incurred operating expenses of $6.50 pe

unit In selling the units. It began the year with 650 units In Inventory and made successive purchases of Its product as

follows.

1 Beginning inventory

20 Purchase

650 units @ $18.50 per unit

1,550 units @ $19.50 per unit

750 units e $20.50 per unit

450 units e $21.50 per unit

3,350 units @ $22.50 per unit

Jan.

Feb.

16 Purchase

May

oct.

3 Purchase

11 Purchase

Dec.

Total

6,750 units

Required:

1. Prepare comparative Income statements for the three Inventory costing methods of FIFO, LIFO, and weighted average

which includes a detailed cost of goods sold section as part of each statement. The company uses a perlodic inventory

system, and Its Income tax rate is 40%. (Round your average cost per unlt to 2 declmal places and round your final

answers to nearest whole dollar amount.)

QP CORP.

Income Statements Comparing FIFO, LIFO, and Weighted Average

For Year Ended December 31

Weighted

Average

FIFO

LIFO

Sales

Cost of goods sold:

Beginning inventory, Jan. 1

Cost of purchases

Cost of goods available for sale

Less: Ending inventory, Dec. 31

Cost of goods sold

Gross profit

Operating expenses

Income before taxes

Income taxes expense

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning