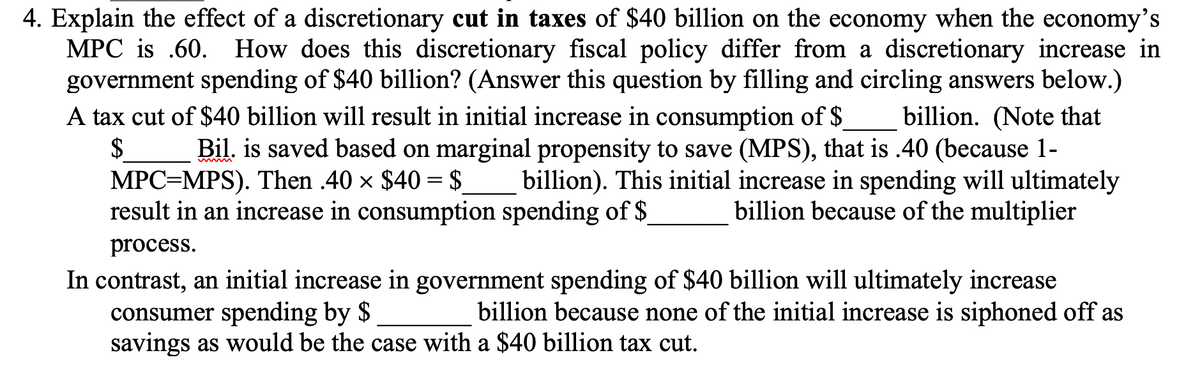

4. Explain the effect of a discretionary cut in taxes of $40 billion on the economy when the economy's MPC is .60. How does this discretionary fiscal policy differ from a discretionary increase in government spending of $40 billion? (Answer this question by filling and circling answers below.) A tax cut of $40 billion will result in initial increase in consumption of $_ billion. (Note that Bil. is saved based on marginal propensity to save (MPS), that is .40 (because 1- billion). This initial increase in spending will ultimately billion because of the multiplier MPC=MPS). Then .40 × $40 = $ result in an increase in consumption spending of $ process. In contrast, an initial increase in government spending of $40 billion will ultimately increase consumer spending by $ savings as would be the case with a $40 billion tax cut. billion because none of the initial increase is siphoned off as

4. Explain the effect of a discretionary cut in taxes of $40 billion on the economy when the economy's MPC is .60. How does this discretionary fiscal policy differ from a discretionary increase in government spending of $40 billion? (Answer this question by filling and circling answers below.) A tax cut of $40 billion will result in initial increase in consumption of $_ billion. (Note that Bil. is saved based on marginal propensity to save (MPS), that is .40 (because 1- billion). This initial increase in spending will ultimately billion because of the multiplier MPC=MPS). Then .40 × $40 = $ result in an increase in consumption spending of $ process. In contrast, an initial increase in government spending of $40 billion will ultimately increase consumer spending by $ savings as would be the case with a $40 billion tax cut. billion because none of the initial increase is siphoned off as

Chapter24: Fiscal Policy

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:4. Explain the effect of a discretionary cut in taxes of $40 billion on the economy when the economy's

MPC is .60. How does this discretionary fiscal policy differ from a discretionary increase in

government spending of $40 billion? (Answer this question by filling and circling answers below.)

A tax cut of $40 billion will result in initial increase in consumption of $

$

MPC=MPS). Then .40 × $40 = $

result in an increase in consumption spending of $

billion. (Note that

Bil. is saved based on marginal propensity to save (MPS), that is .40 (because 1-

billion). This initial increase in spending will ultimately

billion because of the multiplier

process.

In contrast, an initial increase in government spending of $40 billion will ultimately increase

consumer spending by $

savings as would be the case with a $40 billion tax cut.

billion because none of the initial increase is siphoned off as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning