2. Fiscal policy Suppose a hypothetical economy is currently in a situation of deficient aggregate demand of $64 billion. Four economists agree that expansionary fiscal policy can increase total spending and move the economy out of recession, but they are debating which type of expansionary policy should be used. Economist A belleves that the government spending multiplier is 8 and the tax multipler is 4. Economist 8 beleves that the government spending multipler is 4 and the tax multipl er is 2. Compute the amount the government would have to increase spending to close the output gap according to each economist's belief. Then, for each scenario, compute the size of the tax cut that would achieve this same effect. Policy Options for Closing Output Gap Increase in Spending Тах Cut Spending Multiplier Tax Multiplier (Billions of dollars) (Billions of dollars) Economist A Economist B Economist C favors tax cuta over increases in government spending. This means that Economist C likely belleves that: O A dollar in tax cuts immediataly and fully adds to aggregate demand. Tax cuts induce Investment spanding and improve workers' Incentives. Economist D argues that it is not possible to move the economy aut of recession by increasing government spending. Which of the following statements is consistent with Econamist D's belief? O A rise in govemment spending completely crowds out private sector spending. O A rise in govemment spending does not crowd out private sector spending.

2. Fiscal policy Suppose a hypothetical economy is currently in a situation of deficient aggregate demand of $64 billion. Four economists agree that expansionary fiscal policy can increase total spending and move the economy out of recession, but they are debating which type of expansionary policy should be used. Economist A belleves that the government spending multiplier is 8 and the tax multipler is 4. Economist 8 beleves that the government spending multipler is 4 and the tax multipl er is 2. Compute the amount the government would have to increase spending to close the output gap according to each economist's belief. Then, for each scenario, compute the size of the tax cut that would achieve this same effect. Policy Options for Closing Output Gap Increase in Spending Тах Cut Spending Multiplier Tax Multiplier (Billions of dollars) (Billions of dollars) Economist A Economist B Economist C favors tax cuta over increases in government spending. This means that Economist C likely belleves that: O A dollar in tax cuts immediataly and fully adds to aggregate demand. Tax cuts induce Investment spanding and improve workers' Incentives. Economist D argues that it is not possible to move the economy aut of recession by increasing government spending. Which of the following statements is consistent with Econamist D's belief? O A rise in govemment spending completely crowds out private sector spending. O A rise in govemment spending does not crowd out private sector spending.

Chapter24: Fiscal Policy

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:2. Fiscal policy

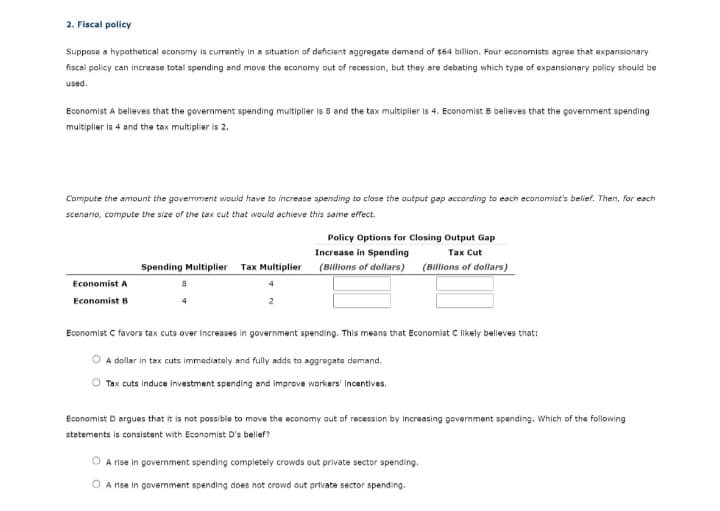

Suppose a hypothetical economy is currently in a situation of deficient aggregate demand of $64 billion. Four economists agree that expansionary

fiscal policy can increase total spending and move the economy out of recession, but they are debating which type of expansionary policy should be

used.

Economist A believes that the government spending multiplier is 8 and the tax multiplier is 4. Economist B believes that the government spending

muitiplier is 4 and the tax multiplier is 2.

Compute the amount the govermment would have to increase spending to close the output gap according to each economist's belief. Then, for each

scenario, compute the size of the tax cut that would achieve this same effect.

Policy Options for Closing Output Gap

Increase in Spending

Таx Cut

Spending Multiplier

Tax Multiplier (Billions of dollars)

(Billions of dollars)

Economist A

Economist B

Economist C favors tax cuts over increases in government spending. This means that Economist C likely believes that:

A dollar in tax cuts immadiataly and fully adds to aggregata demand.

Tax cuts induce investment spending and improve workers' incentives.

Economist D argues that it is not possible to move the economy aut of recession by increasing government spending. Which of the following

stetements is consistent with Econamist D's belief?

A rise in government spending completely crowds out private sector spending.

O A rise in govemment spending does not crowd out private sector spending.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning