4. How shall the profits and losses of the partnership be distributed among the partners? a. It should be divided equally. b. It should be divided according to their profits and losses sharing agreement. c. It should be divided proportionately in accordance with capital contribution. d. It should be divided according to what type of partner they are. Answer:

4. How shall the profits and losses of the partnership be distributed among the partners? a. It should be divided equally. b. It should be divided according to their profits and losses sharing agreement. c. It should be divided proportionately in accordance with capital contribution. d. It should be divided according to what type of partner they are. Answer:

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 21DQ

Related questions

Question

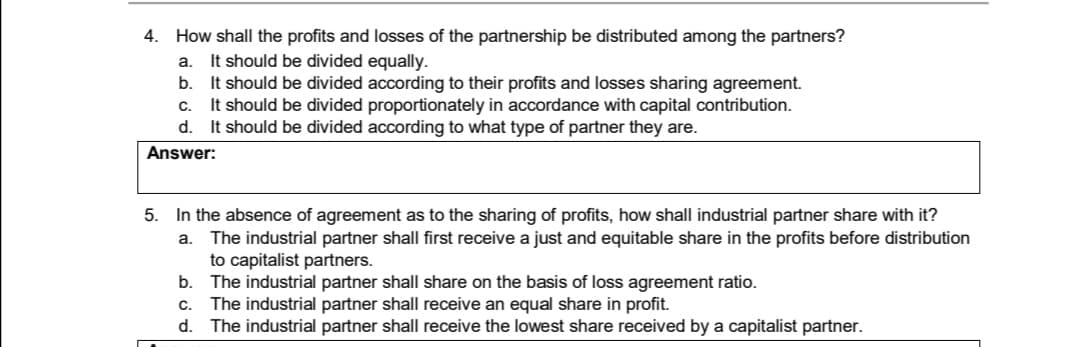

Transcribed Image Text:4. How shall the profits and losses of the partnership be distributed among the partners?

a. It should be divided equally.

b. It should be divided according to their profits and losses sharing agreement.

It should be divided proportionately in accordance with capital contribution.

d. It should be divided according to what type of partner they are.

C.

Answer:

5. In the absence of agreement as to the sharing of profits, how shall industrial partner share with it?

a. The industrial partner shall first receive a just and equitable share in the profits before distribution

to capitalist partners.

b. The industrial partner shall share on the basis of loss agreement ratio.

c. The industrial partner shall receive an equal share in profit.

d. The industrial partner shall receive the lowest share received by a capitalist partner.

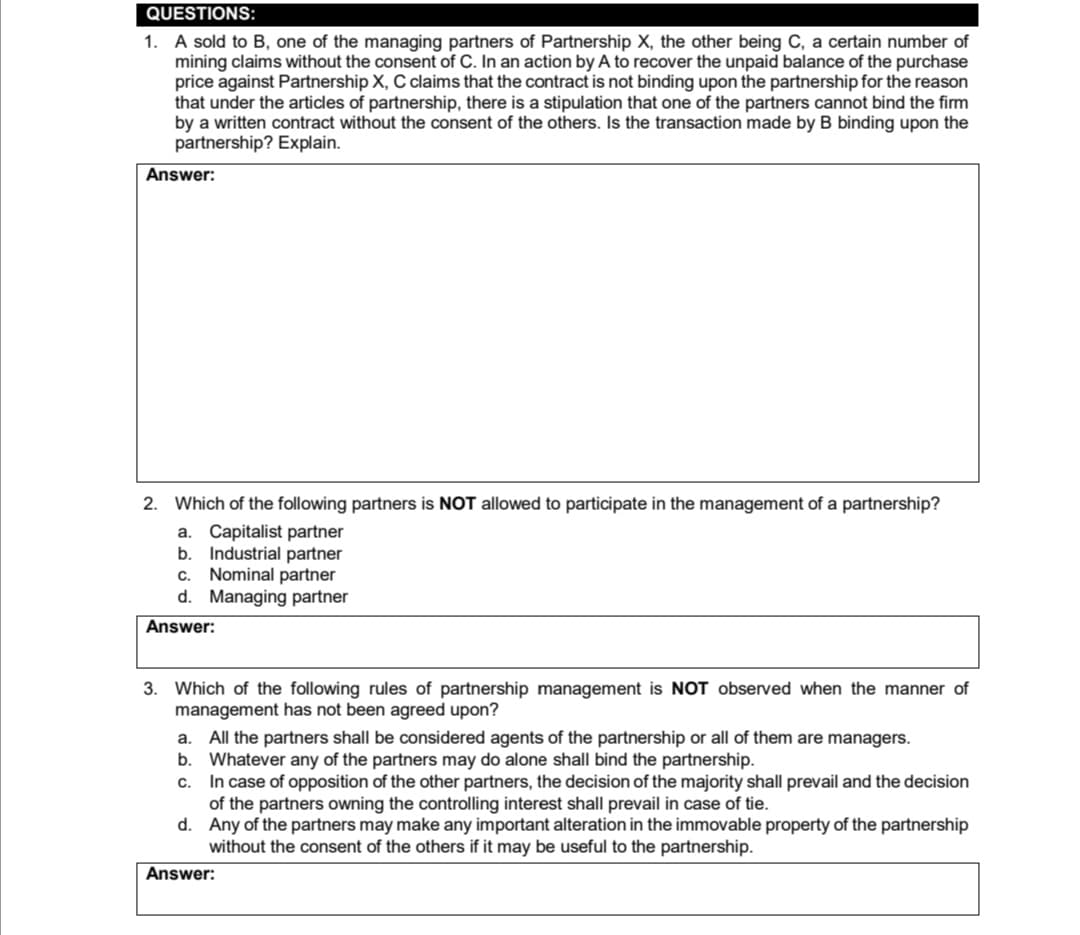

Transcribed Image Text:QUESTIONS:

1. A sold to B, one of the managing partners of Partnership X, the other being C, a certain number of

mining claims without the consent of C. In an action by A to recover the unpaid balance of the purchase

price against Partnership X, C claims that the contract is not binding upon the partnership for the reason

that under the articles of partnership, there is a stipulation that one of the partners cannot bind the firm

by a written contract without the consent of the others. Is the transaction made by B binding upon the

partnership? Explain.

Answer:

2. Which of the following partners is NOT allowed to participate in the management of a partnership?

Capitalist partner

b. Industrial partner

c. Nominal partner

d. Managing partner

a.

Answer:

3. Which of the following rules of partnership management is NOT observed when the manner of

management has not been agreed upon?

a. All the partners shall be considered agents of the partnership or all of them are managers.

b. Whatever any of the partners may do alone shall bind the partnership.

c. In case of opposition of the other partners, the decision of the majority shall prevail and the decision

of the partners owning the controlling interest shall prevail in case of tie.

d. Any of the partners may make any important alteration in the immovable property of the partnership

without the consent of the others if it may be useful to the partnership.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT