Assume that all partnership interests expressed as percentages are those percentages of both profits/losses and capital. Assume that all liabilities are recourse.

Assume that all partnership interests expressed as percentages are those percentages of both profits/losses and capital. Assume that all liabilities are recourse.

Chapter21: Partnerships

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

(please give me Answer within 10-40min.)

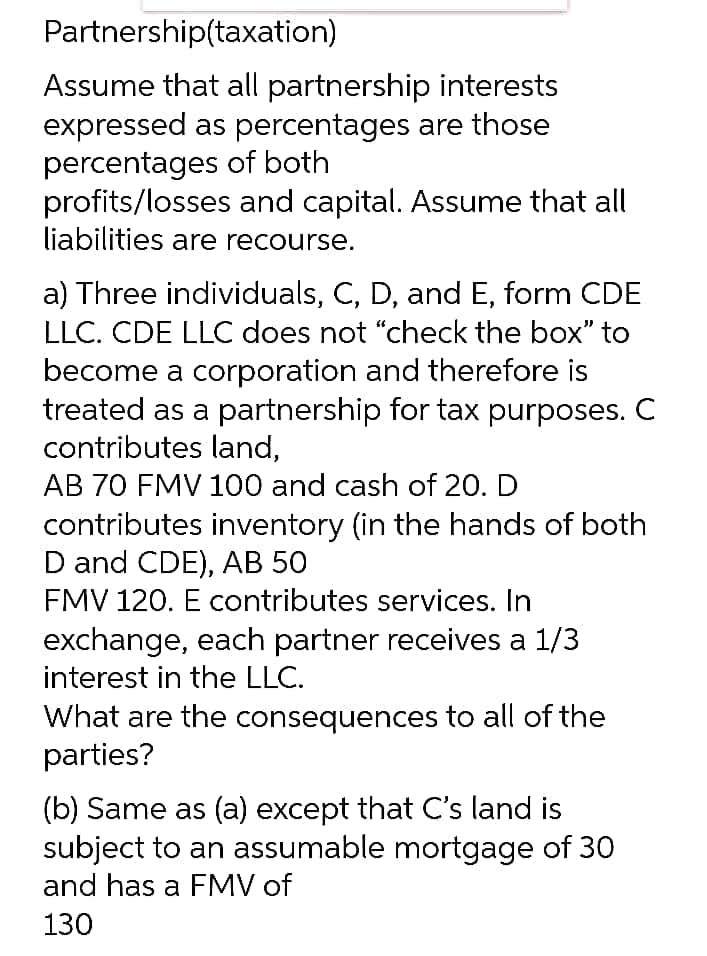

Transcribed Image Text:Partnership(taxation)

Assume that all partnership interests

expressed as percentages are those

percentages of both

profits/losses and capital. Assume that all

liabilities are recourse.

a) Three individuals, C, D, and E, form CDE

LLC. CDE LLC does not "check the box" to

become a corporation and therefore is

treated as a partnership for tax purposes. C

contributes land,

AB 70 FMV 100 and cash of 20. D

contributes inventory (in the hands of both

D and CDE), AB 50

FMV 120. E contributes services. In

exchange, each partner receives a 1/3

interest in the LLC.

What are the consequences to all of the

parties?

(b) Same as (a) except that C's land is

subject to an assumable mortgage of 30

and has a FMV of

130

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you