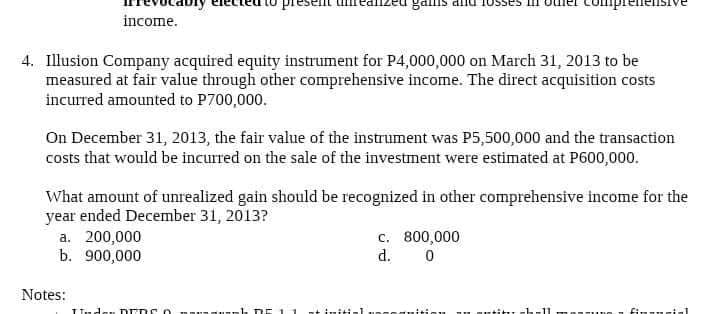

4. Illusion Company acquired equity instrument for P4,000,000 on March 31, 2013 to be measured at fair value through other comprehensive income. The direct acquisition costs incurred amounted to P700,000. On December 31, 2013, the fair value of the instrument was P5,500,000 and the transaction costs that would be incurred on the sale of the investment were estimated at P600,000. What amount of unrealized gain should be recognized in other comprehensive income for the year ended December 31, 2013? a. 200,000 b. 900,000 c. 800,000 d.

4. Illusion Company acquired equity instrument for P4,000,000 on March 31, 2013 to be measured at fair value through other comprehensive income. The direct acquisition costs incurred amounted to P700,000. On December 31, 2013, the fair value of the instrument was P5,500,000 and the transaction costs that would be incurred on the sale of the investment were estimated at P600,000. What amount of unrealized gain should be recognized in other comprehensive income for the year ended December 31, 2013? a. 200,000 b. 900,000 c. 800,000 d.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 28E

Related questions

Question

Transcribed Image Text:mplene

income.

4. Illusion Company acquired equity instrument for P4,000,000 on March 31, 2013 to be

measured at fair value through other comprehensive income. The direct acquisition costs

incurred amounted to P700,000.

On December 31, 2013, the fair value of the instrument was P5,500,000 and the transaction

costs that would be incurred on the sale of the investment were estimated at P600,000.

What amount of unrealized gain should be recognized in other comprehensive income for the

year ended December 31, 2013?

a. 200,000

b. 900,000

c. 800,000

d.

Notes:

mh DE 11nt initial

Ssauition

au auti u ch-ll

finsucial

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning